Form 2555 Ez 2015

What is the Form 2555 Ez

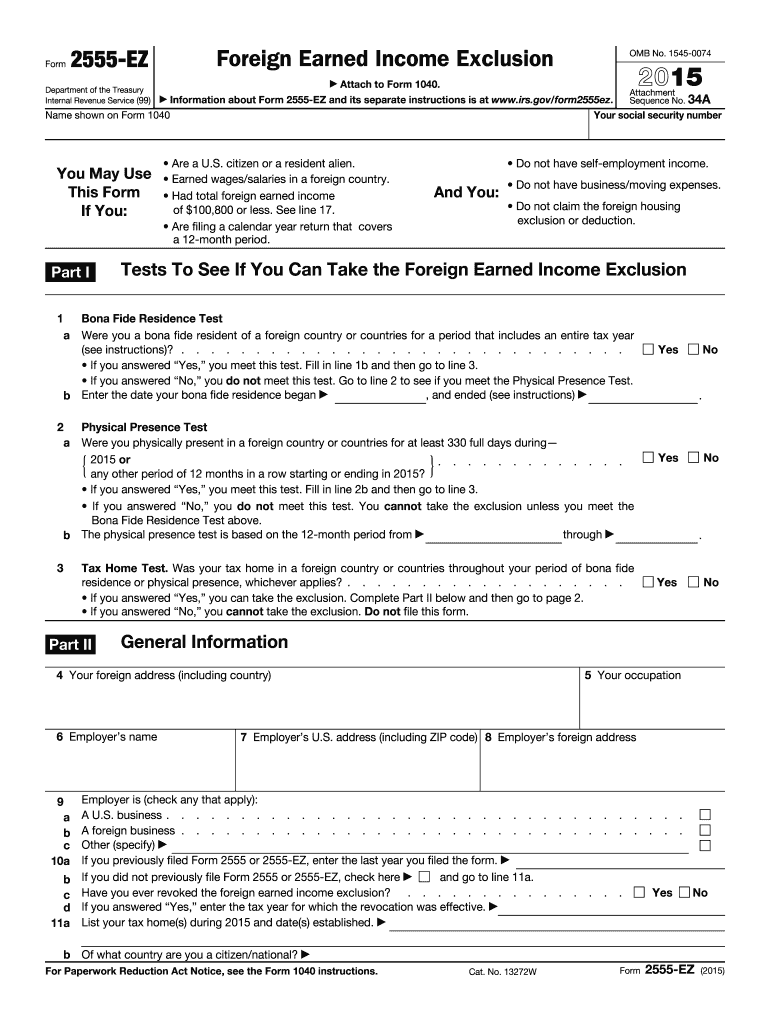

The Form 2555 Ez is a simplified version of the Form 2555, used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a portion of their income earned abroad from U.S. taxation. It is specifically designed for individuals who meet certain criteria regarding their foreign residency and income levels. By using the Form 2555 Ez, taxpayers can streamline their filing process while ensuring they comply with IRS regulations.

How to use the Form 2555 Ez

Using the Form 2555 Ez involves several straightforward steps. First, ensure that you meet the eligibility requirements, which include having foreign earned income and meeting the physical presence test or bona fide residence test. Next, download the form from the IRS website or obtain it through tax preparation software. Complete the form by providing the necessary information, such as your foreign address and income details. Finally, submit the completed form along with your tax return to the IRS, either electronically or by mail.

Steps to complete the Form 2555 Ez

Completing the Form 2555 Ez requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your passport, tax returns, and proof of foreign income.

- Fill out your personal information, including your name, Social Security number, and foreign address.

- Report your foreign earned income, ensuring it does not exceed the exclusion limit.

- Indicate your foreign residence status, confirming that you meet the physical presence or bona fide residence test.

- Review your entries for accuracy before submitting the form with your tax return.

Legal use of the Form 2555 Ez

The Form 2555 Ez is legally binding when completed accurately and submitted in compliance with IRS guidelines. To ensure its legal standing, taxpayers must meet all eligibility criteria and provide truthful information. The IRS requires that all forms be signed and dated, and any false statements can lead to penalties. Utilizing electronic signature solutions can enhance the security and validity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2555 Ez align with the standard tax return deadlines. Typically, U.S. citizens and resident aliens must file their tax returns by April 15. However, if you are living abroad, you may qualify for an automatic two-month extension, allowing you to file by June 15. It is essential to stay informed about any changes in deadlines or additional extensions that may apply.

Eligibility Criteria

To qualify for the Form 2555 Ez, taxpayers must meet specific eligibility criteria, including:

- Being a U.S. citizen or resident alien.

- Having foreign earned income, which must be reported in U.S. dollars.

- Meeting either the physical presence test or the bona fide residence test.

- Not claiming the foreign housing exclusion or deduction.

Required Documents

When completing the Form 2555 Ez, several documents may be required to support your claims. These documents include:

- Proof of foreign earned income, such as pay stubs or tax returns from the foreign country.

- Documentation of your foreign residency, like a lease agreement or utility bills.

- Your passport or other identification to verify your citizenship and residency status.

Quick guide on how to complete form 2555 ez 2015

Effortlessly Prepare Form 2555 Ez on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 2555 Ez on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Edit and Electronically Sign Form 2555 Ez with Ease

- Find Form 2555 Ez and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 2555 Ez to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2555 ez 2015

Create this form in 5 minutes!

How to create an eSignature for the form 2555 ez 2015

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 2555 Ez?

Form 2555 Ez is a simplified version of the standard IRS Form 2555, designed to help expatriates report their foreign earned income and claim the Foreign Earned Income Exclusion. This easy-to-use form is ideal for U.S. citizens or residents living abroad who meet specific criteria regarding their foreign income.

-

How does airSlate SignNow support the completion of Form 2555 Ez?

airSlate SignNow streamlines the process of filling out Form 2555 Ez by providing a user-friendly interface for efficient document management. With our platform, users can easily upload, eSign, and share their completed forms securely, making tax filing less cumbersome for expatriates.

-

Is there a cost to use airSlate SignNow for Form 2555 Ez?

Yes, airSlate SignNow offers different pricing plans depending on the features needed for handling documents like Form 2555 Ez. Our cost-effective solution ensures that you can manage your documents efficiently without breaking the bank, making it accessible for individuals and businesses alike.

-

What features does airSlate SignNow offer for using Form 2555 Ez?

airSlate SignNow provides a variety of features to ease the completion of Form 2555 Ez, including document templates, customizable workflows, and eSigning capabilities. These features enable users to automate their tax document processes, ensuring accuracy and compliance while saving time.

-

Can I integrate airSlate SignNow with other software while using Form 2555 Ez?

Absolutely! airSlate SignNow integrates seamlessly with popular applications including Google Drive, Dropbox, and various CRM systems. This integration allows users to access and manage their Form 2555 Ez directly from their preferred platforms, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for Form 2555 Ez?

Using airSlate SignNow for Form 2555 Ez offers numerous benefits, including ease of use, enhanced security through encryption, and quick turnaround times for document processing. This comprehensive solution helps expatriates manage their tax documents efficiently and reduces the stress associated with filing taxes from abroad.

-

Is it easy to eSign Form 2555 Ez with airSlate SignNow?

Yes, eSigning Form 2555 Ez with airSlate SignNow is straightforward and convenient. Users can sign their documents electronically from any device, ensuring compliance with IRS requirements while maintaining a secure and efficient signing experience.

Get more for Form 2555 Ez

Find out other Form 2555 Ez

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer