540 Es Instructions Form

What is the 540 Es Instructions Form

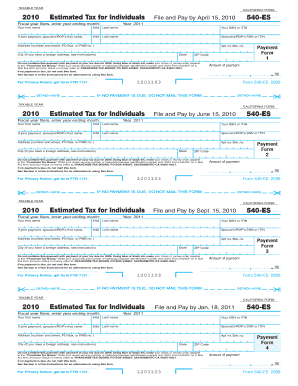

The 540 Es Instructions Form is a crucial document used by taxpayers in California to provide guidance on making estimated tax payments. This form is specifically designed for individuals who expect to owe tax of five hundred dollars or more when they file their annual tax return. It helps taxpayers calculate their estimated tax liability and ensures compliance with state tax regulations.

How to use the 540 Es Instructions Form

Using the 540 Es Instructions Form involves several steps to ensure accurate completion. Taxpayers should first gather their financial information, including income sources and deductions. Next, they will follow the instructions on the form to calculate their estimated tax payments based on their expected income for the year. Once calculations are complete, taxpayers can submit their payments as outlined in the form’s guidelines.

Steps to complete the 540 Es Instructions Form

Completing the 540 Es Instructions Form requires careful attention to detail. Begin by entering your personal information, including your name and Social Security number. Next, calculate your total expected income and applicable deductions. Use the provided tax tables to determine your estimated tax liability. Finally, enter the calculated amounts on the form and choose your payment method, whether online, by mail, or in person.

Legal use of the 540 Es Instructions Form

The legal use of the 540 Es Instructions Form is essential for ensuring compliance with California tax laws. Taxpayers must accurately report their estimated tax payments to avoid penalties and interest charges. The form is designed to meet state legal requirements, and using it correctly helps maintain transparency with the California Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for the 540 Es Instructions Form are critical for taxpayers to remember. Typically, estimated tax payments are due quarterly, with specific dates set by the California Franchise Tax Board. It is important to mark these dates on your calendar to avoid late fees and ensure timely compliance with state tax obligations.

Required Documents

To complete the 540 Es Instructions Form, taxpayers need several key documents. These include previous year’s tax returns, income statements such as W-2s or 1099s, and any relevant documentation for deductions or credits. Gathering these documents in advance can streamline the process and help ensure accurate calculations.

Who Issues the Form

The 540 Es Instructions Form is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensures that taxpayers have the necessary resources to comply with their tax obligations. The FTB provides updates and guidance on the form as tax laws and regulations evolve.

Quick guide on how to complete 540 es instructions form

Complete 540 Es Instructions Form easily on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers you all the tools necessary to generate, modify, and eSign your documents swiftly without any delays. Manage 540 Es Instructions Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign 540 Es Instructions Form effortlessly

- Obtain 540 Es Instructions Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Edit and eSign 540 Es Instructions Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 540 es instructions form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 540 Es Instructions Form?

The 540 Es Instructions Form is a specific template provided for users to understand how to complete their California income tax return effectively. It provides detailed guidelines on areas such as income reporting, deductions, and credits, ensuring that users can accurately file their taxes.

-

How does airSlate SignNow assist in filling out the 540 Es Instructions Form?

airSlate SignNow offers a user-friendly interface that allows you to fill out the 540 Es Instructions Form electronically. With features such as easy document editing and eSigning, you can streamline the process of completing and submitting this form, making tax preparation more efficient.

-

Is the 540 Es Instructions Form available on mobile devices?

Yes, the 540 Es Instructions Form can be accessed and filled out on mobile devices using airSlate SignNow. The platform supports mobile functionality, allowing users to complete their taxes on-the-go without the need for a computer.

-

What are the pricing options for using airSlate SignNow to complete the 540 Es Instructions Form?

airSlate SignNow provides various pricing plans to cater to different business needs, including options for individuals who need to complete the 540 Es Instructions Form. You can choose a plan based on your usage frequency and features required for an effective tax filing process.

-

Are there any additional features to help with the 540 Es Instructions Form?

Absolutely! Beyond just filling out the 540 Es Instructions Form, airSlate SignNow includes features like document storage, collaboration tools, and automated reminders for submission deadlines. These features enhance the overall experience and ensure you meet all your tax obligations.

-

Is there customer support available while filling out the 540 Es Instructions Form?

Yes, airSlate SignNow offers robust customer support options to assist you while you complete the 540 Es Instructions Form. You can access tutorials, FAQs, and direct assistance from our dedicated support team if you encounter any challenges.

-

Can I integrate airSlate SignNow with other applications when completing the 540 Es Instructions Form?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, which enhances your ability to manage documents, including the 540 Es Instructions Form. This allows users to easily import-export data and streamline their workflow across different platforms.

Get more for 540 Es Instructions Form

Find out other 540 Es Instructions Form

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form