it 203 Form 2010

What is the It 203 Form

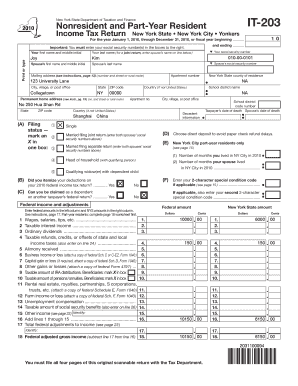

The It 203 Form is a tax document used by non-residents of New York State to report income earned within the state. This form is essential for individuals who do not reside in New York but have income sourced from New York, such as wages, rents, or business income. By using the It 203 Form, non-residents can accurately report their earnings and calculate any taxes owed to the state. It ensures compliance with state tax laws and helps avoid penalties for non-filing.

How to use the It 203 Form

Using the It 203 Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other records of income earned in New York. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your New York income accurately, and calculate your tax liability based on the instructions provided. Finally, submit the completed form to the New York State Department of Taxation and Finance by the specified deadline.

Steps to complete the It 203 Form

Completing the It 203 Form requires careful attention to detail. Follow these steps:

- Gather your income documentation, including any relevant tax forms.

- Provide your personal information at the top of the form.

- Report your New York-source income in the designated sections.

- Calculate your total tax liability using the provided tax tables.

- Sign and date the form to certify that the information is accurate.

- Submit the form by mail or electronically, as per the guidelines.

Legal use of the It 203 Form

The It 203 Form is legally binding and must be completed accurately to comply with New York tax laws. Failure to file this form can result in penalties and interest on unpaid taxes. It is important to understand that submitting false information can lead to legal repercussions. Therefore, it is advisable to consult a tax professional if you have questions about your eligibility or the information required on the form.

Filing Deadlines / Important Dates

Filing deadlines for the It 203 Form are critical to avoid penalties. Typically, the form must be filed by April fifteenth of the year following the tax year being reported. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates and ensure that your form is submitted on time to maintain compliance with state tax regulations.

Required Documents

To complete the It 203 Form, certain documents are necessary. These include:

- W-2 forms showing income earned in New York.

- 1099 forms for any freelance or contract work.

- Records of any other income sourced from New York.

- Documentation of deductions or credits you plan to claim.

Having these documents ready will facilitate a smoother filing process and help ensure that all income is reported accurately.

Quick guide on how to complete 2010 it 203 form

Complete It 203 Form seamlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without delays. Manage It 203 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign It 203 Form effortlessly

- Find It 203 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document administration needs in just a few clicks from your preferred device. Edit and eSign It 203 Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 it 203 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 it 203 form

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the IT 203 Form?

The IT 203 Form is a New York State tax return used by non-residents and part-year residents to file their state income taxes. This form allows individuals to report income earned within New York and claim any eligible credits or deductions. Utilizing airSlate SignNow can simplify the e-signing process for your IT 203 Form, ensuring fast and secure submissions.

-

How can airSlate SignNow help with my IT 203 Form?

AirSlate SignNow provides an intuitive platform for electronically signing your IT 203 Form, making tax filing more efficient. With its user-friendly interface, you can quickly fill out and eSign your document without any hassle. This streamlines the tax filing process, allowing you to focus on other important tasks.

-

Is there a cost associated with using airSlate SignNow for my IT 203 Form?

Yes, airSlate SignNow offers flexible pricing plans suitable for different needs. Depending on the features you require, the cost can vary, but it is generally a cost-effective solution for managing documents like the IT 203 Form. Many users find that the ease of use and time saved justify the expense.

-

Can I integrate airSlate SignNow with other software for processing my IT 203 Form?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when processing the IT 203 Form. Whether you use accounting software or organizational tools, these integrations facilitate a smoother experience, allowing you to automate tasks such as document storage and sharing.

-

What features does airSlate SignNow offer for completing the IT 203 Form?

AirSlate SignNow provides features such as customizable templates, mobile access, and secure cloud storage specifically designed to assist users with forms like the IT 203 Form. The platform allows you to add fields for signatures, dates, and other necessary information, ensuring that your tax documents are completed accurately. Additionally, real-time tracking keeps you informed about the approval process.

-

Are there benefits to using airSlate SignNow for electronic signatures on the IT 203 Form?

Using airSlate SignNow for electronic signatures on your IT 203 Form brings many advantages, including faster turnaround times and increased convenience. Electronic signatures are legally binding, making your submissions valid with less hassle compared to traditional methods. This means you can submit your tax documents without delays, ensuring compliance and peace of mind.

-

Is airSlate SignNow secure for submitting my IT 203 Form?

Yes, airSlate SignNow prioritizes the security of your documents and personal information, ensuring that your IT 203 Form is safe throughout the signing process. The platform uses advanced encryption and complies with industry standards to protect your data. You can submit your tax forms confidently, knowing that your information is secure.

Get more for It 203 Form

- Guaranty attachment to lease for guarantor or cosigner maryland form

- Amendment to lease or rental agreement maryland form

- Warning notice due to complaint from neighbors maryland form

- Lease subordination agreement maryland form

- Apartment rules and regulations maryland form

- Md cancellation form

- Amendment of residential lease maryland form

- Agreement for payment of unpaid rent maryland form

Find out other It 203 Form

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer