Fiilable Sc1041 Online 1999

What is the Fiilable Sc1041 Online

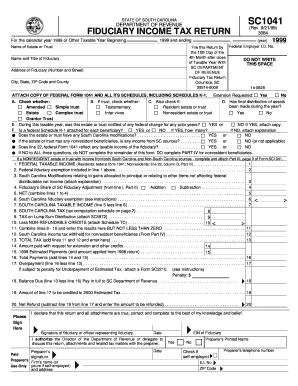

The fiilable SC1041 online is a digital version of a tax form used primarily for the filing of income tax returns for estates and trusts in the United States. This form allows executors or trustees to report the income earned by the estate or trust during the tax year. By utilizing a fillable format, users can easily enter their information directly into the document, streamlining the filing process. The online version ensures that users can complete and submit the form efficiently, reducing the need for physical paperwork.

How to Use the Fiilable Sc1041 Online

Using the fiilable SC1041 online is straightforward. Begin by accessing the form through a reliable platform that supports electronic signatures and secure submissions. Once you have the form open, follow these steps:

- Enter the required information, such as the estate or trust name, taxpayer identification number, and income details.

- Review the form for accuracy, ensuring all entries are correct and complete.

- Utilize any available tools for calculations or data validation to minimize errors.

- Once satisfied, proceed to electronically sign the form using a secure eSignature solution.

- Submit the completed form electronically or print it for mailing, depending on your preference.

Steps to Complete the Fiilable Sc1041 Online

Completing the fiilable SC1041 online involves several key steps to ensure accuracy and compliance with tax regulations. Follow these steps for a smooth experience:

- Gather all necessary documents, including income statements and prior tax returns related to the estate or trust.

- Access the online fillable form and begin entering your data in the designated fields.

- Double-check all entries for accuracy, particularly numerical values and identification numbers.

- Utilize electronic signature options to sign the document securely.

- Submit the form electronically or save it for mailing, ensuring you meet any filing deadlines.

Legal Use of the Fiilable Sc1041 Online

The legal use of the fiilable SC1041 online is contingent upon compliance with federal and state regulations regarding electronic signatures and tax submissions. The form is considered legally binding when completed accurately and signed using a secure eSignature platform. It is essential to ensure that the electronic submission adheres to the guidelines set forth by the IRS and other governing bodies to avoid any issues with acceptance or processing.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the fiilable SC1041 online. These guidelines include requirements for reporting income, deductions, and credits associated with the estate or trust. It is crucial to familiarize yourself with these guidelines to ensure compliance. The IRS also outlines the necessary documentation that must accompany the form, such as K-1 forms for beneficiaries, which detail their share of the income.

Filing Deadlines / Important Dates

Filing deadlines for the fiilable SC1041 online are critical to avoid penalties and ensure compliance. Typically, the form must be filed by the 15th day of the fourth month following the end of the tax year for the estate or trust. For estates and trusts operating on a calendar year, this means the deadline is April 15. It is advisable to check for any updates or changes to deadlines, especially in light of tax law changes or extensions granted by the IRS.

Quick guide on how to complete fiilable sc1041 online

Effortlessly prepare Fiilable Sc1041 Online on any device

Online document administration has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Fiilable Sc1041 Online on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Fiilable Sc1041 Online with ease

- Locate Fiilable Sc1041 Online and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Fiilable Sc1041 Online to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiilable sc1041 online

Create this form in 5 minutes!

How to create an eSignature for the fiilable sc1041 online

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the fiilable SC1041 online form?

The fiilable SC1041 online form is a document used for tax purposes by estates and trusts. It allows users to report income and deductions efficiently. Using airSlate SignNow, you can easily fill out and sign this form digitally, streamlining the process and saving time.

-

How does airSlate SignNow facilitate filling the fiilable SC1041 online?

airSlate SignNow offers intuitive tools for filling the fiilable SC1041 online, making document completion straightforward. Users can edit forms, add signatures, and apply necessary labels without hassle. This ensures that all needed information is accurately included.

-

Is there a cost associated with using airSlate SignNow for the fiilable SC1041 online?

Yes, there is a pricing structure for using airSlate SignNow, but it remains cost-effective for businesses and individuals. Plans vary based on features and usage, allowing you to choose a package that fits your needs while effectively managing the fiilable SC1041 online.

-

What features does airSlate SignNow provide for the fiilable SC1041 online?

AirSlate SignNow offers features like eSignature capabilities, document templates, and collaboration tools for the fiilable SC1041 online. These features enable users to manage documents efficiently and ensure compliance. Enhanced security measures are also in place to protect sensitive information.

-

Can I integrate airSlate SignNow with other applications for managing the fiilable SC1041 online?

Absolutely! airSlate SignNow supports integrations with various third-party applications, enhancing your workflow for the fiilable SC1041 online. You can connect it with popular software like Google Drive, Dropbox, and CRM systems for seamless document management.

-

What are the benefits of using airSlate SignNow for the fiilable SC1041 online?

Using airSlate SignNow for the fiilable SC1041 online provides multiple benefits, including increased efficiency and reduced paperwork. The platform simplifies the signing process and helps you manage deadlines effectively, ensuring that your documents are processed on time.

-

How secure is airSlate SignNow for filing the fiilable SC1041 online?

AirSlate SignNow offers top-notch security for filing the fiilable SC1041 online. With encrypted signatures and secure data storage, user information is protected, ensuring compliance with privacy regulations. This makes it a trustworthy solution for handling sensitive tax documents.

Get more for Fiilable Sc1041 Online

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497310410 form

- Maryland dissolution form

- Maryland dissolve form

- Alternate service order form

- Living trust for husband and wife with no children maryland form

- Living trust for individual who is single divorced or widow or widower with no children maryland form

- Living trust for individual who is single divorced or widow or widower with children maryland form

- Living trust for husband and wife with one child maryland form

Find out other Fiilable Sc1041 Online

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF