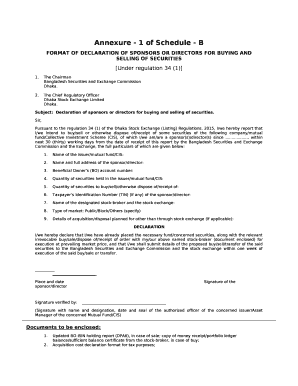

Annexure 1 of Schedule B Form

What is the Schedule B Form?

The Schedule B form is used by taxpayers in the United States to report interest and ordinary dividends. It is an essential part of the individual income tax return, specifically attached to Form 1040. This form helps the Internal Revenue Service (IRS) track income from various sources, ensuring that taxpayers accurately report their earnings. Taxpayers must disclose any interest income received from banks, financial institutions, and other entities, as well as dividends from stocks and mutual funds.

Steps to Complete the Schedule B Form

Filling out the Schedule B form involves several key steps:

- Gather Documentation: Collect all necessary documents, including bank statements and dividend statements, to accurately report your income.

- Fill in Personal Information: Enter your name and Social Security number at the top of the form.

- Report Interest Income: List all sources of interest income in Part I, including amounts received from various accounts.

- Report Dividend Income: In Part II, document all ordinary dividends received, including those from stocks and mutual funds.

- Sign and Date the Form: Ensure that you sign and date the form before submitting it with your tax return.

Legal Use of the Schedule B Form

The Schedule B form serves a legal purpose in tax reporting. It ensures compliance with IRS regulations regarding the reporting of interest and dividend income. Accurate completion of this form is crucial, as failure to report income can lead to penalties or audits. The form must be submitted alongside your annual tax return, and it is subject to review by the IRS to verify the accuracy of reported information.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the Schedule B form. Generally, the deadline for submitting your federal income tax return, including Schedule B, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to avoid late fees and penalties.

Required Documents

To complete the Schedule B form accurately, you will need several documents, including:

- Bank statements detailing interest earned.

- Statements from financial institutions regarding dividends received.

- Any relevant tax documents, such as Form 1099-INT for interest and Form 1099-DIV for dividends.

Form Submission Methods

The Schedule B form can be submitted through various methods. Taxpayers have the option to file electronically using tax software or through a tax professional. Alternatively, the form can be printed and mailed to the IRS along with the completed Form 1040. It is important to ensure that the submission method chosen complies with IRS guidelines to avoid processing delays.

Quick guide on how to complete annexure 1 of schedule b

Complete Annexure 1 Of Schedule B effortlessly on any device

Digital document management has gained traction with businesses and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow equips you with everything necessary to create, amend, and eSign your documents swiftly and without hindrance. Handle Annexure 1 Of Schedule B on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign Annexure 1 Of Schedule B without hassle

- Locate Annexure 1 Of Schedule B and click Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form: via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Annexure 1 Of Schedule B and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annexure 1 of schedule b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an annexure 1 form?

An annexure 1 form is a document that provides additional information or details related to a primary document. In the context of airSlate SignNow, this form can be electronically signed and sent, streamlining the process for businesses that need to maintain accurate records and documentation.

-

How can airSlate SignNow help me manage my annexure 1 forms?

airSlate SignNow simplifies the management of annexure 1 forms by allowing users to create, send, and eSign documents in a secure environment. Our platform ensures that all necessary information is captured accurately and efficiently, saving you time and reducing the likelihood of errors.

-

Are there any costs associated with using the annexure 1 form feature in airSlate SignNow?

Yes, there are pricing plans available for airSlate SignNow that include features for managing annexure 1 forms. We offer a variety of subscription options designed to fit different business needs, from solo users to larger teams, ensuring a cost-effective solution for everyone.

-

Can I integrate airSlate SignNow with other applications when using annexure 1 forms?

Absolutely! airSlate SignNow supports integration with a wide range of applications, making it easy to incorporate your annexure 1 forms into your existing workflows. This allows for seamless data transfer and enhanced productivity across your business operations.

-

What are the benefits of using electronic annexure 1 forms?

Using electronic annexure 1 forms via airSlate SignNow offers numerous benefits, including faster turnaround times and reduced paper waste. Additionally, eSigning enhances security and ensures that your documents are stored safely in the cloud, accessible from anywhere.

-

How secure is the information on my annexure 1 forms?

airSlate SignNow places a strong emphasis on security, employing advanced encryption methods to protect all documents, including your annexure 1 forms. Our platform is designed to ensure that your sensitive information remains confidential and secure throughout the signing process.

-

Can I track the status of my annexure 1 forms once sent?

Yes, airSlate SignNow provides tracking features for all sent documents, including annexure 1 forms. You will receive notifications when the document is viewed, signed, or completed, allowing you to stay informed of its progress in real time.

Get more for Annexure 1 Of Schedule B

Find out other Annexure 1 Of Schedule B

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now