Iht409 Form

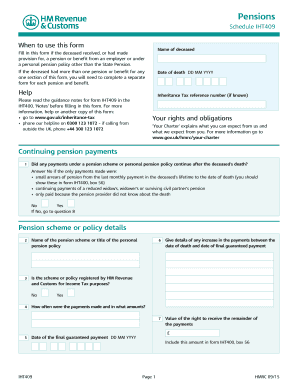

What is the IHT409?

The IHT409 form, also known as the "Inheritance Tax Account," is a crucial document used in the United States for reporting the value of an estate for inheritance tax purposes. This form is typically required when an estate exceeds a certain value threshold, necessitating a formal accounting of assets, liabilities, and any applicable deductions. The information provided on the IHT409 helps the Internal Revenue Service (IRS) determine the tax liability associated with the estate. Understanding the IHT409 is essential for executors and beneficiaries involved in estate settlements.

How to Use the IHT409

Using the IHT409 form involves several steps to ensure accurate reporting of the estate's value. First, gather all necessary documentation, including property appraisals, bank statements, and details of debts owed by the deceased. Next, complete the form by accurately listing all assets and liabilities, ensuring that each entry reflects the fair market value at the time of death. It is important to review the form for completeness and accuracy before submission, as errors can lead to delays or penalties. Once completed, the form should be submitted to the IRS as part of the estate tax return process.

Steps to Complete the IHT409

Completing the IHT409 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including wills, trust documents, and asset valuations.

- List all assets, including real estate, bank accounts, investments, and personal property, along with their fair market values.

- Document any debts or liabilities that the estate owes, such as mortgages, loans, and unpaid taxes.

- Calculate the total value of the estate by subtracting liabilities from assets.

- Review the completed form for accuracy and completeness, ensuring all required fields are filled out.

- Submit the IHT409 form along with any additional required documentation to the IRS by the specified deadline.

Legal Use of the IHT409

The IHT409 form serves a legal purpose in the estate administration process. It is essential for establishing the tax obligations of the estate and ensuring compliance with federal tax laws. The form must be filed accurately and on time to avoid penalties. Additionally, the information provided on the IHT409 can be subject to review by the IRS, making it important to maintain thorough records and documentation supporting the values reported. Executors and beneficiaries should consult with legal or tax professionals to ensure proper use of the form.

Required Documents

To complete the IHT409 form effectively, specific documents are required. These include:

- The decedent's will or trust documents.

- Death certificate.

- Asset valuations, such as appraisals for real estate and personal property.

- Bank statements and financial records for all accounts held by the decedent.

- Documentation of any debts or liabilities, including loans and mortgages.

Filing Deadlines / Important Dates

Filing the IHT409 form within the designated deadlines is crucial to avoid penalties. Typically, the form must be submitted within nine months of the decedent's date of death. Extensions may be available under certain circumstances, but it is essential to file for an extension before the original deadline. Executors should keep track of these important dates to ensure compliance with IRS regulations and maintain the estate's integrity.

Quick guide on how to complete iht409 252389894

Effortlessly Prepare Iht409 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an optimal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without interruptions. Handle Iht409 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Iht409 with Ease

- Locate Iht409 and click Get Form to initiate the process.

- Utilize the tools provided to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the specific tools airSlate SignNow supplies for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to secure your edits.

- Select how you wish to share your document, via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misfiled documents, the hassle of searching for forms, or mistakes that necessitate printing additional copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and electronically sign Iht409 to ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht409 252389894

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an iht409 form pdf?

The iht409 form pdf is a crucial document used in the UK for reporting the value of an estate for Inheritance Tax purposes. It enables personal representatives to detail the assets and liabilities of the deceased, ensuring compliance with HMRC requirements. Understanding the iht409 form pdf can help you manage estate affairs more effectively.

-

How can I fill out the iht409 form pdf using airSlate SignNow?

With airSlate SignNow, you can easily fill out the iht409 form pdf by uploading it to our platform. Our intuitive interface allows you to complete the necessary fields digitally, saving you time and ensuring accuracy. Once completed, you can eSign and share your iht409 form pdf securely.

-

Is airSlate SignNow a cost-effective solution for managing iht409 form pdf?

Yes, airSlate SignNow offers a cost-effective solution for managing documents like the iht409 form pdf. You can choose from various pricing plans tailored to suit individual or business needs, ensuring that you only pay for what you use. Our competitive pricing helps you save money while efficiently handling necessary documentation.

-

What are the key features of airSlate SignNow for iht409 form pdf management?

AirSlate SignNow provides features like document collaboration, eSigning, and customizable templates that simplify the management of your iht409 form pdf. Additionally, our platform offers real-time tracking, notifications, and secure storage, making it easier to handle important paperwork. These tools enhance efficiency and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for iht409 form pdf processing?

Absolutely! AirSlate SignNow boasts multiple integrations with popular applications and platforms, which streamlines the workflow for processing your iht409 form pdf. Whether you're using CRM software or cloud storage solutions, our integrations make it seamless to access and manage your documents. This connectivity enhances productivity and reduces the risk of errors.

-

What benefits does airSlate SignNow offer for sending iht409 form pdf?

By using airSlate SignNow for sending your iht409 form pdf, you enjoy benefits such as expedited document delivery and enhanced security features. Our platform ensures that all communications are encrypted, safeguarding sensitive information. Additionally, you can easily track the status of documents to ensure timely submissions and responses.

-

Is it easy to eSign an iht409 form pdf with airSlate SignNow?

Yes, eSigning an iht409 form pdf with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to sign documents in just a few clicks, whether on desktop or mobile. This convenience ensures that your signing process is fast and efficient, removing the hassles of traditional paperwork.

Get more for Iht409

- 2020 2021 parent verification of marital andor tax filing status form

- Form 941

- Publication 721 2019 tax guide to us civil service form

- Tribal government services form

- Application part 1 of 2 supplement tbc alabama state department form

- 2020 2021 hunting lease liability group insurance application form

- Pursuant to section 1300 form

- Assignment and transfer of students form

Find out other Iht409

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document