Hawaii N 15 Income Tax Return for Form 2019

What is the Hawaii N 15 Income Tax Return For Form

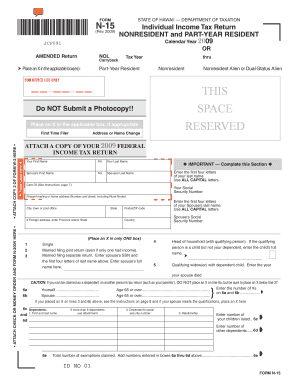

The Hawaii N 15 Income Tax Return For Form is a state-specific tax document used by non-residents and part-year residents of Hawaii to report their income earned within the state. This form is essential for individuals who have income sourced from Hawaii but do not qualify as full-time residents. The form allows taxpayers to calculate their tax liability based on the income earned while in Hawaii, ensuring compliance with state tax regulations.

Steps to complete the Hawaii N 15 Income Tax Return For Form

Completing the Hawaii N 15 Income Tax Return involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the income earned while in Hawaii.

- Fill out the form accurately, ensuring all sections are completed, including personal information and income details.

- Calculate your tax liability based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

How to obtain the Hawaii N 15 Income Tax Return For Form

The Hawaii N 15 Income Tax Return can be obtained through various channels. Taxpayers can download the form directly from the Hawaii Department of Taxation's official website. Additionally, physical copies may be available at local tax offices or public libraries. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Legal use of the Hawaii N 15 Income Tax Return For Form

The Hawaii N 15 Income Tax Return is legally binding when completed correctly and submitted on time. To ensure its legal standing, taxpayers must adhere to the filing requirements set forth by the Hawaii Department of Taxation. This includes providing accurate information, signing the form, and submitting it by the designated deadline. Failure to comply with these regulations may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii N 15 Income Tax Return are crucial for compliance. Typically, the form must be submitted by April 20th of the year following the tax year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes to deadlines announced by the Hawaii Department of Taxation, especially in light of special circumstances such as natural disasters or public health emergencies.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Hawaii N 15 Income Tax Return. The form can be filed electronically through the Hawaii Department of Taxation's online portal, which offers a convenient way to complete and submit the return. Alternatively, taxpayers may choose to mail the completed form to the appropriate tax office address. In-person submissions are also accepted at designated tax offices, providing another option for those who prefer face-to-face assistance.

Quick guide on how to complete hawaii n 15 income tax return for 2009 form

Complete Hawaii N 15 Income Tax Return For Form effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers a perfect environmentally-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Hawaii N 15 Income Tax Return For Form on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to adjust and eSign Hawaii N 15 Income Tax Return For Form with ease

- Locate Hawaii N 15 Income Tax Return For Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Hawaii N 15 Income Tax Return For Form to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii n 15 income tax return for 2009 form

Create this form in 5 minutes!

How to create an eSignature for the hawaii n 15 income tax return for 2009 form

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the Hawaii N 15 Income Tax Return For Form?

The Hawaii N 15 Income Tax Return For Form is a tax document designed for individuals who are residents of Hawaii but earn income from sources outside the state. It allows taxpayers to correctly report their income and claim any applicable credits and deductions. Understanding this form is essential for compliance with Hawaii's tax regulations.

-

How does airSlate SignNow simplify the Hawaii N 15 Income Tax Return For Form process?

airSlate SignNow provides a straightforward platform that allows users to easily fill out, sign, and send the Hawaii N 15 Income Tax Return For Form digitally. The solution eliminates the need for paper and manual processes, making tax season more efficient. This streamlining helps users focus on accuracy rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the Hawaii N 15 Income Tax Return For Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, with some plans including features specifically tailored for managing tax forms like the Hawaii N 15 Income Tax Return For Form. It's cost-effective compared to traditional methods while ensuring secure and efficient document handling. Always check our pricing page for current offers.

-

What features does airSlate SignNow offer for managing the Hawaii N 15 Income Tax Return For Form?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage, all tailored to simplify the Hawaii N 15 Income Tax Return For Form process. Users can track the status of their documents and manage all submissions from one central dashboard. These features enhance user experience and compliance.

-

Can airSlate SignNow be integrated with other software for the Hawaii N 15 Income Tax Return For Form?

Yes, airSlate SignNow offers integrations with popular accounting and tax software, allowing users to seamlessly manage the Hawaii N 15 Income Tax Return For Form directly from their existing tools. This capability streamlines workflows and helps eliminate redundancy, ensuring that all pertinent documents are easily accessible.

-

What are the benefits of using airSlate SignNow for tax filing in Hawaii?

Using airSlate SignNow for filing the Hawaii N 15 Income Tax Return For Form brings numerous benefits, including increased efficiency, cost savings, and improved security. The ability to eSign documents ensures a faster turnaround and reduces the risk of errors. This user-friendly platform caters to individuals and businesses alike, making tax filing a breeze.

-

How can I get support when filling out the Hawaii N 15 Income Tax Return For Form with airSlate SignNow?

airSlate SignNow provides comprehensive customer support, including tutorials, FAQs, and live chat assistance to help users with the Hawaii N 15 Income Tax Return For Form. Our support team understands the tax process and can guide users through any challenges they may face. We aim to ensure a smooth experience for everyone.

Get more for Hawaii N 15 Income Tax Return For Form

Find out other Hawaii N 15 Income Tax Return For Form

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document