RP 458 a 114 New York State Department of Taxation and Finance Office of Real Property Tax Services Application for Alternative Form

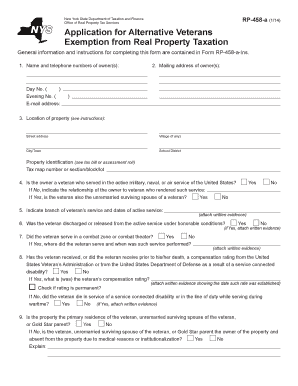

What is the RP-458-a-114 Application for Alternative Veterans Exemption?

The RP-458-a-114 is a form provided by the New York State Department of Taxation and Finance. It serves as an application for the Alternative Veterans Exemption from real property taxation. This exemption is designed to provide financial relief to veterans who have served in the military, allowing them to reduce their property tax burden. The form includes general information and specific instructions for completing the application, ensuring that eligible veterans can access the benefits available to them.

How to Use the RP-458-a-114 Application

To effectively use the RP-458-a-114 application, it is important to carefully follow the instructions provided within the form. Begin by gathering all necessary documentation, including proof of military service and any other required identification. Complete each section of the form accurately, ensuring that all information is up-to-date and correct. After filling out the application, review it for any errors before submission. This attention to detail helps prevent delays in processing your application.

Steps to Complete the RP-458-a-114 Application

Completing the RP-458-a-114 application involves several key steps:

- Gather required documents, such as military discharge papers.

- Fill out personal information, including your name, address, and contact details.

- Provide details about your military service, including dates and branch of service.

- Indicate any other exemptions you may be claiming.

- Sign and date the application to certify its accuracy.

After completing these steps, submit the form to your local tax assessor's office for processing.

Eligibility Criteria for the RP-458-a-114 Application

To qualify for the Alternative Veterans Exemption, applicants must meet specific eligibility criteria. Generally, the applicant must be a veteran who has served in active duty in the United States Armed Forces. Additionally, the veteran must have received an honorable discharge. The exemption may also apply to certain surviving spouses of veterans. It is essential to review the detailed eligibility requirements outlined in the form to ensure compliance.

Required Documents for the RP-458-a-114 Application

When submitting the RP-458-a-114 application, several documents are typically required. These may include:

- Proof of military service, such as a DD-214 form.

- Identification documents, like a driver's license or state ID.

- Any previous exemption documentation, if applicable.

Having these documents ready will facilitate a smoother application process and help verify eligibility for the exemption.

Form Submission Methods for the RP-458-a-114 Application

The RP-458-a-114 application can be submitted in various ways, depending on local regulations. Common submission methods include:

- Mailing the completed form to the local tax assessor's office.

- Submitting the form in person at the local office.

- In some cases, online submission may be available through local government portals.

It is advisable to check with your local tax authority for the preferred submission method and any specific requirements they may have.

Quick guide on how to complete rp 458 a 114 new york state department of taxation and finance office of real property tax services application for alternative

Complete RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative with ease

- Locate RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Alter and eSign RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative and guarantee exceptional communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rp 458 a 114 new york state department of taxation and finance office of real property tax services application for alternative

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RP 458 a 114 application?

The RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative Veterans Exemption From Real Property Taxation allows eligible veterans to claim a tax exemption on real property. This form provides the necessary details and eligibility criteria for veterans to receive signNow tax benefits and is essential for proper filing.

-

Who is eligible to apply for the RP 458 a 114 exemption?

Eligibility for the RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative Veterans Exemption From Real Property Taxation typically includes veterans who have served in the U.S. Armed Forces and have been honorably discharged. Additionally, the property must be the veteran's primary residence, and they must meet specific income requirements.

-

How do I complete the RP 458 a 114 application?

To complete the RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative Veterans Exemption From Real Property Taxation, you need to gather essential documents, including proof of military service. Follow the instructions provided in the form carefully, and ensure all required fields are accurately filled out to avoid delays in processing.

-

Where can I submit my RP 458 a 114 application?

Once you have completed the RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative Veterans Exemption From Real Property Taxation, you can submit it to your local tax assessor's office. It's essential to check with your local office for any specific submission methods, which may include in-person or by mail.

-

What benefits do I receive with the RP 458 a 114 exemption?

The RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative Veterans Exemption From Real Property Taxation offers several benefits, including reduced property tax liability for qualifying veterans. This can lead to signNow financial savings and help in managing annual tax costs more effectively.

-

Is there a cost associated with applying for the RP 458 a 114 exemption?

There is no fee associated with submitting the RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative Veterans Exemption From Real Property Taxation. However, depending on your local jurisdiction, there might be costs related to obtaining necessary documentation or assistance for completing the form.

-

How long does it take to process the RP 458 a 114 application?

The processing time for the RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative Veterans Exemption From Real Property Taxation can vary by locality. Generally, it is advisable to allow several weeks for your application to be processed, especially during peak filing periods.

Get more for RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative

Find out other RP 458 a 114 New York State Department Of Taxation And Finance Office Of Real Property Tax Services Application For Alternative

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement