Oregon Tax Form 150 800 743

What is the Oregon Tax Form 150 800 743

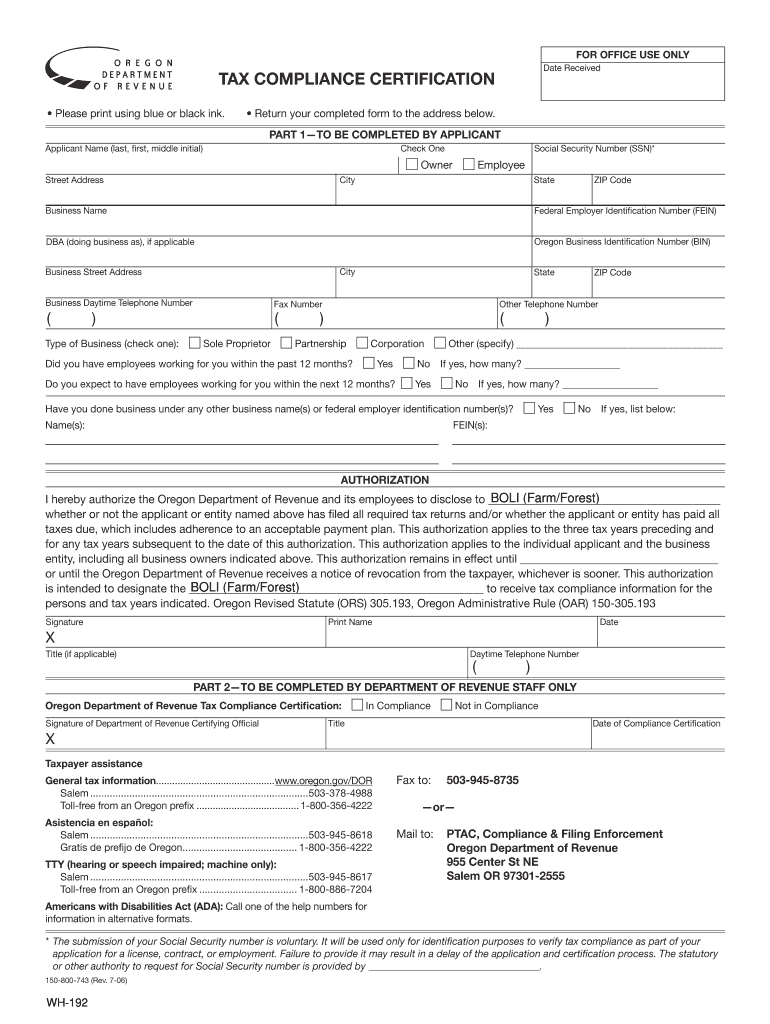

The Oregon Tax Form 150 800 743, commonly referred to as the tax compliance certification, is a crucial document for individuals and businesses operating within Oregon. This form is primarily used to verify compliance with state tax obligations, ensuring that all taxes owed to the Oregon Department of Revenue are paid. It serves as a declaration that the taxpayer is in good standing and has fulfilled their tax responsibilities as mandated by state law.

How to use the Oregon Tax Form 150 800 743

To effectively use the Oregon Tax Form 150 800 743, taxpayers must first ensure they meet the eligibility criteria outlined by the Oregon Department of Revenue. This involves gathering necessary documentation that demonstrates compliance with tax regulations. Once the form is filled out accurately, it should be submitted according to the department's guidelines, which may include online submission or mailing the completed form to the appropriate address.

Steps to complete the Oregon Tax Form 150 800 743

Completing the Oregon Tax Form 150 800 743 involves several key steps:

- Gather relevant documents, including previous tax returns and payment receipts.

- Fill out the form with accurate personal and business information.

- Indicate any applicable deductions or credits to ensure the correct tax liability is reported.

- Review the form for completeness and accuracy before submission.

- Submit the form through the designated method, ensuring it is sent to the correct department.

Legal use of the Oregon Tax Form 150 800 743

The Oregon Tax Form 150 800 743 is legally binding when completed and submitted in accordance with state regulations. It is essential for taxpayers to understand that any misrepresentation or omission of information can lead to penalties. The form must be signed by the taxpayer or an authorized representative, affirming that all information provided is truthful and complete. Compliance with this form also helps maintain good standing with the Oregon Department of Revenue.

Required Documents

When preparing to complete the Oregon Tax Form 150 800 743, taxpayers should have the following documents on hand:

- Previous tax returns to provide context for current tax obligations.

- Receipts or documentation of tax payments made during the year.

- Any notices or correspondence from the Oregon Department of Revenue regarding tax status.

- Identification documents, such as a driver's license or Social Security number.

Form Submission Methods

Taxpayers can submit the Oregon Tax Form 150 800 743 through various methods, ensuring flexibility and convenience. The available submission options include:

- Online submission via the Oregon Department of Revenue’s secure portal.

- Mailing the completed form to the designated address provided by the department.

- In-person submission at local tax offices for those who prefer direct interaction.

Quick guide on how to complete 800 743 converting

Effortlessly Prepare Oregon Tax Form 150 800 743 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a commendable eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with the tools needed to create, edit, and eSign your documents quickly and without hassle. Manage Oregon Tax Form 150 800 743 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

Simple Steps to Edit and eSign Oregon Tax Form 150 800 743 with Ease

- Find Oregon Tax Form 150 800 743 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Oregon Tax Form 150 800 743 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 800 743 converting

How to generate an eSignature for your 800 743 Converting in the online mode

How to generate an eSignature for the 800 743 Converting in Chrome

How to create an electronic signature for signing the 800 743 Converting in Gmail

How to create an eSignature for the 800 743 Converting straight from your smart phone

How to generate an eSignature for the 800 743 Converting on iOS

How to generate an eSignature for the 800 743 Converting on Android devices

People also ask

-

What is the Oregon Tax Form 150 800 743?

The Oregon Tax Form 150 800 743 is a tax form used by businesses and individuals to file specific tax returns in Oregon. It is essential for ensuring compliance with state tax regulations and can be easily managed using airSlate SignNow's eSigning capabilities.

-

How can airSlate SignNow help with the Oregon Tax Form 150 800 743?

With airSlate SignNow, you can easily fill out, sign, and send the Oregon Tax Form 150 800 743 electronically. Our platform simplifies the process, allowing you to ensure accuracy and timely submission, reducing the risk of errors.

-

Is airSlate SignNow a cost-effective solution for managing the Oregon Tax Form 150 800 743?

Yes, airSlate SignNow offers a cost-effective solution for managing the Oregon Tax Form 150 800 743. Our flexible pricing plans cater to businesses of all sizes, allowing you to save time and resources while ensuring compliance.

-

What features does airSlate SignNow offer for the Oregon Tax Form 150 800 743?

AirSlate SignNow provides a range of features for the Oregon Tax Form 150 800 743, including customizable templates, secure eSigning, and real-time tracking of document status. These features streamline the filing process and enhance efficiency.

-

Can I integrate airSlate SignNow with my existing software for the Oregon Tax Form 150 800 743?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easy to manage the Oregon Tax Form 150 800 743 alongside your existing tools. This integration helps maintain workflow efficiency and data consistency.

-

What are the benefits of using airSlate SignNow for the Oregon Tax Form 150 800 743?

Using airSlate SignNow for the Oregon Tax Form 150 800 743 offers numerous benefits, including enhanced security, faster turnaround times, and improved accuracy. Our platform ensures that your tax documents are handled efficiently and safely.

-

Is it easy to eSign the Oregon Tax Form 150 800 743 with airSlate SignNow?

Yes, eSigning the Oregon Tax Form 150 800 743 with airSlate SignNow is incredibly easy. Users can sign documents electronically from any device, which simplifies the process and eliminates the need for printing and scanning.

Get more for Oregon Tax Form 150 800 743

- Instructions vendor registration and substitute w 9 form

- Dr 6596 040723 colorado department of revenue form

- Dr 5002 declaration of wholesale or entity sales tax exemption form

- Print blank tax forms georgia department of revenue

- Dr 2300b and temporarily legal residents identification checklist form

- 13105919999dr 1059 072023 colorado departmen form

- City of tybee fill out and sign printable pdf template form

- Dr 2401 confidential medical examination report if you are using a screen reader or other assistive technology please note that form

Find out other Oregon Tax Form 150 800 743

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy