Oregon Specifications Form

What is the Oregon Specifications

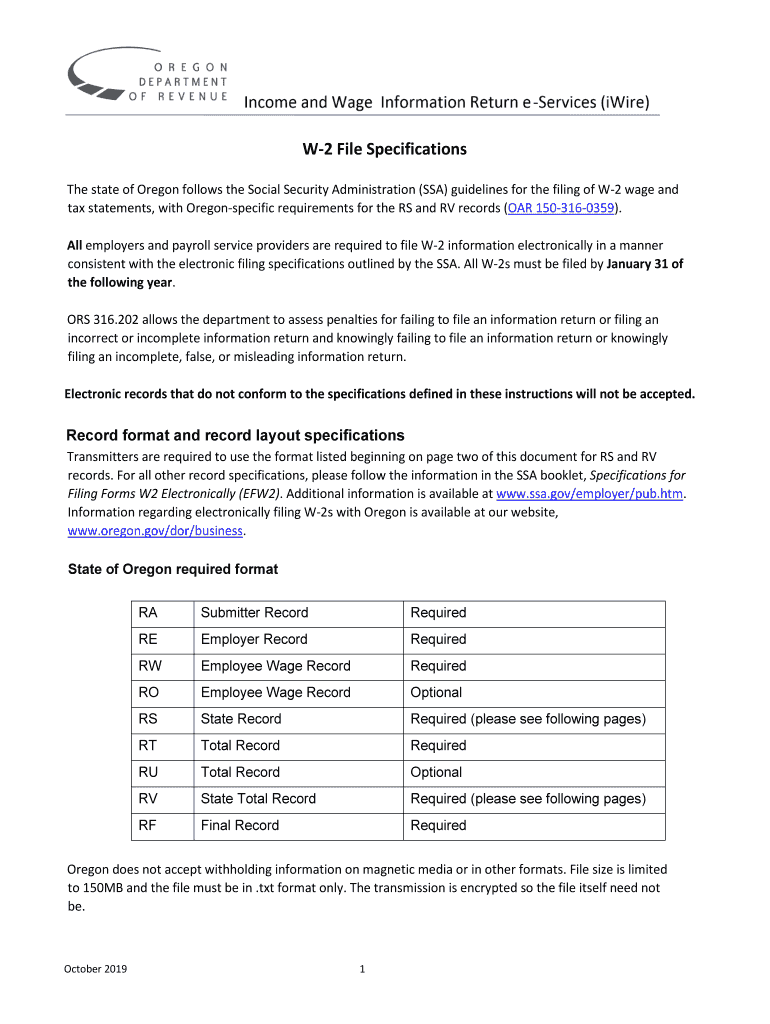

The Oregon Specifications refer to the specific guidelines and requirements set forth by the state of Oregon for the completion and submission of the W-2 form. This form is essential for employers to report wages paid to employees and the taxes withheld from those wages. Understanding the Oregon Specifications is crucial for ensuring compliance with state tax laws and for accurate reporting to the Oregon Department of Revenue.

Key elements of the Oregon Specifications

Several key elements define the Oregon Specifications for the W-2 form. These include:

- Employee Information: Accurate reporting of employee names, addresses, and Social Security numbers.

- Employer Information: Details about the employer, including name, address, and Employer Identification Number (EIN).

- Wage Information: Total wages paid to employees and the amount of state income tax withheld.

- Tax Year: The specific tax year for which the W-2 is being filed must be clearly indicated.

Steps to complete the Oregon Specifications

Completing the Oregon Specifications involves several steps to ensure accuracy and compliance:

- Gather necessary employee and employer information.

- Fill out the W-2 form, ensuring all sections are completed according to the Oregon Specifications.

- Verify the accuracy of all information, including tax amounts and identification numbers.

- Submit the completed form to the appropriate state authority by the designated deadline.

Legal use of the Oregon Specifications

Using the Oregon Specifications legally requires adherence to state laws governing the submission of tax documents. The completed W-2 form must be filed accurately and on time to avoid penalties. Employers are responsible for ensuring that all information is correct and that the form is submitted through the appropriate channels, whether electronically or by mail.

How to obtain the Oregon Specifications

Employers can obtain the Oregon Specifications for the W-2 form through the Oregon Department of Revenue's official website. The site provides downloadable templates and detailed instructions for completing the form. Additionally, employers may contact the department directly for assistance or clarification regarding any specific requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon W-2 form are crucial for compliance. Generally, employers must submit the W-2 forms to the Oregon Department of Revenue by January 31 of the following year. It is essential to stay informed about any changes to these deadlines to avoid late filing penalties.

Quick guide on how to complete oregon w 2 form oregon w 2 filing requirementsoregon w 2

Prepare Oregon Specifications effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and without delays. Handle Oregon Specifications on any device with the airSlate SignNow apps for Android or iOS and streamline any document-based process today.

How to edit and eSign Oregon Specifications effortlessly

- Obtain Oregon Specifications and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Oregon Specifications and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon w 2 form oregon w 2 filing requirementsoregon w 2

How to generate an electronic signature for the Oregon W 2 Form Oregon W 2 Filing Requirementsoregon W 2 in the online mode

How to create an electronic signature for your Oregon W 2 Form Oregon W 2 Filing Requirementsoregon W 2 in Google Chrome

How to make an electronic signature for signing the Oregon W 2 Form Oregon W 2 Filing Requirementsoregon W 2 in Gmail

How to make an electronic signature for the Oregon W 2 Form Oregon W 2 Filing Requirementsoregon W 2 straight from your smartphone

How to generate an electronic signature for the Oregon W 2 Form Oregon W 2 Filing Requirementsoregon W 2 on iOS devices

How to make an electronic signature for the Oregon W 2 Form Oregon W 2 Filing Requirementsoregon W 2 on Android

People also ask

-

What is an Oregon W-2 template?

An Oregon W-2 template is a standardized form used to report wages and tax withholdings for employees in the state of Oregon. It streamlines the process of providing essential tax information to your employees, ensuring compliance with state regulations.

-

How can I use the Oregon W-2 template with airSlate SignNow?

With airSlate SignNow, you can easily upload and customize your Oregon W-2 template for your business needs. Our platform allows you to add signatures and send the document securely to your employees for quick eSigning, making the process efficient and hassle-free.

-

What features does airSlate SignNow offer for Oregon W-2 templates?

AirSlate SignNow provides features such as easy document upload, customizable templates, and secure eSigning for Oregon W-2 forms. Additionally, you can incorporate automation tools to streamline recurring tasks, ensuring a smooth and efficient workflow.

-

Is there a cost associated with using the Oregon W-2 template in airSlate SignNow?

AirSlate SignNow offers various pricing plans, including options for individuals and businesses. The cost of using the Oregon W-2 template is included in these plans, providing great value for comprehensive eSigning solutions tailored to your needs.

-

Can I integrate the Oregon W-2 template with other tools?

Yes, airSlate SignNow supports integration with various third-party applications, allowing you to streamline the process of using the Oregon W-2 template. You can connect tools such as CRMs, cloud storage, and more to enhance your document management workflow.

-

What are the benefits of using an Oregon W-2 template?

Using an Oregon W-2 template simplifies tax preparation and ensures compliance with state regulations. Additionally, it saves time and reduces the risk of errors, ultimately making it easier for both employers and employees during tax season.

-

How do I customize my Oregon W-2 template in airSlate SignNow?

Customizing your Oregon W-2 template in airSlate SignNow is user-friendly. You can modify fields, add your company logo, and configure any specific requirements to meet your business needs, creating a personalized document ready for eSignature.

Get more for Oregon Specifications

- Dr 0112 colorado c corporation income tax return form

- Dr 0104 colorado individual income tax return form

- Dr 0205 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205 if you form

- What is alternative minimum tax amt video form

- Dr 0204 tax year ending computation of penalty due based on underpayment of colorado individual estimated tax if you are using form

- Book 21 if you are using a screen reader or other assistive technology please note that colorado department of revenue forms

- Forms by tax typedepartment of revenue taxation

- Income tax formsindividuals ampamp families

Find out other Oregon Specifications

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure