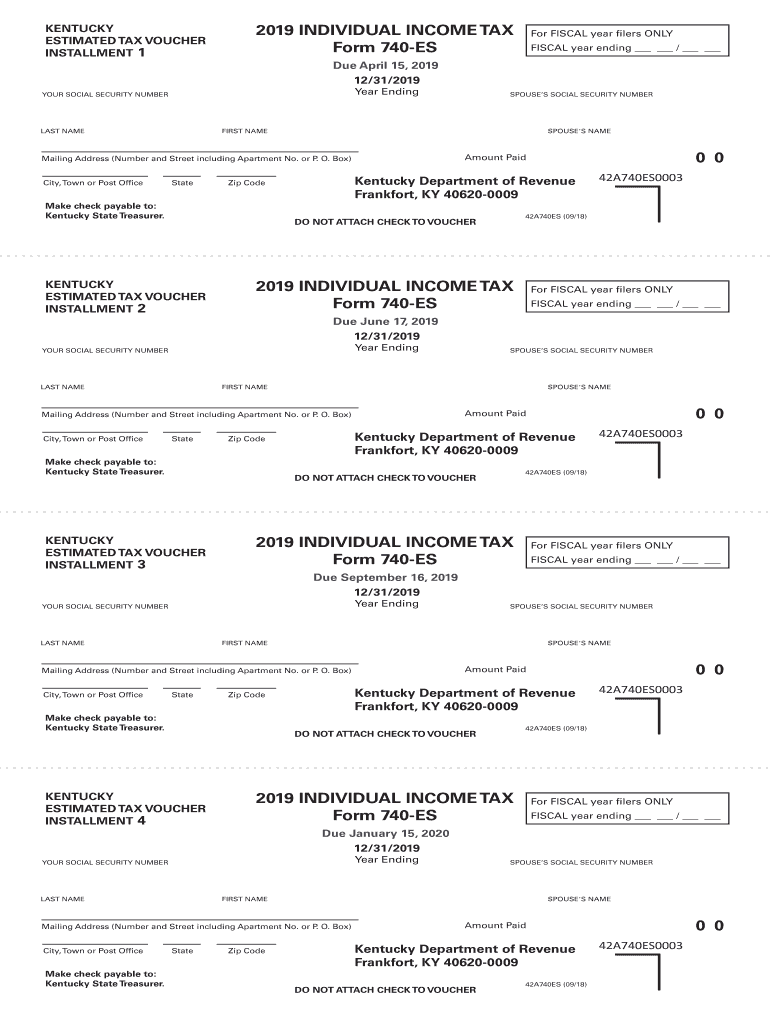

Form 740 Es

What is the 2020 Kentucky Estimated Tax Form?

The 2020 Kentucky estimated tax form, known as the 740 ES, is a document used by individuals and businesses to calculate and pay estimated income tax for the state of Kentucky. This form is essential for taxpayers who expect to owe tax of $500 or more when they file their annual return. The 740 ES helps ensure that taxpayers meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax year.

Steps to Complete the 2020 Kentucky Estimated Tax Form

Completing the 740 ES form involves several straightforward steps:

- Gather your financial information, including income, deductions, and credits.

- Calculate your estimated tax liability for the current year using the previous year's tax return as a reference.

- Divide your total estimated tax liability by four to determine your quarterly payment amount.

- Fill out the 740 ES form with your personal information, including your name, address, and Social Security number.

- Indicate the amount of your estimated tax payment for each quarter.

- Sign and date the form before submitting it.

How to Obtain the 2020 Kentucky Estimated Tax Form

The 2020 Kentucky estimated tax form can be obtained through various means:

- Visit the Kentucky Department of Revenue's official website to download a printable version of the form.

- Request a physical copy by contacting the Kentucky Department of Revenue directly.

- Consult with a tax professional who can provide you with the necessary forms and guidance.

Legal Use of the 2020 Kentucky Estimated Tax Form

The 740 ES form is legally binding when completed and submitted according to Kentucky state tax laws. To ensure that your form is valid:

- Ensure accuracy in your calculations to avoid penalties.

- Submit the form by the due dates to remain compliant with state regulations.

- Keep copies of your submitted forms and payment confirmations for your records.

Filing Deadlines / Important Dates

For the 2020 tax year, the deadlines for filing the 740 ES form are as follows:

- First quarter payment: April 15, 2020

- Second quarter payment: June 15, 2020

- Third quarter payment: September 15, 2020

- Fourth quarter payment: January 15, 2021

Form Submission Methods

The 740 ES form can be submitted in several ways:

- Online through the Kentucky Department of Revenue's e-file system, if available.

- By mail, sending the completed form to the appropriate address provided by the Kentucky Department of Revenue.

- In-person at local tax offices, where you can receive assistance if needed.

Quick guide on how to complete 2019 individual income tax form 740 es 2019 individual

Complete Form 740 Es effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without any holdups. Manage Form 740 Es across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Form 740 Es with ease

- Obtain Form 740 Es and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 740 Es to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 individual income tax form 740 es 2019 individual

How to create an eSignature for your 2019 Individual Income Tax Form 740 Es 2019 Individual in the online mode

How to generate an eSignature for the 2019 Individual Income Tax Form 740 Es 2019 Individual in Chrome

How to generate an electronic signature for putting it on the 2019 Individual Income Tax Form 740 Es 2019 Individual in Gmail

How to make an eSignature for the 2019 Individual Income Tax Form 740 Es 2019 Individual right from your mobile device

How to create an eSignature for the 2019 Individual Income Tax Form 740 Es 2019 Individual on iOS

How to create an eSignature for the 2019 Individual Income Tax Form 740 Es 2019 Individual on Android devices

People also ask

-

What is the 2020 Kentucky estimated tax form?

The 2020 Kentucky estimated tax form is a document used by taxpayers in Kentucky to estimate their tax liabilities for the year. It helps individuals and businesses plan their tax payments throughout the year to avoid penalties. Completing this form accurately is essential for effective tax management.

-

How can airSlate SignNow help with the 2020 Kentucky estimated tax form?

airSlate SignNow provides a seamless way to eSign and send your 2020 Kentucky estimated tax form. Our platform ensures that your documents are securely signed, stored, and shared, making it easier to meet your tax obligations on time. With our user-friendly interface, you can manage your tax forms efficiently.

-

What are the pricing options for airSlate SignNow in relation to tax forms?

airSlate SignNow offers flexible pricing plans designed to suit businesses of all sizes. Whether you need to send a single 2020 Kentucky estimated tax form or multiple documents, our cost-effective solutions ensure you can manage your tax documentation without overspending. Review our plans to find one that fits your budget.

-

Is airSlate SignNow compliant with tax regulations for the 2020 Kentucky estimated tax form?

Yes, airSlate SignNow complies with all relevant tax regulations, ensuring that your 2020 Kentucky estimated tax form is processed legally and securely. Our platform utilizes industry-standard security measures to protect sensitive tax information, so you can sign and submit your forms with confidence.

-

Can I integrate airSlate SignNow with other accounting software for my 2020 Kentucky estimated tax form?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easy to connect your workflows. This means you can automate the process of completing and signing your 2020 Kentucky estimated tax form within your preferred accounting tools.

-

What features does airSlate SignNow provide to assist with tax forms?

airSlate SignNow includes features like customizable templates, bulk sending, and real-time tracking for your 2020 Kentucky estimated tax form. These tools streamline the signing process and enhance efficiency, ensuring you stay organized and meet all deadlines effortlessly.

-

How secure is airSlate SignNow for handling my 2020 Kentucky estimated tax form?

Security is a top priority at airSlate SignNow. We employ bank-level encryption and secure cloud storage to protect your data, including your 2020 Kentucky estimated tax form. Our commitment to compliance with data protection regulations ensures your information is handled safely.

Get more for Form 740 Es

- 104 book colorado individual income tax filing guide form

- Georgia department of revenue compliance division form

- 500 es estimated tax individualfiduciarygeorgia department of form

- Taxes for individuals georgia department of revenue form

- Tax registration georgia department of revenue form

- Dr 0112ep corporate estimated income tax if you are using a screen reader or other assistive technology please note that form

- Dr 0104pn part year residentnonresident tax calculation schedule form

- Dr 1002 colorado salesuse tax rates 666885017 form

Find out other Form 740 Es

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form