Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca 2013

What is the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca

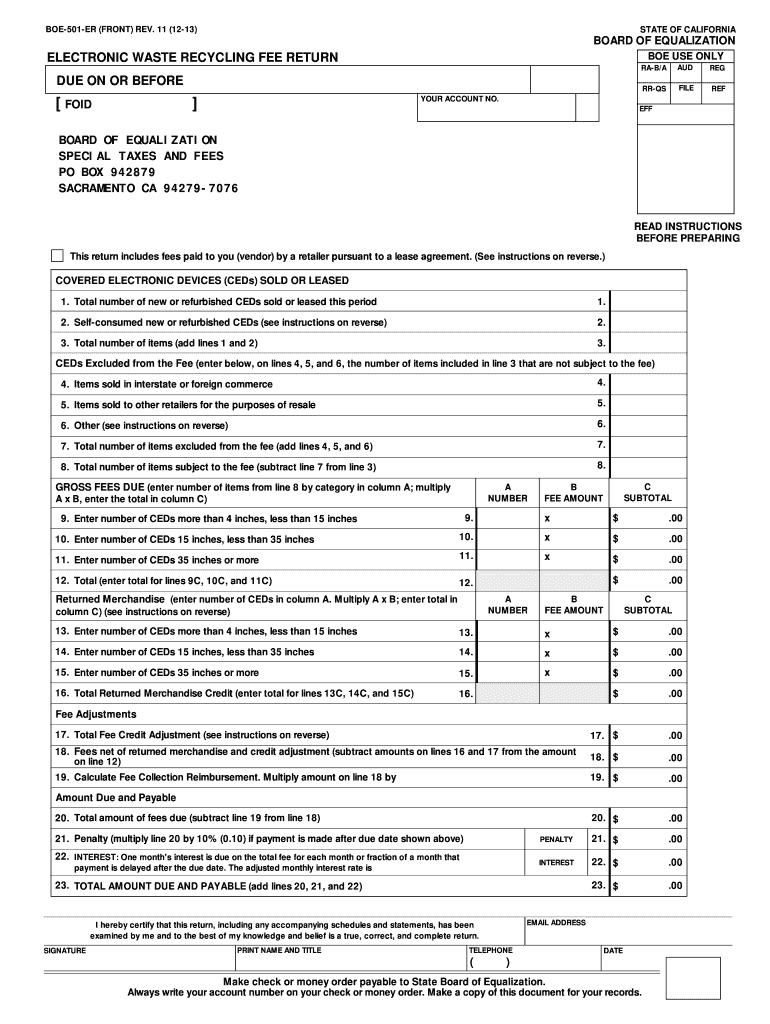

The Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca is a specific tax form used in California to report the electronic waste recycling fee. This fee is imposed on the sale of certain electronic devices, with the purpose of funding the recycling of electronic waste. Businesses that sell these electronic devices must complete this form to ensure compliance with state regulations. The form collects information about the sales of covered electronic devices and calculates the total fee owed to the state.

How to use the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca

Using the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca involves several steps. First, gather sales data for all covered electronic devices sold during the reporting period. Next, enter this information into the appropriate fields of the form. It is crucial to ensure accuracy, as errors can lead to penalties. After completing the form, it can be submitted electronically or via mail, depending on the preferred method. Utilizing an eSignature solution can streamline the signing and submission process, ensuring that the form is filed on time.

Steps to complete the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca

Completing the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca involves a series of systematic steps:

- Collect sales records for all covered electronic devices sold during the reporting period.

- Determine the applicable electronic waste recycling fees based on the sales data.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before finalizing it.

- Choose a submission method: electronically or by mail.

- If submitting electronically, use a secure eSignature solution for signing the document.

Legal use of the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca

The Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca is legally required for businesses that sell covered electronic devices in California. Failing to submit this form can result in penalties and fines. The form must be completed accurately and submitted on time to comply with state tax laws. Additionally, using an eSignature is legally acceptable under the ESIGN Act, making it a viable option for signing and submitting the form digitally.

Filing Deadlines / Important Dates

Filing deadlines for the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca are typically set by the California Department of Tax and Fee Administration. Businesses must be aware of these deadlines to avoid late fees. Generally, the form is due quarterly, with specific dates for each quarter. It is essential to check the official state resources for the most current filing dates and any changes that may occur.

Form Submission Methods (Online / Mail / In-Person)

The Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca can be submitted through various methods. Businesses have the option to file online, which is often the most efficient method. Submitting via mail is also available, but it may take longer for processing. In-person submission is typically not required but may be an option for those who prefer to deliver their forms directly. Utilizing an eSignature platform can facilitate online submissions, ensuring that the forms are securely signed and sent promptly.

Quick guide on how to complete electronic waste recycling fee return boe 501 er boe ca

Your assistance manual on how to prepare your Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca

If you’re curious about how to generate and submit your Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca, here are some brief recommendations on how to simplify tax filing.

To begin, all you need to do is register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and return to revise information as necessary. Optimize your tax organization with enhanced PDF editing, eSigning, and seamless sharing.

Follow the guidelines below to complete your Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca in minutes:

- Set up your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Obtain form to access your Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding electronic signature (if required).

- Review your document and correct any mistakes.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can increase return mistakes and postpone refunds. Importantly, before electronically filing your taxes, consult the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct electronic waste recycling fee return boe 501 er boe ca

Create this form in 5 minutes!

How to create an eSignature for the electronic waste recycling fee return boe 501 er boe ca

How to make an eSignature for your Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca in the online mode

How to make an eSignature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca in Chrome

How to make an electronic signature for putting it on the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca in Gmail

How to generate an electronic signature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca straight from your mobile device

How to make an eSignature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca on iOS

How to create an electronic signature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca on Android devices

People also ask

-

What is the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca?

The Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca is a tax return form used in California to report and remit fees collected on electronic devices. This fee supports the recycling of electronic waste, ensuring that it is disposed of responsibly. Understanding this form is essential for compliance with state regulations.

-

How do I complete the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca?

To complete the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca, you'll need to gather data on the sales of electronic devices subject to the fee. airSlate SignNow offers templates and tools that can simplify the eSigning and submission process, helping you manage your paperwork efficiently.

-

Are there any fees associated with the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca?

While filing the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca itself does not incur direct fees, you may need to consider any costs related to electronic waste recycling. Using airSlate SignNow can help you save money with its cost-effective solutions for eSigning documentation associated with this process.

-

What are the benefits of using airSlate SignNow for the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca?

Using airSlate SignNow for the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca streamlines the eSigning process, making it easier for businesses to manage compliance documentation. The platform is user-friendly and secure, offering features that enhance productivity and facilitate timely submissions.

-

Can I integrate airSlate SignNow with my accounting software for the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca?

Yes, airSlate SignNow can be integrated with various accounting software solutions, which helps in managing and documenting transactions related to the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca effortlessly. This integration allows for seamless data transfer, reducing the risk of errors during the filing process.

-

What types of businesses need to file the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca?

Any business that sells electronic devices in California and collects the electronic waste recycling fee is required to file the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca. This includes retailers, wholesalers, and manufacturers of eligible electronic items, ensuring that they contribute to responsible recycling efforts.

-

How often do I need to file the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca?

The filing frequency for the Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca typically depends on the amount of fee collected. Generally, businesses must file quarterly, but it's best to confirm with the California Department of Tax and Fee Administration for your specific requirements for compliance.

Get more for Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca

- First report of injury maine form

- Pickett and hatcher form

- Lesson 4 skills practice solve two step equations answer key form

- Mla practice template form

- Indirect questions exercises pdf form

- Application to register domestic animals domestic form

- Credit application form archibald new amp used cars kaitaia northland archibaldcars co

- Superlife account number form

Find out other Electronic Waste Recycling Fee Return BOE 501 ER Boe Ca

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure