Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca 2016

What is the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca

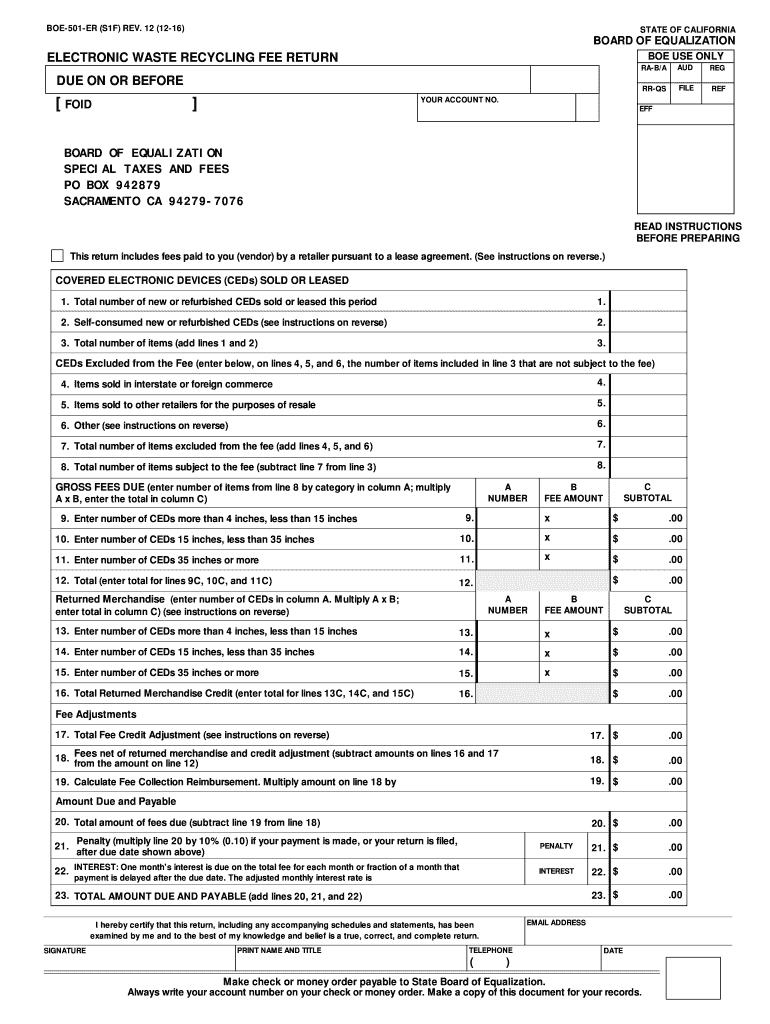

The Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, is a specific form used in California to report and remit fees associated with the recycling of electronic waste. This form is crucial for businesses and individuals who sell or distribute electronic devices that may contain hazardous materials. The fee collected is intended to fund the proper recycling and disposal of electronic waste, ensuring environmental protection and compliance with state regulations.

Steps to complete the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca

Completing the Electronic Waste Recycling Fee Return involves several key steps:

- Gather necessary information, including sales data for electronic devices sold during the reporting period.

- Calculate the total electronic waste recycling fee based on the applicable rates for each device type.

- Fill out the BOE 501 ER form with accurate details, ensuring all required fields are completed.

- Review the form for accuracy to avoid penalties or delays in processing.

- Submit the completed form either online, by mail, or in person, depending on your preference and compliance requirements.

Legal use of the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca

The legal use of the Electronic Waste Recycling Fee Return is governed by California state law. It is mandatory for businesses that sell electronic devices to file this return to comply with the Electronic Waste Recycling Act. Failing to submit the form or inaccurately reporting fees can result in penalties, including fines and additional fees. It is essential to ensure that the form is completed in accordance with state regulations to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Electronic Waste Recycling Fee Return are crucial for compliance. Typically, the return is due quarterly, with specific deadlines set by the California Department of Tax and Fee Administration. It is important to stay informed about these dates to ensure timely submission and avoid late fees. Businesses should mark their calendars for these deadlines and prepare the necessary documentation in advance.

Form Submission Methods (Online / Mail / In-Person)

The Electronic Waste Recycling Fee Return can be submitted through various methods, providing flexibility for filers:

- Online Submission: Filers can complete and submit the form electronically through the California Department of Tax and Fee Administration's website.

- Mail Submission: The completed form can be printed and mailed to the designated address provided on the form.

- In-Person Submission: Filers may also choose to submit the form in person at local offices of the California Department of Tax and Fee Administration.

Key elements of the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca

Understanding the key elements of the Electronic Waste Recycling Fee Return is essential for accurate completion. Important components include:

- Identifying Information: This includes the business name, address, and seller's permit number.

- Sales Data: Accurate reporting of the number of electronic devices sold during the reporting period.

- Fee Calculation: The total fee owed based on the number and types of devices sold.

- Signature: An authorized representative must sign the form to validate the information provided.

Quick guide on how to complete electronic waste recycling fee return boe 501 er boe ca 403489369

Your assistance manual on how to prepare your Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca

If you’re curious about how to finalize and submit your Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, here are some brief instructions on how to simplify tax submission.

To begin, you merely need to set up your airSlate SignNow account to revise how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document platform that enables you to edit, produce, and complete your tax documents with ease. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and return to modify details as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Adhere to the following steps to finish your Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca in moments:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Press Get form to launch your Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca in our editor.

- Complete the essential fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to append your legally-recognized eSignature (if necessary).

- Examine your document and rectify any discrepancies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can elevate return errors and postpone refunds. Naturally, before e-filing your taxes, consult the IRS website for declaration rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct electronic waste recycling fee return boe 501 er boe ca 403489369

Create this form in 5 minutes!

How to create an eSignature for the electronic waste recycling fee return boe 501 er boe ca 403489369

How to make an eSignature for your Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca 403489369 online

How to create an electronic signature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca 403489369 in Google Chrome

How to create an eSignature for signing the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca 403489369 in Gmail

How to generate an electronic signature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca 403489369 right from your smartphone

How to make an electronic signature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca 403489369 on iOS

How to make an eSignature for the Electronic Waste Recycling Fee Return Boe 501 Er Boe Ca 403489369 on Android OS

People also ask

-

What is the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca?

The Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, is a form used to report the electronic waste handling fee imposed on certain electronics sold in California. This fee helps fund the recycling program for electronic waste, ensuring environmentally safe disposal. Understanding this form is crucial for businesses that sell electronics to comply with California state regulations.

-

How do I complete the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca?

To complete the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, businesses must accurately report the amount of electronic waste sold and the corresponding fees collected. You can simplify this process using airSlate SignNow, which provides easy eSigning options and document management features. Ensure all sales figures are accurate to avoid potential compliance issues.

-

Are there penalties for not filing the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca?

Yes, failing to file the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, can result in penalties and fines imposed by the California Board of Equalization. It's essential to stay compliant by filing the return on time. Utilizing airSlate SignNow can help streamline the process and ensure you meet all deadlines.

-

Can I file the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, electronically?

Yes, the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, can be filed electronically, making the process more efficient. Using airSlate SignNow, you can fill out and submit your returns online with secure eSigning capabilities. This ensures faster processing and helps you maintain compliance effortlessly.

-

What features does airSlate SignNow offer for managing the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca?

airSlate SignNow provides robust features for managing the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, including customizable templates and smart fields that auto-populate based on previous data. With eSigning and secure document storage, you can easily track submissions and document history. This ensures a seamless compliance process for your business.

-

Is there a cost associated with filing the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca?

While the filing itself may not have a direct cost, businesses are responsible for collecting and remitting the electronic waste recycling fees in accordance with state regulations. Utilizing airSlate SignNow offers a cost-effective solution for preparing and submitting the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, minimizing the time and resources required.

-

How can airSlate SignNow help my business stay compliant with the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca?

airSlate SignNow assists businesses in staying compliant with the Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca, by providing automated reminders for filing deadlines and easy access to necessary documentation. Our platform streamlines the eSigning process, ensuring you submit accurate returns on time. This allows you to focus on your business while we handle compliance.

Get more for Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca

- Places in a city word search form

- Usafe form 291a 448424181

- Ze request form cbie bcei

- State form 55317 r 11 16

- Employment application wetzel39s pretzels form

- Form it 631 claim for security officer training tax credit tax year

- Equity purchase agreement template 787742087 form

- Equity share agreement template form

Find out other Electronic Waste Recycling Fee Return, BOE 501 ER Boe Ca

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online