Electronic Waste Recycling Fee Return California Department of 2017

What is the Electronic Waste Recycling Fee Return California Department Of

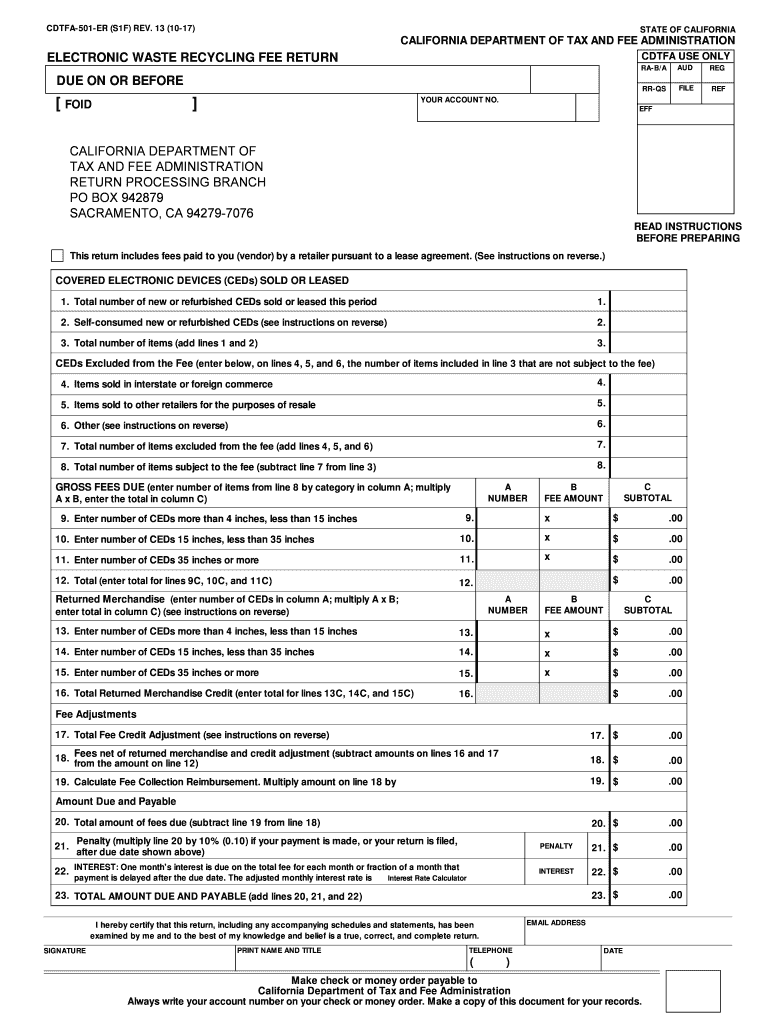

The Electronic Waste Recycling Fee Return is a specific form required by the California Department of Tax and Fee Administration (CDTFA). This form is designed for businesses that sell certain electronic devices, which are subject to an electronic waste recycling fee. The fee helps fund the proper disposal and recycling of electronic waste, ensuring environmental protection and compliance with state regulations. By completing this form, businesses report the amount of electronic waste fees collected from consumers and remit the appropriate amounts to the state.

Steps to complete the Electronic Waste Recycling Fee Return California Department Of

Completing the Electronic Waste Recycling Fee Return involves several key steps:

- Gather necessary information, including sales data for electronic devices and the total fees collected.

- Access the form through the California Department of Tax and Fee Administration's website or a secure online platform.

- Fill in the required fields accurately, ensuring all figures align with your sales records.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or by mail, following the guidelines provided by the CDTFA.

How to obtain the Electronic Waste Recycling Fee Return California Department Of

The Electronic Waste Recycling Fee Return can be obtained directly from the California Department of Tax and Fee Administration's website. Businesses can download the form in a fillable PDF format or access it through a digital signing platform for easier completion. It is essential to ensure you have the most current version of the form to comply with state regulations. Additionally, businesses may receive the form via mail if they are registered with the CDTFA.

Legal use of the Electronic Waste Recycling Fee Return California Department Of

To ensure the legal use of the Electronic Waste Recycling Fee Return, businesses must adhere to California state laws regarding electronic waste. The form must be filled out accurately and submitted by the required deadlines to avoid penalties. Using electronic signatures is permitted, provided they comply with the ESIGN Act, ensuring that the form remains legally binding. It is advisable for businesses to maintain records of submitted forms and any correspondence with the CDTFA for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Electronic Waste Recycling Fee Return are critical for compliance. Businesses are typically required to submit the form quarterly. The specific due dates are usually the last day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 30. It is important to check the CDTFA's official calendar for any updates or changes to these deadlines to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Electronic Waste Recycling Fee Return can be submitted through various methods to accommodate different business needs. Businesses can file the form online via the California Department of Tax and Fee Administration's website, which provides a streamlined process for electronic submission. Alternatively, the form can be mailed to the CDTFA's designated address or submitted in person at a local office. Each method has specific guidelines, so businesses should choose the one that best suits their operational preferences.

Quick guide on how to complete electronic waste recycling fee return california department of

Your assistance manual on how to prepare your Electronic Waste Recycling Fee Return California Department Of

If you’re interested in learning how to generate and submit your Electronic Waste Recycling Fee Return California Department Of, here are some brief instructions on simplifying the tax filing process.

To begin, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document platform that enables you to modify, create, and complete your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, returning to change information as needed. Optimize your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Adhere to the steps below to finalize your Electronic Waste Recycling Fee Return California Department Of in just a few minutes:

- Establish your account and start editing PDFs in no time.

- Utilize our directory to locate any IRS tax form; sift through various versions and schedules.

- Select Get form to access your Electronic Waste Recycling Fee Return California Department Of in our editor.

- Complete the mandatory fillable fields with your data (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to filing errors and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct electronic waste recycling fee return california department of

FAQs

-

How do I fill out the N-600 certificate of citizenship application if you already received a US passport from the state department and returned your Greencard as the questions seem to assume one is still on immigrant status?

In order to file N-600 to apply for a Certificate of Citizenship, you must already be a US citizen beforehand. (The same is true to apply for a US passport — you must already be a US citizen beforehand.) Whether you applied for a passport already is irrelevant; it is normal for a US citizen to apply for a US passport; applying for a passport never affects your immigration status, as you must already have been a US citizen before you applied for a passport.The form’s questions are indeed worded poorly. Just interpret the question to be asking about your status before you became a citizen, because otherwise the question would make no sense, as an applicant of N-600 must already be a US citizen at the time of filing the application.(By the way, why are you wasting more than a thousand dollars to apply for a Certificate of Citizenship anyway? It basically doesn’t serve any proof of citizenship purposes that a US passport doesn’t already serve as.)

Create this form in 5 minutes!

How to create an eSignature for the electronic waste recycling fee return california department of

How to make an eSignature for your Electronic Waste Recycling Fee Return California Department Of online

How to make an electronic signature for the Electronic Waste Recycling Fee Return California Department Of in Chrome

How to create an eSignature for putting it on the Electronic Waste Recycling Fee Return California Department Of in Gmail

How to create an eSignature for the Electronic Waste Recycling Fee Return California Department Of right from your mobile device

How to make an electronic signature for the Electronic Waste Recycling Fee Return California Department Of on iOS

How to generate an electronic signature for the Electronic Waste Recycling Fee Return California Department Of on Android OS

People also ask

-

What is the Electronic Waste Recycling Fee Return California Department Of?

The Electronic Waste Recycling Fee Return California Department Of is a mandatory fee that residents must pay when purchasing certain electronic devices to support the recycling of e-waste. This fee contributes to a fund that ensures proper recycling and disposal of electronic waste in California, protecting the environment and public health.

-

How do I file the Electronic Waste Recycling Fee Return California Department Of?

To file the Electronic Waste Recycling Fee Return California Department Of, you can visit the California Department of Tax and Fee Administration's website. The process involves filling out an online form or submitting a paper return, detailing the electronic devices purchased and the corresponding fees.

-

What electronic devices are subject to the Electronic Waste Recycling Fee Return California Department Of?

The Electronic Waste Recycling Fee Return California Department Of applies to various electronic devices, including computers, monitors, televisions, and laptops. It's essential to check the specific regulations from the California Department of Tax and Fee Administration to ensure compliance when purchasing these items.

-

Are there penalties for not filing the Electronic Waste Recycling Fee Return California Department Of?

Yes, failing to file the Electronic Waste Recycling Fee Return California Department Of can result in penalties, late fees, and interest on the unpaid amount. It is crucial to submit your return on time to avoid any potential issues with the California Department of Tax and Fee Administration.

-

What are the benefits of paying the Electronic Waste Recycling Fee Return California Department Of?

Paying the Electronic Waste Recycling Fee Return California Department Of helps promote responsible recycling initiatives and supports environmental sustainability efforts in California. This fee ensures that electronic waste is managed properly, reducing landfill waste and protecting natural resources.

-

How can airSlate SignNow help with managing Electronic Waste Recycling Fee Return California Department Of?

airSlate SignNow offers an easy-to-use platform for eSigning and managing documents related to the Electronic Waste Recycling Fee Return California Department Of. With our cost-effective solution, businesses can streamline their filing processes, ensuring compliance and efficient record-keeping.

-

Is there a customer support team available for questions about the Electronic Waste Recycling Fee Return California Department Of?

Absolutely! The California Department of Tax and Fee Administration has a dedicated customer support team that can assist with questions regarding the Electronic Waste Recycling Fee Return California Department Of. Additionally, airSlate SignNow provides customer support to help with any document-related inquiries.

Get more for Electronic Waste Recycling Fee Return California Department Of

- Medical records invoice pdf form

- Oxford house secretary report form

- Application for electricity connection form

- Amop pharmacy form

- Form m 60 certificate of record for vision screen andor eye

- Request a pay duty officer halton regional police service form

- Cit 120west virginiacorporation net income tax form

- Equity sharing agreement template form

Find out other Electronic Waste Recycling Fee Return California Department Of

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple