California Electronic Waste Fee Form 2018

What is the California Electronic Waste Fee Form

The California Electronic Waste Fee Form is a document required for individuals and businesses to report and pay the electronic waste recycling fee. This fee is applicable to specific electronic devices sold in California, such as televisions, computer monitors, and laptops. The purpose of this fee is to fund the recycling and safe disposal of electronic waste, ensuring that hazardous materials are managed responsibly and do not harm the environment.

How to use the California Electronic Waste Fee Form

To use the California Electronic Waste Fee Form, individuals must first determine if they are responsible for paying the electronic waste fee based on the products they sell. Once identified, they can fill out the form with relevant information, including the number of devices sold and the corresponding fees. After completing the form, it can be submitted electronically or via mail, depending on the preferred submission method.

Steps to complete the California Electronic Waste Fee Form

Completing the California Electronic Waste Fee Form involves several straightforward steps:

- Gather necessary information, including sales data for electronic devices.

- Access the form through the appropriate state website or platform.

- Fill in the required fields, ensuring accuracy in reporting the number of devices sold.

- Calculate the total fee based on the number of devices and applicable rates.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, as preferred.

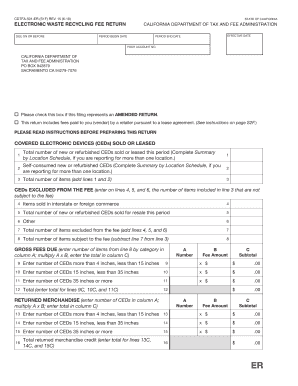

Key elements of the California Electronic Waste Fee Form

Key elements of the California Electronic Waste Fee Form include:

- Business Information: Name, address, and contact details of the seller.

- Device Details: Types and quantities of electronic devices sold.

- Fee Calculation: Breakdown of the electronic waste fees based on the number of devices.

- Signature: A declaration confirming the accuracy of the information provided.

Form Submission Methods

The California Electronic Waste Fee Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many users prefer submitting the form electronically via the state’s designated website, which often provides a faster processing time.

- Mail Submission: For those who prefer a paper trail, the form can be printed and mailed to the appropriate state office.

- In-Person Submission: Some individuals may choose to submit the form in person at designated state offices for immediate processing.

Penalties for Non-Compliance

Failure to complete and submit the California Electronic Waste Fee Form on time can result in penalties. These may include fines or additional fees assessed by the state. It is crucial for individuals and businesses to understand their responsibilities regarding electronic waste fees to avoid potential legal and financial repercussions.

Quick guide on how to complete cdtfa 501 er electronic waste recycling fee return

Your assistance manual on how to prepare your California Electronic Waste Fee Form

If you’re wondering how to generate and send your California Electronic Waste Fee Form, here are some brief guidelines on how to simplify tax processing.

To get started, you need to register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, draft, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and go back to adjust responses as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and intuitive sharing features.

Follow the instructions below to complete your California Electronic Waste Fee Form within minutes:

- Create your profile and begin working on PDFs in just a few moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your California Electronic Waste Fee Form in our editor.

- Input the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may increase return errors and delay refunds. Be sure, before e-filing your taxes, to verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 501 er electronic waste recycling fee return

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 501 er electronic waste recycling fee return

How to generate an eSignature for your Cdtfa 501 Er Electronic Waste Recycling Fee Return in the online mode

How to make an electronic signature for your Cdtfa 501 Er Electronic Waste Recycling Fee Return in Chrome

How to create an electronic signature for putting it on the Cdtfa 501 Er Electronic Waste Recycling Fee Return in Gmail

How to generate an electronic signature for the Cdtfa 501 Er Electronic Waste Recycling Fee Return straight from your smart phone

How to make an electronic signature for the Cdtfa 501 Er Electronic Waste Recycling Fee Return on iOS

How to make an electronic signature for the Cdtfa 501 Er Electronic Waste Recycling Fee Return on Android

People also ask

-

What is the California mattress recycling fee?

This program, known as Bye Bye Mattress, is funded through a $10.50 recycling fee collected on all purchases of new, used and renovated mattresses, futons and box springs.

-

Why does California charge a mattress recycling fee?

State law requires retailers to collect this fee on any mattress or box spring sale to fund the state's mattress recycling program. This program provides a network of participating cities, towns, retailers, recyclers and other organizations where old mattresses are collected for recycling at no additional cost to you.

-

Why are mattresses so expensive to dispose of?

Currently thatʼs only the small states of Rhode Island and Connecticut and recycling-friendly California. The programs are funded by a $9 to $16 fee at point of purchase (even from an online vendor), enacted by legislation, that helps fund the drop-off sites, transport, and eventual recycling of mattresses.

-

How to dispose of a mattress in California for free?

The Bye Bye Mattress program provides free or low-cost recycling opportunities throughout the state. Consumers can bring their used mattresses and box springs to designated recycling centers at no cost. These centers are located across California, ensuring accessibility for urban and rural residents alike.

-

How much is electronic waste worth?

Amount of e-waste generated and collected globally The metals contained in the e-waste generated globally in 2022 alone – approximately 31 million tonnes – were valued at US$91 billion, including US $19 billion in copper, US $15 billion in gold, and US $16 billion in iron.

-

Is there any value in recovering e-waste?

Bearing this in mind, there is signNow economic potential in the world's electronic waste, as discarded items contain valuable materials such as copper, gold, iron, aluminum, and other minerals and rare earth elements (REE) that can be extracted.

-

Why does California charge a recycling fee?

Helping your business succeed is important to the California Department of Tax and Fee Administration (CDTFA). The fees you collect and pay to the state provide funding for a program for consumers to return, recycle, and ensure safe and environmentally sound disposal of covered electronic devices (CEDs).

-

What is the CA electronic waste recycling fee?

$4 More than four inches but less than 15 inches. $5 At least 15 inches but less than 35 inches. $6 35 inches or more.

Get more for California Electronic Waste Fee Form

- Bounce house amp games release of liability form

- Payroll timecard correction form

- Mo 580 1460 form

- Cfone registration form

- Household income statement form

- Studentgroup travel waiver of liability and hold harmless agreement angelo form

- Jh ltc quick quote form ltc1028 coastal financial partners group

- Equity partner agreement template form

Find out other California Electronic Waste Fee Form

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online