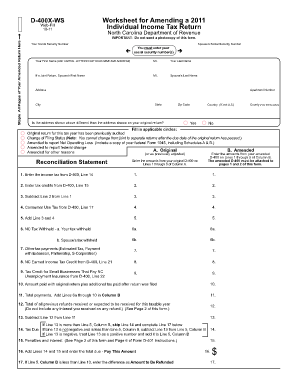

D 400X WS Worksheet for Amending a Individual Income Tax Form

What is the D 400X WS Worksheet For Amending A Individual Income Tax

The D 400X WS Worksheet for amending an individual income tax is a specific form used by taxpayers in the United States to correct or modify previously filed income tax returns. This worksheet allows individuals to report changes in their income, deductions, or credits, ensuring their tax filings are accurate and compliant with IRS regulations. It is essential for taxpayers who have identified errors or wish to claim additional deductions or credits after their initial submission.

How to use the D 400X WS Worksheet For Amending A Individual Income Tax

Using the D 400X WS Worksheet involves several straightforward steps. First, gather all necessary documentation, including your original tax return and any relevant financial records. Next, fill out the worksheet by providing the required information, such as your personal details and the specific changes you are making. It is crucial to ensure that all entries are accurate to avoid further complications. Once completed, review the worksheet thoroughly before submitting it to the appropriate tax authority.

Steps to complete the D 400X WS Worksheet For Amending A Individual Income Tax

Completing the D 400X WS Worksheet requires careful attention to detail. Follow these steps:

- Obtain the D 400X WS Worksheet from the IRS or your tax preparer.

- Fill in your personal information, including your name, address, and Social Security number.

- Identify the tax year you are amending and the original amounts reported.

- Clearly indicate the changes you are making, providing explanations where necessary.

- Calculate the new tax liability based on the amended information.

- Sign and date the worksheet before submission.

Legal use of the D 400X WS Worksheet For Amending A Individual Income Tax

The D 400X WS Worksheet is legally recognized as a valid document for amending tax returns in the United States. To ensure its legal standing, it must be completed accurately and submitted within the designated time frame set by the IRS. Compliance with all relevant tax laws is essential, as failure to do so may result in penalties or further audits. Utilizing electronic signature solutions can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

Timely submission of the D 400X WS Worksheet is crucial. Generally, taxpayers must file an amended return within three years from the original filing date or within two years from the date they paid the tax, whichever is later. It is advisable to keep track of these deadlines to avoid missing the opportunity to amend your tax return. Staying informed about any changes in IRS regulations regarding filing deadlines is also beneficial.

Form Submission Methods (Online / Mail / In-Person)

The D 400X WS Worksheet can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved e-filing software, which often streamlines the process. Alternatively, the completed worksheet can be mailed to the appropriate IRS address, ensuring that it is sent via a reliable postal service. In some cases, individuals may also submit the form in person at designated IRS offices, although this option may vary based on location.

Quick guide on how to complete d 400x ws worksheet for amending a individual income tax

Effortlessly Prepare D 400X WS Worksheet For Amending A Individual Income Tax on Any Device

Digital document management has gained signNow traction with businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your files swiftly without interruptions. Manage D 400X WS Worksheet For Amending A Individual Income Tax on any device using the airSlate SignNow Android or iOS applications and streamline any document-driven process today.

How to Alter and Electronically Sign D 400X WS Worksheet For Amending A Individual Income Tax with Ease

- Find D 400X WS Worksheet For Amending A Individual Income Tax and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs within a few clicks from your chosen device. Modify and electronically sign D 400X WS Worksheet For Amending A Individual Income Tax and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 400x ws worksheet for amending a individual income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 400X WS Worksheet For Amending A Individual Income Tax?

The D 400X WS Worksheet For Amending A Individual Income Tax is a specific form designed to assist individuals in correcting their previously filed income tax returns. This worksheet guides users through the amendment process, ensuring accurate reporting of any changes. By utilizing this worksheet, taxpayers can effectively communicate adjustments to their financial information.

-

How do I access the D 400X WS Worksheet For Amending A Individual Income Tax?

You can easily access the D 400X WS Worksheet For Amending A Individual Income Tax through our platform, which provides an all-in-one solution for tax documentation. Simply create an account, navigate to the tax forms section, and locate the D 400X WS Worksheet. Our user-friendly interface makes it simple to fill out and eSign the document.

-

Is there a cost associated with using the D 400X WS Worksheet For Amending A Individual Income Tax?

AirSlate SignNow offers a cost-effective solution for utilizing the D 400X WS Worksheet For Amending A Individual Income Tax. Our pricing plans are competitive and cater to different user needs, ensuring you get the best value for your investments. You can choose a subscription that fits your budget while accessing all necessary features.

-

What features does the D 400X WS Worksheet For Amending A Individual Income Tax include?

The D 400X WS Worksheet For Amending A Individual Income Tax includes features such as a step-by-step guide to completing your amendment, real-time comments, and collaboration options for easy sharing with tax professionals. Additionally, our platform allows you to securely eSign the document, streamlining the process signNowly.

-

Can I integrate the D 400X WS Worksheet For Amending A Individual Income Tax with other tools?

Yes, airSlate SignNow allows seamless integration of the D 400X WS Worksheet For Amending A Individual Income Tax with various third-party applications. This enables you to connect with accounting software, CRM systems, and other productivity tools you may already be using. This integration enhances workflow efficiency and document management.

-

What are the benefits of using the D 400X WS Worksheet For Amending A Individual Income Tax through airSlate SignNow?

Utilizing the D 400X WS Worksheet For Amending A Individual Income Tax via airSlate SignNow offers numerous benefits, including easy accessibility and a streamlined workflow. With electronic signatures, users can save time and stay organized during the amendment process. Our solution also helps reduce the likelihood of errors, ensuring compliance with tax laws.

-

Is there customer support available for the D 400X WS Worksheet For Amending A Individual Income Tax?

Absolutely! Our dedicated customer support team is available to assist you with any inquiries regarding the D 400X WS Worksheet For Amending A Individual Income Tax. Whether you need help navigating the platform or have specific questions about the worksheet, we're here to ensure you have a smooth experience.

Get more for D 400X WS Worksheet For Amending A Individual Income Tax

Find out other D 400X WS Worksheet For Amending A Individual Income Tax

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online