INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm 2022

What is the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm

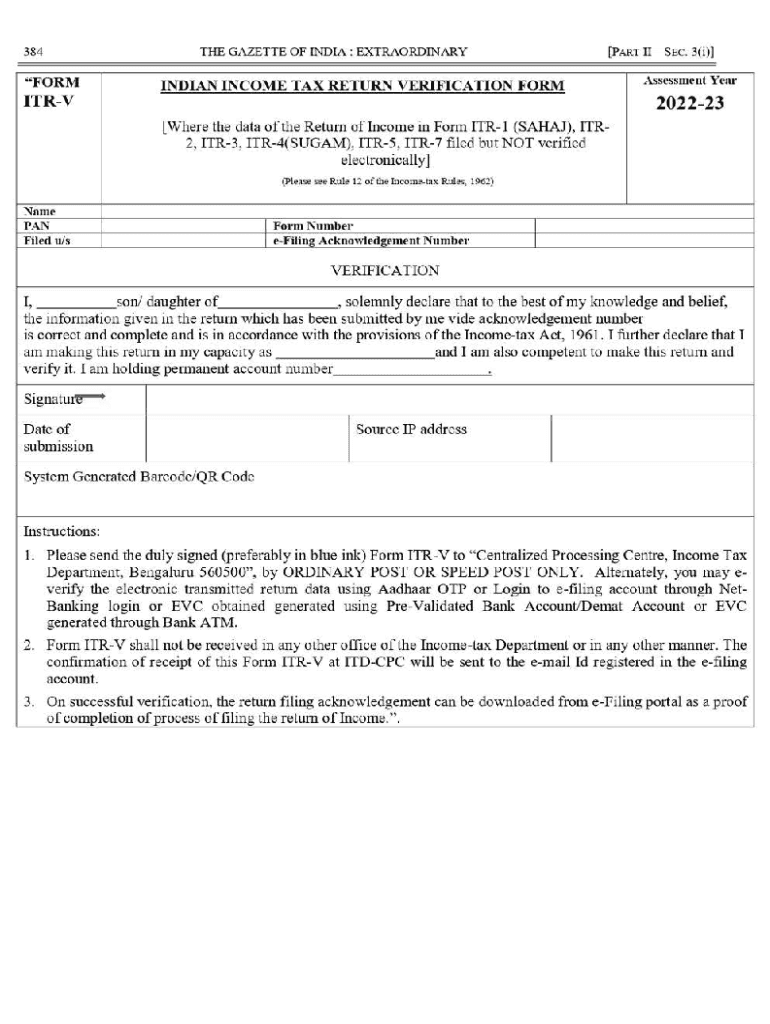

The Indian Income Tax Return Verification Form Assessm is a crucial document used to confirm the authenticity of an individual's income tax return. This form serves as a verification tool that ensures the submitted tax return aligns with the information provided to the tax authorities. It is essential for maintaining compliance with tax regulations and can be required during audits or assessments by the Internal Revenue Service (IRS). The form typically includes personal identification details, income sources, and tax liabilities, making it an integral part of the tax filing process.

Steps to complete the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm

Completing the Indian Income Tax Return Verification Form Assessm involves several key steps:

- Gather necessary documents, including your income statements, previous tax returns, and identification details.

- Fill out the form accurately, ensuring all personal and financial information is correct.

- Review the completed form for any errors or omissions.

- Sign the form electronically using a trusted eSignature solution to ensure its validity.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm

The legal use of the Indian Income Tax Return Verification Form Assessm is significant for ensuring compliance with tax laws. This form must be filled out and submitted as per the guidelines established by the IRS. When properly executed, it serves as a legally binding document that can be used in legal proceedings or audits. Adhering to the requirements of eSignature laws, such as the ESIGN Act and UETA, ensures that the form holds up in a court of law, providing protection for both the taxpayer and the tax authorities.

Required Documents

To successfully complete the Indian Income Tax Return Verification Form Assessm, you will need to gather several important documents:

- Personal identification, such as a driver's license or Social Security number.

- Income statements, including W-2s or 1099 forms.

- Previous tax returns for reference.

- Any supporting documentation related to deductions or credits claimed.

Form Submission Methods (Online / Mail / In-Person)

There are various methods available for submitting the Indian Income Tax Return Verification Form Assessm:

- Online: Utilize a secure eSignature platform for electronic submission.

- Mail: Print the completed form and send it to the designated tax authority address.

- In-Person: Visit a local tax office to submit the form directly.

Examples of using the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm

Examples of using the Indian Income Tax Return Verification Form Assessm include:

- Submitting the form during an IRS audit to verify reported income.

- Providing the form when applying for a loan that requires proof of income.

- Using the form to resolve discrepancies in tax filings with the IRS.

Quick guide on how to complete indian income tax return verification form assessm

Complete INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm effortlessly on any gadget

Digital document organization has gained traction with companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools you require to generate, modify, and eSign your documents promptly without holdups. Manage INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm with ease

- Locate INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Disregard misplaced or lost files, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indian income tax return verification form assessm

Create this form in 5 minutes!

How to create an eSignature for the indian income tax return verification form assessm

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm?

The INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm is an essential document that individuals must submit to verify their income tax returns with the Indian government. This form ensures that your tax filings are accurate and compliant with existing regulations, helping you avoid any penalties.

-

How can airSlate SignNow help with the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm?

airSlate SignNow provides a seamless solution for sending and eSigning the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm. Our platform allows users to manage documentation efficiently, ensuring that tax returns are verified promptly and securely.

-

Is there a cost associated with using airSlate SignNow for the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a fee associated with using our platform for the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm, we provide a cost-effective solution that saves time and enhances efficiency.

-

What features does airSlate SignNow offer for managing the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm?

airSlate SignNow offers features such as electronic signatures, document templates, and real-time tracking for the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm. These features help streamline the process, making it easy for users to complete their tax verification documentation quickly.

-

Can I integrate airSlate SignNow with other software for the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm?

Yes, airSlate SignNow provides various integration options with popular software applications. This allows users to link their processes to ensure smoother workflows when handling the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm.

-

How does airSlate SignNow ensure the security of my INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm?

AirSlate SignNow prioritizes the security of your documents by employing industry-standard encryption and secure cloud storage. This means your INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm will be protected against unauthorized access and data bsignNowes.

-

What are the benefits of using airSlate SignNow for the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm?

Using airSlate SignNow for the INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm offers numerous benefits, including increased efficiency, reduced paperwork, and easy document tracking. Our platform simplifies the verification process, allowing users to focus on other important tasks.

Get more for INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm

- Forms maryland department of assessments and taxation

- State law authorizes the secretary of state to refund fees only under certain conditions form

- Form 5199 fdcvt reimbursement request state of michigan michigan

- Definition of adjusted gross income internal revenue service form

- 5200 annual return for hmo use tax 5200 annual return for hmo use tax michigan form

- Form rev184i individual or sole proprietor power of attorney

- Filing a petroleum tax refund claimminnesota department form

- Spouses name if a joint income tax return form

Find out other INDIAN INCOME TAX RETURN VERIFICATION FORM Assessm

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form