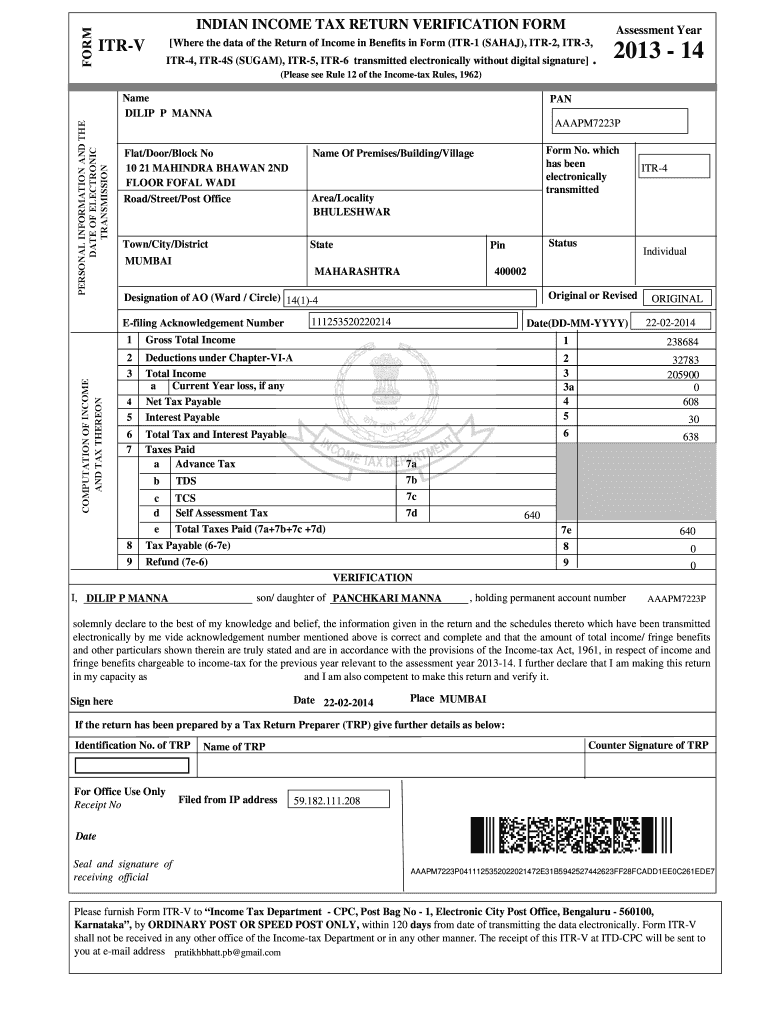

Income Tax Return Verification 2014

What is the Income Tax Return Verification

The Income Tax Return Verification is a crucial document that confirms the accuracy and legitimacy of an individual's or business's income tax return. This verification serves as proof that the submitted tax return has been reviewed and accepted by the relevant tax authority, ensuring compliance with federal and state tax regulations. It is essential for taxpayers to maintain this document as it may be required for various purposes, including loan applications, financial audits, and other legal proceedings.

Steps to complete the Income Tax Return Verification

Completing the Income Tax Return Verification involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documents, including your completed income tax form, W-2s, 1099s, and any other relevant financial records.

- Review Your Tax Return: Carefully check your tax return for any errors or omissions. Ensure that all income, deductions, and credits are accurately reported.

- Complete the Verification Form: Fill out the Income Tax Return Verification form, providing all required information as specified by the tax authority.

- Submit the Verification: Depending on the requirements, submit your verification form online, by mail, or in person at your local tax office.

- Retain Copies: Keep copies of your verification and all supporting documents for your records.

Legal use of the Income Tax Return Verification

The Income Tax Return Verification holds legal significance as it validates the information reported in your tax return. It is often used in legal contexts, such as during audits or disputes with tax authorities. By providing this verification, taxpayers can demonstrate their compliance with tax laws, potentially avoiding penalties or legal repercussions. It is essential to ensure that the verification is accurately completed and submitted within the required timeframes to maintain its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Return Verification are typically aligned with the tax return submission deadlines. For most taxpayers, the deadline to file their federal income tax return is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to be aware of any state-specific deadlines as well, as they may differ from federal timelines. Keeping track of these dates ensures timely submission and compliance with tax regulations.

Required Documents

To complete the Income Tax Return Verification, several documents are necessary:

- Completed Income Tax Return: The primary document that needs verification.

- W-2 Forms: These forms report wages and taxes withheld from your employer.

- 1099 Forms: Used to report income from self-employment or other sources.

- Supporting Documentation: Any additional documents that support deductions, credits, or income claims.

Who Issues the Form

The Income Tax Return Verification form is typically issued by the Internal Revenue Service (IRS) for federal tax purposes. State tax authorities may also provide their own verification forms, which may differ in format and requirements. It is essential to use the correct form that corresponds to the tax jurisdiction relevant to your situation. Ensure that you are using the most current version of the form to avoid any compliance issues.

Quick guide on how to complete income tax verification form 2014 2019

A concise manual on how to prepare your Income Tax Return Verification

Finding the appropriate template can be a challenge when you need to present official international documents. Even if you possess the necessary form, it might be tedious to quickly fill it out according to all the specifications if you are using physical copies instead of managing everything digitally. airSlate SignNow is the online electronic signature service that assists you in overcoming such hurdles. It enables you to select your Income Tax Return Verification and swiftly complete and sign it on-site without the need to reprint documents whenever you make an error.

Here are the actions you should take to prepare your Income Tax Return Verification with airSlate SignNow:

- Click the Obtain Form button to add your document to our editor right away.

- Begin with the first blank field, enter your information, and continue with the Next tool.

- Fill in the vacant boxes using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your Income Tax Return Verification requires it.

- Use the right-side panel to add more fields for you or others to complete if necessary.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Finished button and selecting your file-sharing preferences.

Once your Income Tax Return Verification is prepared, you can distribute it however you prefer - send it to recipients through email, SMS, fax, or even print it directly from the editor. You can also safely preserve all your completed documents in your account, organized into folders as per your preferences. Don’t spend time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct income tax verification form 2014 2019

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

What is the capacity column in the ITR-1 last page?

In case the return is being filed by you in a representative capacity, then for verification purpose this column inserted by income tax department. If you himself verify your return the mention Self in Capacity Column.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

Create this form in 5 minutes!

How to create an eSignature for the income tax verification form 2014 2019

How to create an eSignature for the Income Tax Verification Form 2014 2019 online

How to create an electronic signature for the Income Tax Verification Form 2014 2019 in Chrome

How to generate an electronic signature for signing the Income Tax Verification Form 2014 2019 in Gmail

How to create an electronic signature for the Income Tax Verification Form 2014 2019 from your smartphone

How to make an electronic signature for the Income Tax Verification Form 2014 2019 on iOS devices

How to make an electronic signature for the Income Tax Verification Form 2014 2019 on Android

People also ask

-

What is an income tax form PDF and why is it important?

An income tax form PDF is a digital format of tax documents that individuals and businesses use to report income and calculate tax liabilities. It is important because it ensures that your tax submissions are accurate and organized, facilitating a smoother filing process with the IRS.

-

How can airSlate SignNow help me manage my income tax form PDFs?

airSlate SignNow provides a secure platform for uploading, signing, and sending income tax form PDFs. Its user-friendly interface allows you to easily manage your documents, ensuring that you stay on top of your tax submissions without hassle.

-

Is there a cost associated with using airSlate SignNow for income tax form PDFs?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs and budgets. You'll find that the cost-effective solution allows you to manage your income tax form PDFs without breaking the bank, while benefitting from extensive features and support.

-

Can I integrate airSlate SignNow with other tools for income tax form PDFs?

Absolutely! airSlate SignNow seamlessly integrates with popular apps such as Google Drive, Dropbox, and accounting software, allowing you to streamline your workflow for income tax form PDFs. This flexibility helps you maintain organized records and enhances productivity.

-

What are the security features of airSlate SignNow for income tax form PDFs?

airSlate SignNow prioritizes your data security, offering bank-level encryption and secure cloud storage for all your income tax form PDFs. With features like two-factor authentication, you can confidently manage sensitive tax documents with peace of mind.

-

Can I eSign my income tax form PDFs using airSlate SignNow?

Yes, you can easily eSign your income tax form PDFs with airSlate SignNow. Our platform allows you to add electronic signatures quickly, making the process of finalizing your tax documents efficient and compliant with legal standards.

-

How easy is it to share my income tax form PDFs using airSlate SignNow?

Sharing your income tax form PDFs with airSlate SignNow is incredibly easy. You can send documents directly to recipients via email or share links, ensuring that your tax forms signNow the right people promptly and securely.

Get more for Income Tax Return Verification

- Local recipient organization certification format

- Coast guard tdy worksheet form

- Louisiana addendum to bail bond application and agreement form

- Af 55 form

- Hawaii region rallycross tech inspection checklist doc light vehicle pre delivery checklist catalogue no 45071422 form no 1503

- Request for reserve component assignment or attachment apd army form

- No secrets policy for family therapy and couple form

- Public records exemption request form st johns county clerk of

Find out other Income Tax Return Verification

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple