Notfctn 10 Central Tax English PDF CBIC 2023-2026

Understanding the Return Verification Form

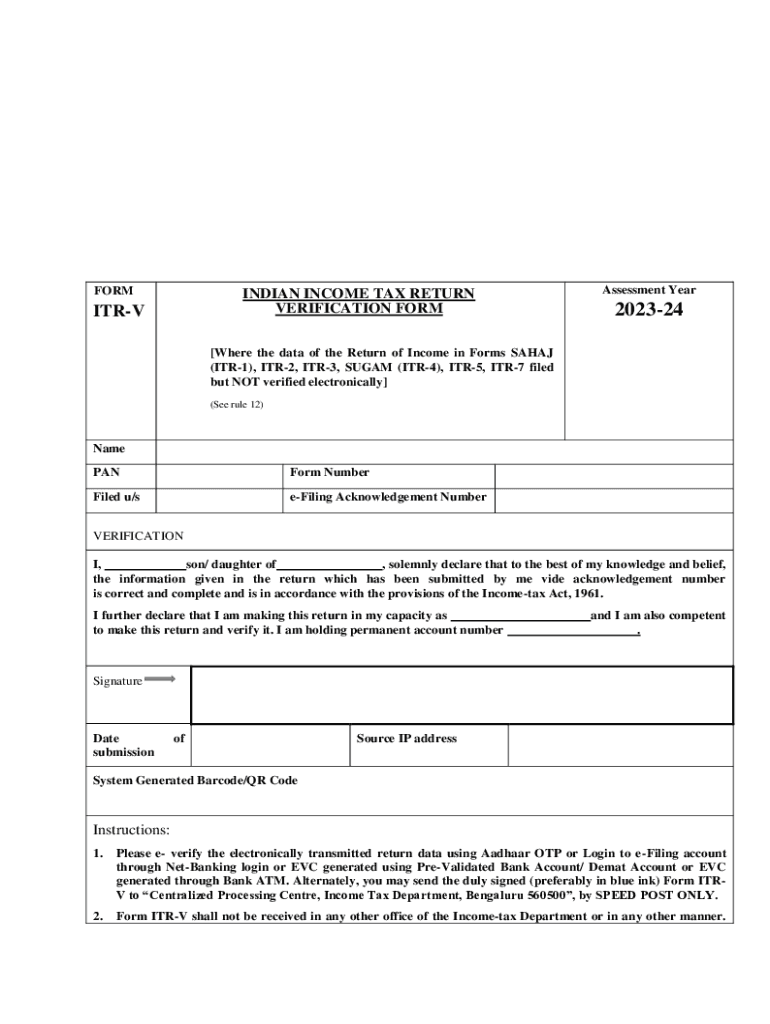

The return verification form is a crucial document used primarily for tax purposes in the United States. This form helps taxpayers confirm the accuracy of their submitted tax returns and provides a means for the Internal Revenue Service (IRS) to verify the information provided. It is essential for ensuring that all reported income, deductions, and credits are legitimate and comply with federal tax laws.

Steps to Complete the Return Verification Form

Completing the return verification form involves several key steps:

- Gather all necessary documents, including your tax return and any supporting documentation.

- Fill out the form accurately, ensuring that all information matches your tax return.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority, either electronically or via mail, depending on the submission guidelines.

Required Documents for Submission

When filling out the return verification form, it is important to have the following documents on hand:

- Your completed tax return for the relevant year.

- Any W-2 or 1099 forms that report your income.

- Receipts or documentation for any deductions or credits claimed.

- Identification information, such as your Social Security number.

Form Submission Methods

The return verification form can be submitted through various methods, depending on the requirements set forth by the IRS:

- Online: Many taxpayers can submit the form electronically through the IRS e-file system.

- Mail: If you prefer to submit a paper form, ensure you send it to the correct address specified by the IRS.

- In-Person: Some tax offices may allow for in-person submissions, but it is advisable to check ahead for availability.

IRS Guidelines for the Return Verification Form

The IRS provides specific guidelines regarding the use of the return verification form. These guidelines include:

- Timelines for submission, which are typically aligned with tax filing deadlines.

- Instructions on how to correct any discrepancies found during the verification process.

- Clarifications on what to do if you receive a notice from the IRS regarding your tax return.

Penalties for Non-Compliance

Failure to properly complete and submit the return verification form can result in several penalties, including:

- Fines imposed by the IRS for inaccuracies or late submissions.

- Potential audits if discrepancies are found between your tax return and the verification form.

- Delays in processing any refunds that may be due to you.

Quick guide on how to complete notfctn 10 central tax english pdf cbic

Prepare Notfctn 10 central tax english pdf CBIC effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and without delays. Manage Notfctn 10 central tax english pdf CBIC on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign Notfctn 10 central tax english pdf CBIC with ease

- Locate Notfctn 10 central tax english pdf CBIC and click Get Form to commence.

- Utilize the tools at your disposal to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Notfctn 10 central tax english pdf CBIC and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notfctn 10 central tax english pdf cbic

Create this form in 5 minutes!

How to create an eSignature for the notfctn 10 central tax english pdf cbic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a return verification form?

A return verification form is a document used to confirm the receipt of returned items or services. It ensures that both parties have a record of the return transaction, which can be crucial for inventory management and customer service.

-

How can airSlate SignNow help with return verification forms?

airSlate SignNow allows you to create, send, and eSign return verification forms quickly and efficiently. With our user-friendly interface, you can streamline the return process, ensuring that all necessary documentation is completed accurately and promptly.

-

Is there a cost associated with using airSlate SignNow for return verification forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage return verification forms without breaking the bank.

-

What features does airSlate SignNow offer for managing return verification forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking for return verification forms. These tools help you manage your documents efficiently and ensure that all parties are informed throughout the process.

-

Can I integrate airSlate SignNow with other software for return verification forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your return verification forms alongside your existing tools. This integration enhances your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for return verification forms?

Using airSlate SignNow for return verification forms offers numerous benefits, including increased accuracy, reduced processing time, and improved customer satisfaction. Our platform ensures that your return processes are streamlined and professional.

-

How secure is the information on return verification forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect the information on your return verification forms, ensuring that your data remains confidential and secure.

Get more for Notfctn 10 central tax english pdf CBIC

- In late fees form

- Contract for deed is recorded in the official office of the recorder of records in book form

- The instrument was acknowledged before me on date by form

- Estimated date of substantial completion of the work form

- Control number mt004ad form

- To lessor form

- State of montana including any uniform premarital agreement act or other applicable laws

- Adopted by the state of montana and form

Find out other Notfctn 10 central tax english pdf CBIC

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free