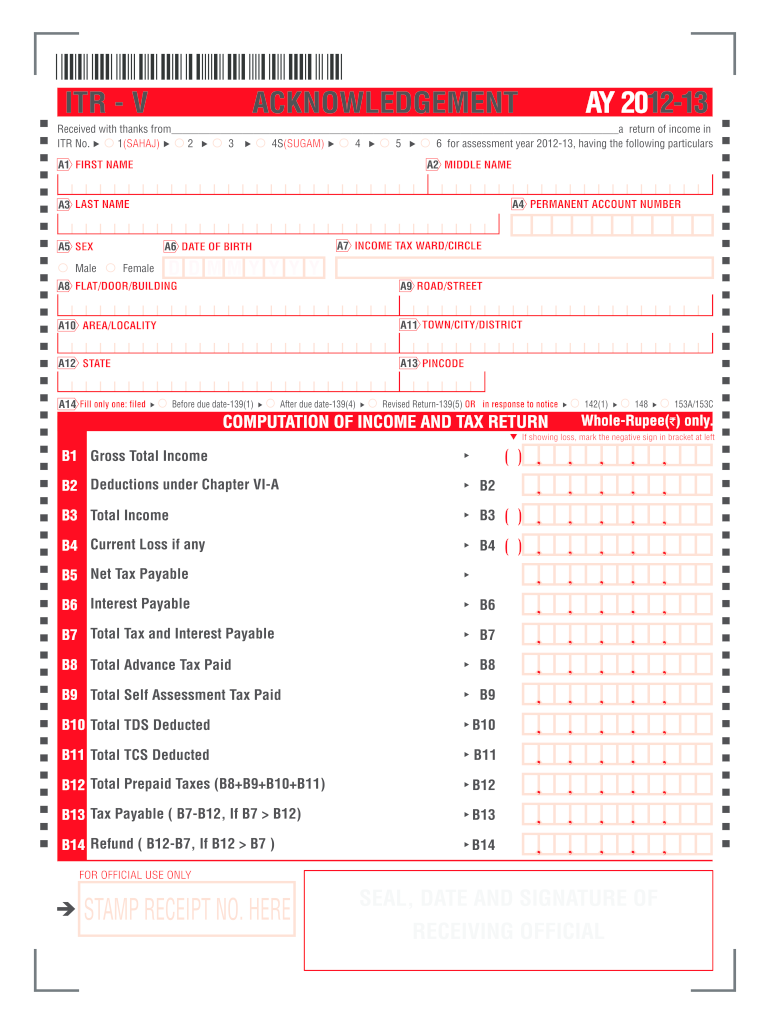

Writeable Itr V Form 2012

What is the Writeable Itr V Form

The Writeable Itr V Form is a specific tax document used in the United States, primarily for reporting income and tax obligations. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The form allows users to input their financial data in a structured manner, facilitating the calculation of taxes owed or refunds due. Understanding the purpose and requirements of this form is crucial for effective tax management.

How to use the Writeable Itr V Form

Using the Writeable Itr V Form involves several straightforward steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, access the form through a reliable platform that supports digital completion and signing. Fill in the required fields with accurate information, ensuring that all entries are clear and legible. After completing the form, review it for any errors before submitting it to the appropriate tax authority, either electronically or by mail.

Steps to complete the Writeable Itr V Form

Completing the Writeable Itr V Form can be broken down into a series of manageable steps:

- Gather necessary documents, such as W-2s and 1099s.

- Access the Writeable Itr V Form through a trusted digital platform.

- Fill in personal information, including name, address, and Social Security number.

- Input income details and any deductions or credits applicable to your situation.

- Double-check all entries for accuracy and completeness.

- Sign the form electronically if using a digital platform.

- Submit the completed form to the IRS or state tax authority as required.

Legal use of the Writeable Itr V Form

The Writeable Itr V Form is legally binding when completed and submitted according to IRS guidelines. This means that all information provided must be truthful and accurate. Misrepresentation or errors can lead to penalties, including fines or legal action. It is essential to ensure that the form is filled out correctly to maintain compliance with tax laws and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Writeable Itr V Form typically align with the annual tax filing season in the United States. Generally, individuals must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to these deadlines to avoid late filing penalties and ensure timely processing of your tax return.

Required Documents

To accurately complete the Writeable Itr V Form, several documents are necessary. These include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any relevant financial statements or documentation.

Examples of using the Writeable Itr V Form

The Writeable Itr V Form can be used in various scenarios, such as:

- Individuals filing their annual income tax returns.

- Self-employed individuals reporting business income.

- Taxpayers claiming deductions for educational expenses.

- Individuals seeking tax credits for child care or other eligible expenses.

Quick guide on how to complete writeable itr v form 2012

A brief guide on how to create your Writeable Itr V Form

Locating the appropriate template can be a challenge when you are required to submit official international documents. Even if you possess the necessary form, it can be cumbersome to swiftly prepare it according to all specifications if you utilize physical copies rather than handling everything digitally. airSlate SignNow is the web-based eSignature platform that assists you in navigating these challenges. It enables you to acquire your Writeable Itr V Form and efficiently complete and sign it on-site without needing to reprint documents whenever you make a mistake.

Here are the steps you need to follow to create your Writeable Itr V Form with airSlate SignNow:

- Hit the Get Form button to upload your document to our editor immediately.

- Begin with the first vacant field, supply information, and proceed with the Next option.

- Complete the empty fields utilizing the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your Writeable Itr V Form requires it.

- Utilize the right-side panel to add additional sections for you or others to complete if needed.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Done button and choosing your file-sharing preferences.

Once your Writeable Itr V Form is ready, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your finished documents in your account, organized into folders based on your liking. Don’t spend time on manual document filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct writeable itr v form 2012

FAQs

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I treat unrealized losses in equity for ITR? Which form should I fill out?

There is no procedure for set of unrealized losses in equity from other profit. The actual losses can be set of against the profit of other equities. For the purpose of profit or losses in the transaction of equity, the form no.3 should be filed.

-

As a professional in the fashion industry, which ITR form do I need to fill out?

As a professional in fashion industryif you are providing services as professional on your own then your income will be assessable under income under the head business and profession and hence you are required to file ITR 4 before 31st July and for the current AY 5th augustHowever if your income is more than 25 lacs then you are required to file tax audit report under which case your due date of filling will be 30th septHowever if you are providing services in fashion industry under employment and you are not having any other income other than salary then file ITR 2Hope this will be sufficient

-

Where can I fill out the ITR-5 form?

ITR 5 can be filed online or offline. Online filing is mandatory for taxpayers who are liable to audit u/s 44AB. Else, the taxpayer can fill out the form electronically and print a copy to mail to CPC Bangalore.If you have more questions regarding taxes please visit taxforum.hrblock.in and the tax experts will promptly answer all your queries.Follow us on Quora and be updated on all the tax related questions for individuals and business taxes that we answer.Hope this information was useful. H&R Block India

-

What do I need to fill in ITR verification form?

When you file your return, the income tax department sends the ITR-V to your email id. It may take 2-3 days for the ITR-V to signNow your inbox.You can also download ITR-V manually. Follow these easy steps.1) Go to the government IT website and click on ‘Login Here’ option if you have already registered or click on ‘Register Yourself’ button to create a new account.2) Fill in the login details.3) After logging in, click on ‘e-Filed Returns/Forms’ under "My Account" section from top menu.4) Choose ‘Income Tax Return’ from the drop-down list.5) Now select the assessment year for which you want to download the ITR-V and click on Submit’.6) Click on ‘Ack. No.’ to open the section to download ITR-V. Click on ‘ITR-V / Acknowledgement’ to get your ITR-V. The password of your ITR-V is the combination of AN and Date of Birth (all in lowercase). e.g. If your PAN is TTTPA1111A and Date of Birth is 28th of December 1995 then your password will be tttpa1111a281219957) Print this verification receipt. Sign it and post it to CPC, Bangalore to complete your e-filing process. The address of CPC is given at the bottom of every ITR-V.You can also e-verify your return to complete your return filing process. Go to this link to find out the process of e-verifying IT return.https://help.allindiaitr.com/hc/...

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

Create this form in 5 minutes!

How to create an eSignature for the writeable itr v form 2012

How to make an electronic signature for the Writeable Itr V Form 2012 in the online mode

How to make an electronic signature for your Writeable Itr V Form 2012 in Google Chrome

How to create an electronic signature for signing the Writeable Itr V Form 2012 in Gmail

How to generate an eSignature for the Writeable Itr V Form 2012 straight from your smart phone

How to generate an electronic signature for the Writeable Itr V Form 2012 on iOS

How to create an eSignature for the Writeable Itr V Form 2012 on Android

People also ask

-

What is a Writeable Itr V Form?

The Writeable Itr V Form is a digital document that allows users to input information directly into the form fields before submitting it. This form is particularly useful for tax purposes, enabling individuals to complete their income tax return conveniently and efficiently. By using the Writeable Itr V Form, users can save time and reduce errors associated with traditional paper forms.

-

How does airSlate SignNow support the Writeable Itr V Form?

airSlate SignNow provides a user-friendly platform that allows you to create, fill out, and eSign the Writeable Itr V Form seamlessly. With intuitive features, you can easily upload your form, add necessary signatures, and share it with others for their input. This streamlines the entire process, making tax filing a breeze.

-

Can I customize the Writeable Itr V Form in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the Writeable Itr V Form to meet their specific needs. You can add your branding, modify existing fields, and include additional information relevant to your tax situation. This level of customization ensures that your form is tailored to your requirements.

-

What are the pricing options for using the Writeable Itr V Form with airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various user needs, including options for individuals and businesses. You can choose a plan that suits your requirements and budget, allowing you to utilize the Writeable Itr V Form without breaking the bank. Visit our pricing page for detailed information.

-

Is the Writeable Itr V Form compatible with mobile devices?

Absolutely! The Writeable Itr V Form can be accessed and completed on mobile devices using the airSlate SignNow app. This mobile compatibility ensures that you can work on your tax forms anywhere, anytime, making it convenient for on-the-go users.

-

What benefits does using the Writeable Itr V Form offer?

Using the Writeable Itr V Form with airSlate SignNow offers numerous benefits, including enhanced efficiency, reduced paper waste, and improved accuracy. The digital format allows for easy editing and instant submission, which can signNowly speed up the tax filing process. Additionally, eSigning provides an extra layer of security.

-

Does airSlate SignNow integrate with other applications for the Writeable Itr V Form?

Yes, airSlate SignNow supports integrations with various applications to enhance your experience with the Writeable Itr V Form. You can connect with popular platforms like Google Drive, Dropbox, and more, ensuring that your documents and data can be easily accessed and managed in one place.

Get more for Writeable Itr V Form

Find out other Writeable Itr V Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe