Fillable Online Nalc Branch78 PS Form 2847 NALC Branch 2020

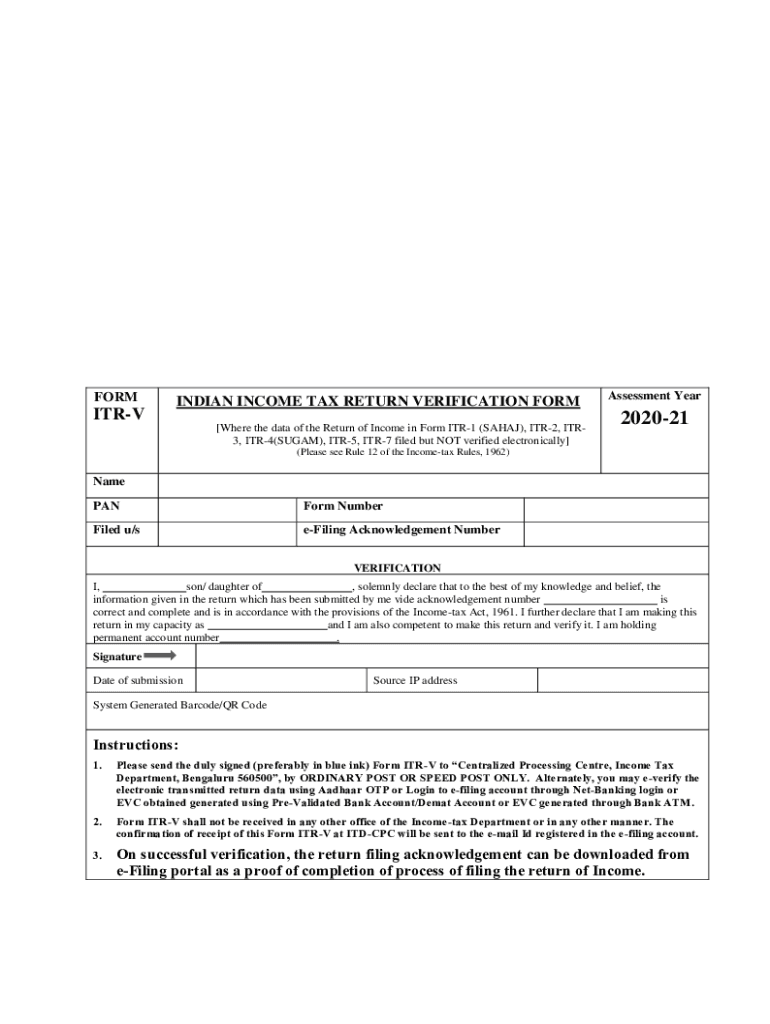

Understanding the Tax Verification Form

The tax verification form is a crucial document used by individuals and businesses to confirm their tax information. This form serves to verify income, tax payments, and compliance with tax regulations. It is often required by financial institutions, government agencies, and employers to ensure that the information provided is accurate and up-to-date. Understanding the purpose and requirements of this form is essential for anyone navigating the tax landscape in the United States.

Steps to Complete the Tax Verification Form

Completing the tax verification form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including your income tax return, W-2 forms, and any additional financial records. Next, accurately fill out the form with your personal information, including your Social Security number, address, and tax year. Review the completed form for errors before submitting it. Finally, ensure that you sign and date the form to validate your submission.

Required Documents for Tax Verification

When filling out the tax verification form, specific documents are often required to support your claims. These may include:

- Your most recent income tax return (Form 1040 or equivalent)

- W-2 forms from your employer

- 1099 forms for any additional income

- Proof of any deductions or credits claimed

Having these documents ready will streamline the verification process and help avoid delays.

IRS Guidelines for Tax Verification

The IRS provides specific guidelines regarding the use of tax verification forms. It is important to follow these guidelines to ensure compliance and avoid potential penalties. The IRS may require verification forms for various reasons, including audits, loan applications, and eligibility for government programs. Familiarizing yourself with these guidelines can help you understand when and how to use the form effectively.

Form Submission Methods

There are several methods for submitting the tax verification form. You can choose to submit it online through designated portals, mail it directly to the requesting agency, or deliver it in person. Each method has its own set of requirements and processing times, so it is advisable to select the option that best suits your needs and timeline.

Penalties for Non-Compliance

Failing to comply with tax verification requirements can result in significant penalties. These may include fines, delayed processing of applications, or even legal action in severe cases. Understanding the potential consequences of non-compliance emphasizes the importance of accurately completing and submitting the tax verification form as required.

Quick guide on how to complete fillable online nalc branch78 ps form 2847 nalc branch

Complete Fillable Online Nalc branch78 PS Form 2847 NALC Branch effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Fillable Online Nalc branch78 PS Form 2847 NALC Branch on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Fillable Online Nalc branch78 PS Form 2847 NALC Branch with minimal effort

- Find Fillable Online Nalc branch78 PS Form 2847 NALC Branch and click on Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document browsing, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Fillable Online Nalc branch78 PS Form 2847 NALC Branch to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online nalc branch78 ps form 2847 nalc branch

Create this form in 5 minutes!

How to create an eSignature for the fillable online nalc branch78 ps form 2847 nalc branch

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is a tax verification form and how is it used?

A tax verification form is a document used to verify a taxpayer's identity and income information. It is often required when applying for loans, financial aid, or certain tax-related requests. By using airSlate SignNow, you can easily create and send a tax verification form, ensuring a smooth and secure process.

-

How can airSlate SignNow simplify the process of completing a tax verification form?

airSlate SignNow streamlines the completion of a tax verification form by providing a user-friendly platform for eSigning and document management. Users can fill out the form digitally, sign it securely, and send it directly to the relevant parties. This eliminates the need for physical paperwork and speeds up the verification process.

-

Is there a cost associated with using airSlate SignNow for a tax verification form?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Each plan includes features that make sending and eSigning a tax verification form easy and cost-effective. You can explore the pricing tiers on our website to find the option that best suits your requirements.

-

What features does airSlate SignNow offer for tax verification forms?

airSlate SignNow provides a range of features for handling a tax verification form, including customizable templates, secure eSigning, automated workflows, and real-time tracking. These features enhance efficiency and ensure that your tax verification forms are processed quickly and securely.

-

Can I integrate airSlate SignNow with other tools for handling tax verification forms?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to handle tax verification forms efficiently. Popular integrations include CRM systems, cloud storage services, and productivity tools. This ensures that you can maintain your existing workflows while taking advantage of airSlate SignNow's capabilities.

-

What are the benefits of using airSlate SignNow for tax verification forms?

Using airSlate SignNow for tax verification forms offers benefits such as enhanced security, improved efficiency, and reduced processing times. The digital nature of eSigning ensures that documents are signed promptly, while the secure storage protects sensitive information. This results in a more effective way to manage your tax verification processes.

-

How does airSlate SignNow ensure the security of tax verification forms?

airSlate SignNow prioritizes security by utilizing industry-standard encryption and secure storage solutions for all documents, including tax verification forms. This ensures that your sensitive information is protected against unauthorized access. Compliance with legal standards also adds an extra layer of protection for your documents.

Get more for Fillable Online Nalc branch78 PS Form 2847 NALC Branch

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant west virginia form

- West virginia tenant 497431673 form

- West virginia notice 497431674 form

- Temporary lease agreement to prospective buyer of residence prior to closing west virginia form

- Wv eviction 497431676 form

- Letter from landlord to tenant returning security deposit less deductions west virginia form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return west virginia form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return west form

Find out other Fillable Online Nalc branch78 PS Form 2847 NALC Branch

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself