NAIC Uniform Application for Alabama Department of Insurance Insurance Alabama

What is the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

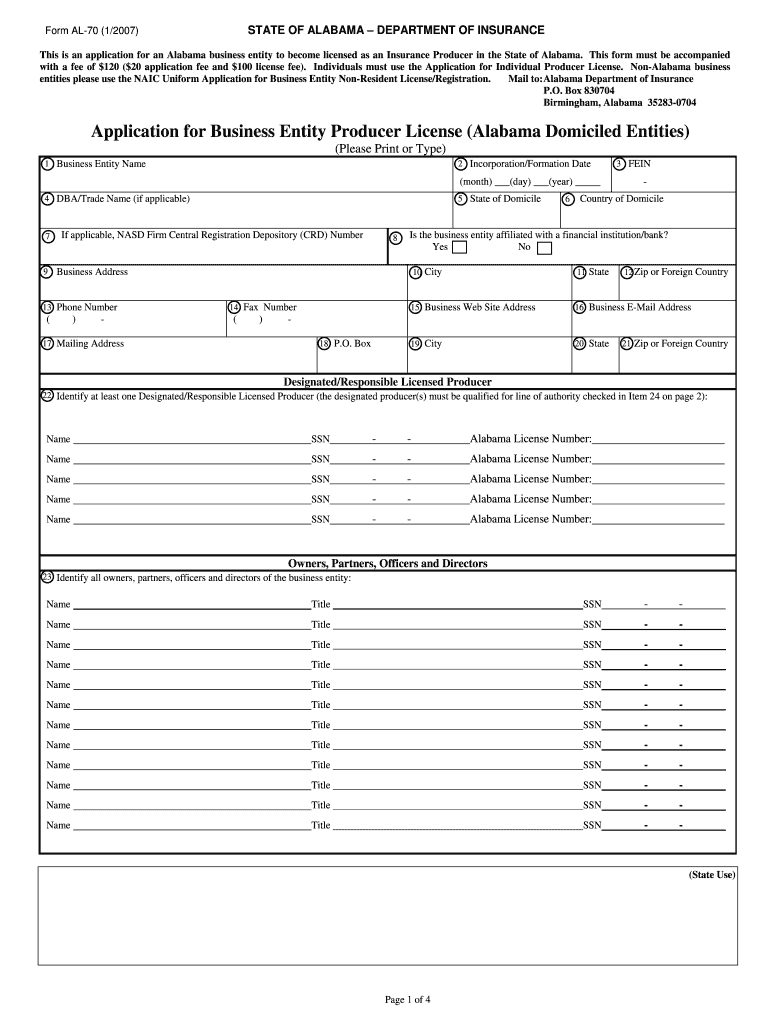

The NAIC Uniform Application for Alabama Department of Insurance Insurance Alabama is a standardized form used by insurance professionals to apply for various licenses within the state of Alabama. This application is designed to streamline the licensing process for insurance agents, brokers, and other related entities. It ensures that all necessary information is collected uniformly, making it easier for both applicants and regulatory bodies to process applications efficiently.

How to use the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

Using the NAIC Uniform Application for Alabama Department of Insurance Insurance Alabama involves several steps. First, applicants must gather all required information, including personal identification details, business information, and any relevant financial disclosures. Next, the form can be completed either online or in a printed format. Once filled out, it must be submitted to the Alabama Department of Insurance along with any applicable fees. It is essential to review the application thoroughly to ensure all information is accurate and complete before submission.

Steps to complete the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

Completing the NAIC Uniform Application requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including identification and business licenses.

- Access the application form through the Alabama Department of Insurance website or other authorized sources.

- Fill out the form, ensuring all sections are completed accurately.

- Review the application for any errors or missing information.

- Submit the application online or by mail, along with any required fees.

Legal use of the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

The legal use of the NAIC Uniform Application for Alabama Department of Insurance Insurance Alabama is crucial for ensuring compliance with state regulations. This form must be completed in accordance with Alabama laws governing insurance licensing. Proper execution of the application helps to establish the legitimacy of the applicant's request for a license and ensures that all legal obligations are met. Failure to comply with these regulations may result in delays or denials of the application.

Key elements of the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

Key elements of the NAIC Uniform Application include personal identification information, business entity details, and disclosures related to financial history and criminal background. Each section is designed to capture essential data that the Alabama Department of Insurance needs to evaluate the applicant's qualifications. Providing accurate and complete information is vital, as it directly impacts the approval process.

State-specific rules for the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

Each state has specific rules regarding the NAIC Uniform Application. In Alabama, applicants must adhere to state laws and regulations that govern insurance licensing. This includes meeting eligibility criteria, submitting the application within designated timeframes, and providing any additional documentation as required by the Alabama Department of Insurance. Understanding these state-specific rules is essential for a successful application process.

Quick guide on how to complete naic uniform application for alabama department of insurance insurance alabama

Handle [SKS] seamlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to deliver your form, via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choice. Modify and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many Americans are paying out 40% or more of their monthly bills on liability insurance? I have only had one wreck in my life, otherwise a clean driving record. Insurance only paid $2800 total. I pay $350 for liability in Alabama.

Amanda, $875 ($350/.4) a month in salary (before or after taxes) (or $875x12/52 = $201.92/week) is not a lot of money anywhere, so that is why your percent of monthly bills is high. Now, having said that, we do NOT know: 1) what car you drive; 2) what your limits of liability are; 3 how old you are; 4) where in Alabama that you live (it does change your rates) 5) are you the only one on the policy? (because if it is a family policy, and your car is $350/month, another driver with an even worse record could be assigned as the driver of YOUR car) AND we are assuming: 1) you are a female; and 2) that you are not insuring the Collision & Comprehensive to repair or replace your car.As to their ONLY having paid out $2,800, that probably wiped out at least a whole years profit on your policy. Let me know and we’ll whittle this down for you.

-

Is there a way to get my Blue Cross Blue Shield of Alabama insurance that I bought through the marketplace (BEG) to pay for bariatric surgery even though they say they don't cover it?

I don’t think so. I tried every way I could think of and they categorically denied it. Their policy is very explicit when it comes to weight loss surgery. That said, I remember reading that there’s a strong national push to make it illegal to discriminate against the obese that could take the choice out of their hands. Who knows when that will happen though. For me, I knew I didn’t have time to wait, so I mortgaged my house to afford it. It’s a shame people have to go that far just to get the health treatment they need. (And for those of you who are ignorant of the health situation, people who are severely obese have zero chance of losing the weight and keeping it off without surgery, because intolerance prevents them from losing it by storing fat we should be burning.) Good luck!

-

How much time and money does it take for a new startup (<50 employees) to fill out the paperwork to become a group for the purpose of negotiating for health insurance for their founders and employees?

I'm not sure if this is a purely exploratory question or if you're inferring that you're planning on navigating the group health insurance market without the assistance of a broker. If the latter, I'd caution against it for several reasons (which I'll omit for now for the sake of brevity).To get a group quote, generally all that's needed is an employee census. Some states apply a modifier to the rate depending on the overall health of the group members (for a very accurate quote, employees may need to fill out general health statements).Obtaining rates themselves can take a few minutes (for states like CA which don't have a signNow health modifier) to several days.I suspect your cor question is the time/effort required once you've determined the most appropriate plan design for your company. This is variable depending on how cohesive your employee base is.Best case scenario - if all employees are in one location and available at the same time, I could bring an enrollment team and get all the paperwork done in the course of 1-3 hours depending on the size of your group. In the vast majority of cases, the employer's paperwork is typically around 6 pages of information, and the employee applications about 4-8 pages. Individually none of them take more than several minutes to complete.Feel free to contact me directly if you have specific questions or concerns.

-

What rules of thumb are there for figuring out how much life insurance to buy?

If you are not married, and have no dependents, then you don't need life insurance.If you are married and your spouse also works, one year's salary is enough insurance for them to cover funeral expenses, mourn, and move to a smaller home and sell the current house if needed.If you have dependents, and/or your spouse doesn't work, the situation becomes very dependent on your personal finances overall. Assuming you are a one-income household, with two pre-school aged children, you may want to consider a total life insurance value equal to enough money to cover:-Cost of paying off your mortgage immediately-Cost of fixed annuity to pay for annual expenses for your spouse, less housing cost-Children's educational expensesThat's the most common rule of thumb, but you should consider whether it is an outdated notion that your spouse will never be able to work or provide for themselves if you die.Also, whether you believe that parents should pay for a child's college education, or even whether a child needs to go to college (or a state school vs. private school) can impact that part of the equation.As you age, you will likely set aside 529 plans for your kids, pay down your mortgage, etc. In that case, you should adjust the total value of your insurance downward to save yourself on monthly premium costs. The very wealthy self-insure for the most part - you want to move in that direction as your personal wealth increases.Finally, don't mix investments with insurance. Insurance is for protection only. Therefore, "buy term and invest the rest" is the best advice. Whole insurance makes it difficult to remember how much you are spending on the insurance part, and how much you're investing.

-

Can UK drivers drive in Republic of Ireland without having to pay for any extra insurance/fill out any paperwork?

Can UK drivers drive in Republic of Ireland without having to pay for any extra insurance/fill out any paperwork?If you are a UK driver bringing your UK car here for a visit, chances are your UK insurance already covers you for everything you need (but check!) Your EU license is acceptable all over the EU (for now) which includes Ireland.It might be worth getting breakdown insurance, especially if you are coming here by boat. It’s less of a big deal if you already live in the North.If you are moving here to live, check with the Irish Revenue first about importing your car. If you don’t do it right you can be hit for a big chunk of tax.

-

How hard is it for insurance to cover prescriptions refilled out of state?

You asked: How hard is it for insurance to cover prescriptions refilled out of state? Allow me to introduce you to a similar concept: How difficult is it to get a prescription filled in another state, whether your Health Insurer will "cover" it or not?Answer: What if your prescription is for a restricted medication, e.g. such as those that are Schedule II, III, IV, or V under DEA regulations? The answer to that depends on at least two parties: the laws/regulations of the State where you want to obtain your Rx refill, and the policy of that particular pharmacy or pharmacy chain in that same state. From personal experience, DO NOT ASSUME that Scheduled medications will be refilled in any other state. Find out IN ADVANCE.

-

Will my pharmacist still fill a prescription if my insurance doesn't cover it but I opt to pay for it out of pocket instead?

Yes, with a caveat or two. He could fill it for cash provided it is not a refill of a controlled substance and is not too early to fill. Any other class of drugs that is a maintenance med or antibiotic would be fine if three reason for the insurance denial was too soon. If the prescription is for a drug that you've never taken before, then the pharmacist would probably fill it, unless it's for a schedule drug that is replacing another schedule drug that was recently filed. If the latter is the case, the pharmacist would probably call the doctor and get his reasoning for the new Rx. The doctor might be able to persuade your insurance company to set up an override for the denied claim in that situation.The reason I've said all this is that I've heard it all, and I've had many people all stiff like this while withholding critical information that would affect my decision on whether or not to fill the prescription.

Related searches to NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

Create this form in 5 minutes!

How to create an eSignature for the naic uniform application for alabama department of insurance insurance alabama

How to generate an eSignature for your Naic Uniform Application For Alabama Department Of Insurance Insurance Alabama online

How to create an eSignature for the Naic Uniform Application For Alabama Department Of Insurance Insurance Alabama in Google Chrome

How to create an electronic signature for putting it on the Naic Uniform Application For Alabama Department Of Insurance Insurance Alabama in Gmail

How to generate an eSignature for the Naic Uniform Application For Alabama Department Of Insurance Insurance Alabama from your smartphone

How to make an electronic signature for the Naic Uniform Application For Alabama Department Of Insurance Insurance Alabama on iOS

How to generate an eSignature for the Naic Uniform Application For Alabama Department Of Insurance Insurance Alabama on Android devices

People also ask

-

What is the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama?

The NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama is a standardized form used by insurance companies to apply for licensing in Alabama. It streamlines the application process, ensuring that all necessary information is submitted correctly. By using this form, businesses can expedite their licensing by adhering to state requirements.

-

How can airSlate SignNow help with the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama?

airSlate SignNow provides a user-friendly platform to fill out and eSign the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama. With our digital solution, you can complete the application quickly and securely. This enhances the efficiency of your licensing process by avoiding delays commonly associated with traditional methods.

-

What are the pricing options for using airSlate SignNow with the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama?

airSlate SignNow offers several pricing plans to cater to businesses of all sizes looking to complete the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama. We have affordable monthly and annual subscriptions that include unlimited eSigning capabilities and access to additional features. You can choose a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama?

With airSlate SignNow, users benefit from features such as templates, automated workflows, and real-time tracking for the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama. These tools help streamline document management and enhance collaboration. You can also customize the signing process to meet your specific requirements.

-

Are there integrations available for airSlate SignNow when working with the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama?

Yes, airSlate SignNow integrates seamlessly with various platforms to assist you in managing the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama. Our integrations with popular software and applications enhance your workflow and simplify document sharing. You can connect with tools you already use, ensuring an efficient process.

-

How secure is the eSigning process for the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama?

The eSigning process through airSlate SignNow for the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama is highly secure. We utilize advanced encryption and compliance with industry standards to ensure that your documents are protected. You can trust that your information is safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama?

Using airSlate SignNow for the NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama offers numerous benefits, including time savings and enhanced accuracy in document processing. Our platform eliminates the need for printing, mailing, and faxing, drastically reducing turnaround times. This means you can focus on running your business more efficiently.

Get more for NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

Find out other NAIC Uniform Application For Alabama Department Of Insurance Insurance Alabama

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement