Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

What is the Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

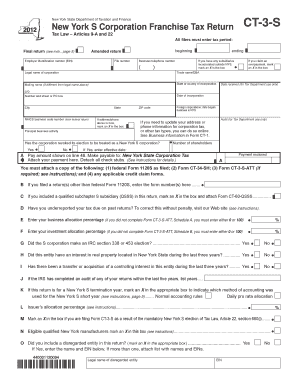

The Form CT 3 S is a tax return specifically designed for S corporations operating in New York. This form enables S corporations to report their income, deductions, and credits to the New York State Department of Taxation and Finance. Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. The CT 3 S form is essential for ensuring compliance with state tax regulations and for determining the franchise tax owed by the corporation.

Steps to complete the Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

Completing the Form CT 3 S involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant tax documents. Next, fill out the form by providing details such as the corporation's name, address, and federal employer identification number (EIN). Be sure to report all income and deductions accurately, as this will affect the tax liability. After completing the form, review it for any errors or omissions before submission.

How to use the Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

The Form CT 3 S serves as a critical tool for S corporations to fulfill their tax obligations in New York. To use the form effectively, begin by downloading it from the New York State Department of Taxation and Finance website or through authorized providers. Once you have the form, follow the instructions carefully, ensuring that all sections are completed accurately. After filling out the form, you can submit it electronically or by mail, depending on your preference and compliance requirements.

Filing Deadlines / Important Dates

It is crucial for S corporations to be aware of the filing deadlines associated with the Form CT 3 S. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. Failure to file on time may result in penalties and interest, making it essential to adhere to these important dates to maintain compliance with New York tax laws.

Legal use of the Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

The legal use of the Form CT 3 S is governed by New York tax laws and regulations. To ensure that the form is legally binding, S corporations must adhere to specific requirements, such as providing accurate information and obtaining necessary signatures. Electronic submissions are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. This legal framework ensures that the form holds up in case of audits or disputes.

Key elements of the Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

Several key elements are essential to the Form CT 3 S. These include the corporation's identification information, total income, allowable deductions, and credits. Additionally, the form requires the calculation of the franchise tax based on the corporation's New York receipts. Understanding these elements is vital for accurately completing the form and ensuring that the corporation meets its tax obligations. Each section must be filled out with precise figures to avoid complications during the filing process.

Quick guide on how to complete form ct 3 snew york s corporation franchise tax returnct3s

Effortlessly Prepare Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric procedure today.

The easiest way to modify and electronically sign Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S effortlessly

- Find Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize crucial sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Confirm all the details and click the Done button to save your changes.

- Choose how you prefer to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that require printing additional copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 snew york s corporation franchise tax returnct3s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S?

Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S is a tax return specifically designed for S corporations operating in New York. It helps S corporations report their income, deductions, and credits to the New York State Department of Taxation and Finance. By accurately completing this form, businesses can ensure compliance with state tax laws and regulations.

-

How can airSlate SignNow assist with completing Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S?

airSlate SignNow simplifies the process of completing Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S by providing a user-friendly platform for document preparation and e-signatures. Users can easily fill out the form, save their progress, and securely send it for signatures. This saves time and reduces the likelihood of errors during the submission process.

-

What features does airSlate SignNow offer for managing Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S?

airSlate SignNow includes features such as document templates for Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S, electronic signatures, and cloud storage for easy access. Additionally, the platform allows for seamless collaboration, enabling multiple stakeholders to review and sign documents in real-time. This streamlines the filing process for S corporations.

-

Is there a cost associated with using airSlate SignNow for Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S?

Yes, while airSlate SignNow provides a variety of pricing plans, including options for individuals and businesses, the costs can vary based on the features selected. It is an affordable solution compared to traditional document signing methods. Users can take advantage of free trials to determine if it meets their needs for managing Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S.

-

Can airSlate SignNow integrate with other software for Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S processes?

Absolutely! airSlate SignNow offers integrations with popular accounting software and business applications that can further streamline the handling of Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S. This ensures that all data is synced and organized, making it easier to manage finances and filings efficiently. Integrations enhance productivity and data accuracy.

-

What are the benefits of using airSlate SignNow for Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S?

Using airSlate SignNow for Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S offers valuable benefits such as efficiency, compliance, and a reduced risk of errors. The electronic signature feature expedites the signing process, while document templates ensure accuracy. Overall, it simplifies and speeds up tax filing for S corporations.

-

How secure is airSlate SignNow when handling Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S?

airSlate SignNow employs industry-standard security measures to protect sensitive data while handling Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S. This includes SSL encryption, secure cloud storage, and access controls, ensuring that your financial and personal information remains confidential and protected. Users can trust the platform for secure document management.

Get more for Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

Find out other Form CT 3 SNew York S Corporation Franchise Tax ReturnCT3S

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template