Complete 1099 Set AccuPay Systems Form

What is the Complete 1099 Set AccuPay Systems

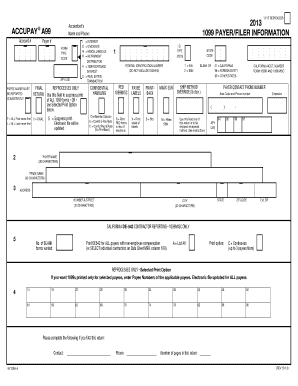

The Complete 1099 Set AccuPay Systems is a collection of tax forms used to report various types of income other than wages, salaries, and tips. This set typically includes forms such as 1099-MISC, 1099-NEC, and others that are essential for both businesses and individuals. These forms are crucial for ensuring compliance with IRS regulations and for accurately reporting income received throughout the tax year.

How to use the Complete 1099 Set AccuPay Systems

Using the Complete 1099 Set AccuPay Systems involves several steps to ensure accurate reporting. First, determine which 1099 forms apply to your situation based on the type of income received. Next, gather all necessary information, including the recipient's name, address, and taxpayer identification number. Once you have collected the required data, you can fill out the forms either digitally or by hand, ensuring that all information is correct and complete.

Steps to complete the Complete 1099 Set AccuPay Systems

Completing the Complete 1099 Set AccuPay Systems can be streamlined by following these steps:

- Identify the appropriate 1099 forms needed for your reporting.

- Collect all relevant information about the payee, including their legal name and tax identification number.

- Fill out the forms accurately, ensuring all fields are completed.

- Review the forms for any errors or omissions.

- File the completed forms with the IRS and provide copies to the recipients by the required deadlines.

Legal use of the Complete 1099 Set AccuPay Systems

The legal use of the Complete 1099 Set AccuPay Systems is essential for compliance with federal tax laws. Each form must be filled out accurately and submitted to the IRS by the deadlines established for tax reporting. Failure to comply with these regulations can result in penalties, so it is important to understand the legal obligations associated with each form in the set.

Filing Deadlines / Important Dates

Filing deadlines for the Complete 1099 Set AccuPay Systems vary depending on the specific form. Generally, forms must be submitted to the IRS by January thirty-first of the year following the tax year being reported. Recipients should also receive their copies by this date. It is crucial to stay informed about these deadlines to avoid late penalties.

Who Issues the Form

The Complete 1099 Set AccuPay Systems forms are typically issued by businesses or individuals who have made payments to non-employees, such as freelancers or contractors. This includes various types of payments, such as rent, royalties, or other income. The issuer is responsible for accurately completing and filing the forms with the IRS and providing copies to the recipients.

Quick guide on how to complete complete 1099 set accupay systems

Effortlessly Prepare Complete 1099 Set AccuPay Systems on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Complete 1099 Set AccuPay Systems on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Complete 1099 Set AccuPay Systems with Ease

- Find Complete 1099 Set AccuPay Systems and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive details using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it onto your PC.

Say goodbye to lost or misfiled documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks on your chosen device. Modify and electronically sign Complete 1099 Set AccuPay Systems ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the complete 1099 set accupay systems

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Complete 1099 Set AccuPay Systems?

The Complete 1099 Set AccuPay Systems is a comprehensive solution designed to streamline the process of creating, sending, and filing 1099 tax forms. This system allows businesses to manage and organize their tax forms efficiently, ensuring compliance and ease of use.

-

How does the Complete 1099 Set AccuPay Systems integrate with existing accounting software?

The Complete 1099 Set AccuPay Systems offers seamless integration with popular accounting software, allowing users to import data directly into the platform. This feature minimizes manual data entry, reducing errors and saving time for businesses during tax season.

-

What are the pricing options for the Complete 1099 Set AccuPay Systems?

The Complete 1099 Set AccuPay Systems provides flexible pricing plans tailored to meet the needs of businesses of all sizes. Customers can choose from monthly or annual subscription options, making it a cost-effective solution for managing 1099 forms.

-

What features does the Complete 1099 Set AccuPay Systems offer?

The Complete 1099 Set AccuPay Systems includes features such as electronic filing, eSignature capabilities, and automated reminders for important tax deadlines. These tools simplify the tax preparation process, ensuring businesses stay compliant with IRS regulations.

-

How does the Complete 1099 Set AccuPay Systems benefit small businesses?

Small businesses benefit from the Complete 1099 Set AccuPay Systems by saving time and reducing stress during tax season. With its user-friendly interface and automated features, it allows small business owners to focus on growing their business instead of getting bogged down with paperwork.

-

Is the Complete 1099 Set AccuPay Systems suitable for freelancers and independent contractors?

Yes, the Complete 1099 Set AccuPay Systems is ideal for freelancers and independent contractors who need to manage and file their 1099 forms efficiently. It enables them to automate the process, making it easier to keep track of income and expenses for tax reporting.

-

Can I track the status of my 1099 forms with the Complete 1099 Set AccuPay Systems?

Absolutely! The Complete 1099 Set AccuPay Systems provides real-time tracking of your 1099 forms, allowing you to monitor the status of filings and ensure that all documents are submitted correctly. This feature adds an extra layer of reassurance during tax season.

Get more for Complete 1099 Set AccuPay Systems

- Covers warrantydept com form

- Chrysalis academy online application 2022 form

- Certificate for aadhaar enrolment update form pdf editable

- Hl sharma pharmacology 3rd edition pdf download form

- Innovis credit ze form

- About usreferencefaqfrequently asked questions on national pension system al form

- Fannie mae form 200

- Business cash advance application green payment solutions form

Find out other Complete 1099 Set AccuPay Systems

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe