Interactive W 9 Form

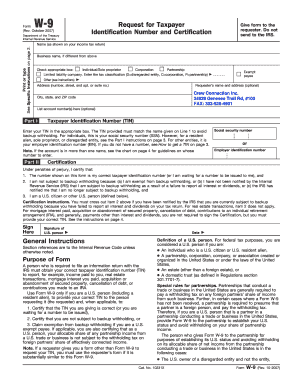

What is the Interactive W-9 Form

The Interactive W-9 Form is a tax document used in the United States by individuals and entities to provide their taxpayer identification information to businesses or other entities that are required to report payments made to them. The form is primarily used by freelancers, contractors, and vendors to ensure accurate tax reporting. It collects essential details such as the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security number or an Employer Identification Number.

How to Use the Interactive W-9 Form

Using the Interactive W-9 Form is straightforward. First, access the form through a reliable electronic platform. Fill in the required fields with accurate information, ensuring that your TIN matches the name provided. After completing the form, review all entries for accuracy. Finally, electronically sign the document to validate it. This digital signature ensures compliance with legal standards, making the form legally binding.

Steps to Complete the Interactive W-9 Form

Completing the Interactive W-9 Form involves several clear steps:

- Access the form through a secure digital platform.

- Enter your name and business name, if applicable.

- Provide your address, including city, state, and ZIP code.

- Input your taxpayer identification number (TIN).

- Select the appropriate tax classification that applies to you or your business.

- Sign the form electronically to confirm its accuracy.

- Submit the completed form to the requesting entity.

Legal Use of the Interactive W-9 Form

The Interactive W-9 Form is legally recognized when completed according to IRS guidelines. It serves as a means of verifying taxpayer information for reporting purposes. To ensure its legal standing, the form must be signed by the individual or entity providing the information. Electronic signatures are valid under the ESIGN Act, provided the signing process meets specific legal criteria. This includes using a secure platform that maintains compliance with applicable eSignature regulations.

IRS Guidelines

The IRS provides clear guidelines for completing and submitting the W-9 Form. It is essential to follow these guidelines to avoid potential issues with tax reporting. The IRS requires that the form be filled out accurately and submitted promptly upon request. Additionally, the IRS stipulates that any changes in taxpayer information must be reported using a new W-9 Form. Understanding these guidelines helps ensure compliance and minimizes the risk of penalties.

Examples of Using the Interactive W-9 Form

The Interactive W-9 Form is commonly used in various scenarios, including:

- Freelancers providing services to businesses.

- Contractors working on construction projects.

- Vendors supplying goods to companies.

- Individuals receiving rental income.

In each case, the form facilitates accurate tax reporting and ensures that the correct information is provided to the IRS.

Quick guide on how to complete interactive w 9 form

Complete Interactive W 9 Form effortlessly on any device

Digital document management has become prevalent among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without holdups. Manage Interactive W 9 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven operation today.

The easiest way to alter and eSign Interactive W 9 Form seamlessly

- Locate Interactive W 9 Form and click on Get Form to commence.

- Utilize the tools we provide to fill in your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Bid farewell to lost or misplaced files, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Interactive W 9 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the interactive w 9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Interactive W 9 Form?

The Interactive W 9 Form is a digital version of the IRS form that allows freelancers and contractors to provide their taxpayer information electronically. This form simplifies the tax form completion process and ensures accurate data submission. By using an Interactive W 9 Form, you can streamline your onboarding process for new hires or vendors.

-

How does airSlate SignNow enhance the use of the Interactive W 9 Form?

airSlate SignNow enhances the Interactive W 9 Form by providing features like electronic signatures, document tracking, and easy sharing options. This platform ensures that your documents are legally binding and secure. Additionally, it makes the form accessible from any device, allowing for efficient handling of tax documents.

-

Is the Interactive W 9 Form compliant with IRS regulations?

Yes, the Interactive W 9 Form created through airSlate SignNow is compliant with IRS regulations. Our solution adheres to the latest standards for electronic signatures and document submissions. This guarantees that your completed forms will be accepted by the IRS and protect your business from potential liabilities.

-

What are the pricing options for using the Interactive W 9 Form via airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various needs for using the Interactive W 9 Form. You can choose from monthly or annual subscriptions depending on your business size and usage frequency. Our cost-effective solution ensures you get maximum value while managing your document signing needs efficiently.

-

Can I integrate the Interactive W 9 Form with other software tools?

Absolutely! airSlate SignNow allows seamless integration with a variety of software tools, including CRM systems, cloud storage, and accounting software. This integration makes managing the Interactive W 9 Form and other documents much easier, streamlining your workflow and improving efficiency across platforms.

-

What benefits does using the Interactive W 9 Form provide to businesses?

Using the Interactive W 9 Form offers numerous benefits to businesses, including time-saving automation, improved accuracy, and enhanced security. By digitizing the form, you can reduce paperwork and errors associated with manual entries. Additionally, airSlate SignNow's tracking features keep you informed about the document status, ensuring timely processing.

-

How can I ensure data security with the Interactive W 9 Form?

airSlate SignNow prioritizes data security for your Interactive W 9 Form through robust encryption and secure cloud storage. We employ industry-leading security measures to protect your sensitive information throughout the signing and submission process. You can confidently manage your documents knowing that their security is our top concern.

Get more for Interactive W 9 Form

- Creating a basic form 1120 us corporate income tax return

- Ct 183184 iinstructions for forms taxnygov

- Mw508 202249 121422 c mw508 202249 121422 form

- Quick guide to completing form ct 3 general business corporation

- Matrix line item instructions utah state tax commission form

- Form ct 3 m general business corporation mta surcharge return tax year 2022

- Form it 2105 estimated income tax payment voucher tax

- Form ct 399 depreciation adjustment schedule tax year 2022

Find out other Interactive W 9 Form

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free