Form it 2105 Estimated Income Tax Payment Voucher Tax 2022

What is the Form IT 2105 Estimated Income Tax Payment Voucher?

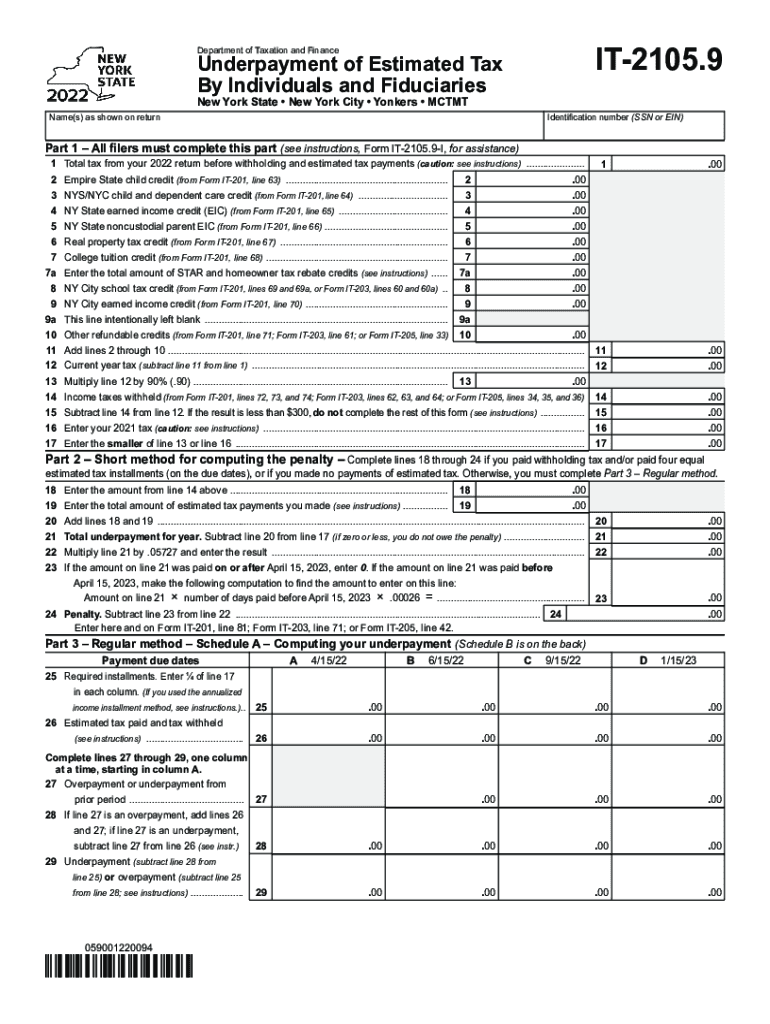

The Form IT 2105 is a tax document used by individuals in the United States to make estimated income tax payments to the state of New York. This form is essential for taxpayers who expect to owe tax of $300 or more when they file their annual income tax return. It allows individuals to calculate and submit their estimated tax payments throughout the year, ensuring compliance with state tax obligations.

Steps to Complete the Form IT 2105

Completing the Form IT 2105 involves several key steps:

- Gather necessary information: Collect your income details, deductions, and credits to accurately estimate your tax liability.

- Calculate your estimated tax: Use the provided worksheet on the form to determine the amount you owe based on your expected income.

- Fill out the form: Enter your personal information, including name, address, and Social Security number, along with your calculated estimated tax amount.

- Review the form: Ensure all information is accurate and complete before submission.

- Submit the form: Send your completed Form IT 2105 along with your payment to the appropriate address provided by the New York State Department of Taxation and Finance.

Legal Use of the Form IT 2105

The Form IT 2105 serves a legal purpose in the context of tax compliance. It is recognized by the New York State Department of Taxation and Finance as a valid method for taxpayers to report and pay their estimated income taxes. Properly completing and submitting this form can help avoid penalties and interest for underpayment of taxes. It is crucial to adhere to the guidelines set forth by the state to ensure that the form is legally binding.

Filing Deadlines / Important Dates

Timely submission of the Form IT 2105 is critical to avoid penalties. The deadlines for filing estimated tax payments typically align with quarterly due dates:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Taxpayers should be aware of these dates to ensure compliance and avoid interest on late payments.

Examples of Using the Form IT 2105

Taxpayers in various situations can utilize the Form IT 2105. For instance:

- Self-employed individuals: Those who earn income from freelance work or a business may need to make estimated payments to cover their tax obligations.

- Investors: Individuals who earn significant income from investments may also find it necessary to use this form to manage their tax payments effectively.

- High earners: Taxpayers expecting to owe a substantial amount of tax at year-end should use the form to avoid underpayment penalties.

Who Issues the Form IT 2105?

The Form IT 2105 is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department's website or through authorized tax professionals.

Quick guide on how to complete form it 2105 estimated income tax payment voucher tax

Complete Form IT 2105 Estimated Income Tax Payment Voucher Tax seamlessly on any device

Digital document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the required form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Form IT 2105 Estimated Income Tax Payment Voucher Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax effortlessly

- Locate Form IT 2105 Estimated Income Tax Payment Voucher Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2105 estimated income tax payment voucher tax

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 estimated income tax payment voucher tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it2105 feature in airSlate SignNow?

The it2105 feature in airSlate SignNow allows users to streamline their document signing process. It enables secure eSigning and document management, making it easier for businesses to handle contracts and agreements efficiently. With it2105, you can save time and eliminate the hassle of printing and scanning.

-

How does the pricing structure work for it2105?

airSlate SignNow offers competitive pricing for its it2105 feature, which is designed to suit businesses of all sizes. Pricing plans are flexible, with options for monthly or annual subscriptions, allowing users to choose a package that best fits their needs. Additionally, there are free trials available to explore it2105 before committing.

-

What benefits does it2105 bring to my business?

The it2105 feature enhances productivity by simplifying the eSigning process and reducing turnaround time for document approvals. Businesses experience increased efficiency and improved workflow, as it2105 eliminates manual tasks associated with traditional signing methods. Ultimately, this can lead to cost savings and faster transaction cycles.

-

What integrations are available with it2105?

airSlate SignNow's it2105 feature seamlessly integrates with popular productivity tools like Google Workspace, Salesforce, and Microsoft Office. This compatibility ensures that you can easily incorporate it2105 into your existing workflows, thereby enhancing your overall document management practices. These integrations help create a more cohesive experience when using multiple software solutions.

-

Is it2105 suitable for small businesses?

Yes, the it2105 feature in airSlate SignNow is specifically designed to support small businesses looking for cost-effective and efficient eSigning solutions. It provides all the essential tools needed for managing electronic signatures without overwhelming users. Small businesses can leverage it2105 to enhance their operations without incurring signNow costs.

-

Can I customize templates using the it2105 feature?

Absolutely! The it2105 feature allows users to create and customize templates to meet their specific business needs. This flexibility enables businesses to standardize their document processes while ensuring they remain aligned with branding and compliance requirements. Customizable templates can save time and improve consistency in document handling.

-

What security measures are in place for it2105 transactions?

airSlate SignNow prioritizes security in its it2105 feature, employing industry-standard encryption to protect your documents and data. All transactions made through it2105 are secured to prevent unauthorized access and ensure data integrity. Users can sign documents confidently, knowing that their information is well-protected.

Get more for Form IT 2105 Estimated Income Tax Payment Voucher Tax

- Aging parent package rhode island form

- Sale of a business package rhode island form

- Legal documents for the guardian of a minor package rhode island form

- New state resident package rhode island form

- Commercial property sales package rhode island form

- General partnership package rhode island form

- Contract for deed package rhode island form

- Living will form 497325351

Find out other Form IT 2105 Estimated Income Tax Payment Voucher Tax

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online