State Form 43760 Intuit

What is the State Form 43760 Intuit

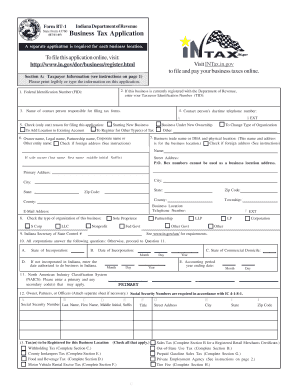

The State Form 43760 Intuit is a specific document used for tax purposes in the United States. It is designed to assist individuals and businesses in reporting their financial information accurately to state authorities. This form may be required for various tax-related activities, including income reporting, deductions, and credits. Understanding the purpose of this form is crucial for compliance with state tax regulations.

How to use the State Form 43760 Intuit

Using the State Form 43760 Intuit involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form by entering the required information in the designated fields. It is important to review the form for accuracy before submission. If you are using digital tools, ensure that you are familiar with the software features that facilitate eSigning and submission.

Steps to complete the State Form 43760 Intuit

Completing the State Form 43760 Intuit involves a systematic approach:

- Gather all relevant financial documents.

- Access the form through a reliable platform.

- Fill in your personal and financial information accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, following the specific instructions provided.

Legal use of the State Form 43760 Intuit

The legal use of the State Form 43760 Intuit is governed by state tax laws. To ensure that the form is considered valid, it must be completed accurately and submitted within the required deadlines. Electronic signatures are recognized as legally binding when they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using a secure platform for eSigning can enhance the legal validity of your submission.

Key elements of the State Form 43760 Intuit

Key elements of the State Form 43760 Intuit include:

- Personal identification information, such as name and address.

- Income details, including wages, interest, and other sources of revenue.

- Deductions and credits that may apply to your tax situation.

- Signature section for verification of the information provided.

Form Submission Methods

The State Form 43760 Intuit can be submitted through various methods, including:

- Online submission via a secure e-filing platform.

- Mailing a printed copy of the completed form to the appropriate state agency.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete state form 43760 intuit

Prepare State Form 43760 Intuit effortlessly on any gadget

Digital document handling has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to procure the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents rapidly and without hassle. Manage State Form 43760 Intuit on any device through the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The easiest way to edit and electronically sign State Form 43760 Intuit effortlessly

- Locate State Form 43760 Intuit and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form: by email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign State Form 43760 Intuit and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state form 43760 intuit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is State Form 43760 Intuit?

State Form 43760 Intuit is a specific document required for reporting certain tax-related information in Intuit software. It helps users ensure compliance with state regulations by providing the necessary details accurately. By leveraging airSlate SignNow, you can easily eSign and manage this form without hassle.

-

How can airSlate SignNow help with State Form 43760 Intuit?

airSlate SignNow simplifies the process of completing and eSigning State Form 43760 Intuit by providing an intuitive platform for document management. With its user-friendly interface, you can quickly upload, send, and track this form. This ensures that your submissions are timely and compliant with state regulations.

-

Is there a cost to use airSlate SignNow for State Form 43760 Intuit?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Each plan provides access to essential features for managing documents, including State Form 43760 Intuit, at a cost-effective rate. You can choose the plan that best fits your volume of transactions and required functionalities.

-

Can I integrate airSlate SignNow with other Intuit products?

Absolutely! airSlate SignNow seamlessly integrates with various Intuit products, allowing you to streamline your document workflows. This feature ensures you can easily access and eSign State Form 43760 Intuit along with other related documents, enhancing efficiency within your business operations.

-

What features does airSlate SignNow offer for handling State Form 43760 Intuit?

airSlate SignNow provides a range of features designed to simplify document handling, including templates, automated reminders, and status tracking. These tools ensure that your State Form 43760 Intuit is completed accurately and on time. Additionally, the platform includes security features to protect sensitive data.

-

How does eSigning State Form 43760 Intuit benefit my business?

eSigning State Form 43760 Intuit with airSlate SignNow increases efficiency and reduces turnaround time for critical submissions. It eliminates the need for physical paperwork, providing a fast and secure method to get required approvals. This not only saves time but also enhances your business's professional image.

-

Is airSlate SignNow secure for handling State Form 43760 Intuit?

Yes, airSlate SignNow prioritizes security with features such as encryption and secure data storage. When you eSign State Form 43760 Intuit through our platform, you can be assured that your information is protected against unauthorized access. Our compliance with industry standards further ensures the safety of your documents.

Get more for State Form 43760 Intuit

Find out other State Form 43760 Intuit

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online