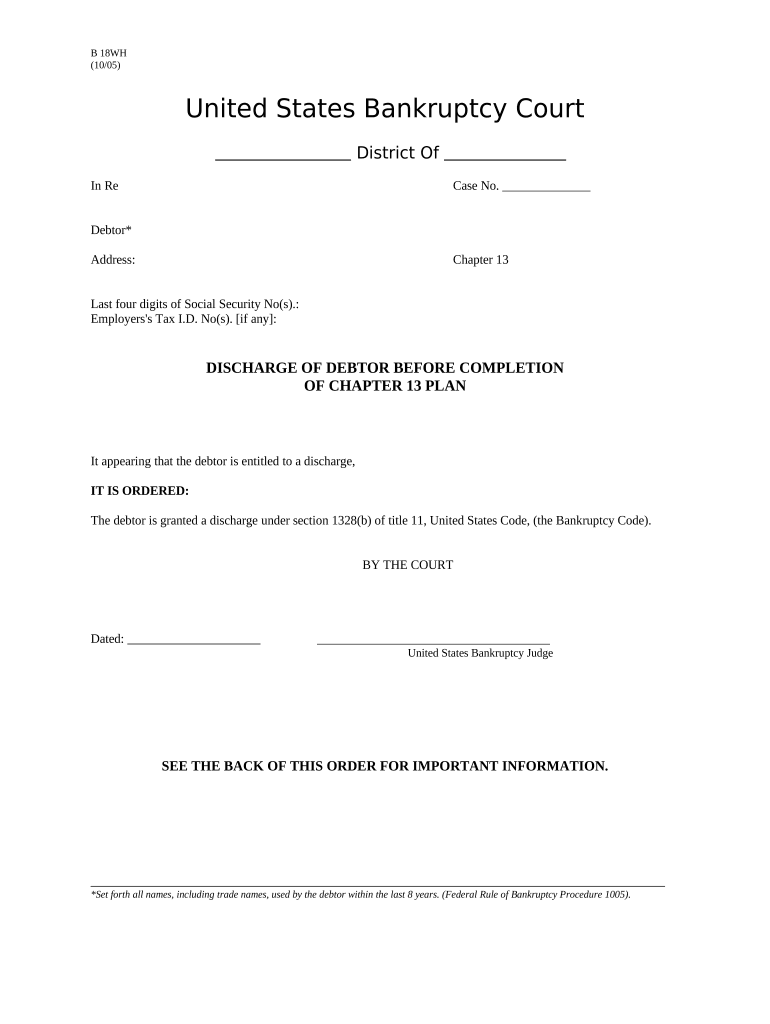

Chapter 13 Plan Form

What is the Chapter 13 Plan

The Chapter 13 Plan is a legal framework that allows individuals with regular income to reorganize their debts and create a repayment plan to pay off creditors over a period of three to five years. This plan is designed for individuals who want to keep their property while making manageable payments. The process begins when a debtor files a petition in bankruptcy court, which includes a detailed plan outlining how they intend to repay their debts. This plan must be approved by the court and is binding on all creditors once confirmed.

Steps to Complete the Chapter 13 Plan

Completing the Chapter 13 Plan involves several important steps:

- Gather financial information, including income, expenses, and debts.

- Draft a repayment plan that details how much will be paid to creditors and over what time frame.

- File the Chapter 13 petition with the bankruptcy court, including the repayment plan and required documents.

- Attend the meeting of creditors, where you will discuss your plan with the trustee and creditors.

- Make any necessary adjustments to the plan based on feedback from the court or creditors.

- Obtain court approval of the plan, which allows you to begin making payments as outlined.

Key Elements of the Chapter 13 Plan

Several key elements must be included in the Chapter 13 Plan to ensure its effectiveness:

- A complete list of all debts, including secured and unsecured obligations.

- A proposed monthly payment amount based on the debtor's income and expenses.

- The duration of the repayment plan, typically three to five years.

- How the plan will treat secured debts, such as mortgages or car loans.

- Provisions for priority debts, such as child support or taxes.

Legal Use of the Chapter 13 Plan

The legal use of the Chapter 13 Plan is governed by federal bankruptcy laws, which require that the plan be feasible, proposed in good faith, and comply with the bankruptcy code. The plan must provide for the payment of all priority claims in full and must be approved by the bankruptcy court. Once confirmed, the plan becomes a binding agreement between the debtor and creditors, ensuring that all parties adhere to its terms. Failure to comply with the plan can result in dismissal of the bankruptcy case.

Required Documents

To successfully file a Chapter 13 Plan, several documents are required:

- Proof of income, such as pay stubs or tax returns.

- A list of all creditors and the amounts owed.

- A budget outlining monthly expenses.

- Documentation of any secured debts, including property titles or loan agreements.

- Any other documents requested by the bankruptcy court or trustee.

Form Submission Methods

The Chapter 13 Plan can be submitted through various methods, depending on the preferences of the debtor and the requirements of the court. Common submission methods include:

- Online filing through the bankruptcy court's electronic filing system.

- Mailing the completed forms directly to the bankruptcy court.

- In-person submission at the court clerk's office.

Quick guide on how to complete chapter 13 plan 497335352

Effortlessly Prepare Chapter 13 Plan on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Chapter 13 Plan seamlessly on any device using the airSlate SignNow apps for Android or iOS and enhance your document-focused workflows today.

How to Edit and eSign Chapter 13 Plan Effortlessly

- Obtain Chapter 13 Plan and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Select pertinent sections of your documents or obscure sensitive details with the tools provided by airSlate SignNow designed specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Chapter 13 Plan to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to order chapter 13 with airSlate SignNow?

To order chapter 13 through airSlate SignNow, simply navigate to our platform and select the chapter 13 option. Fill out the necessary details, and you can complete the ordering process quickly and securely. Our user-friendly interface makes it easy to submit your request without any hassle.

-

What are the pricing options available for ordering chapter 13?

airSlate SignNow offers competitive pricing plans for ordering chapter 13, catering to businesses of all sizes. We have a variety of subscription options that provide flexibility based on your document signing needs. Get started today and take advantage of our cost-effective solutions.

-

What features does airSlate SignNow offer for chapter 13 orders?

When you order chapter 13 through airSlate SignNow, you gain access to a range of features such as customizable templates, real-time tracking, and secure eSigning. These features are designed to streamline your document management process and enhance productivity. Experience the benefits of efficient workflow automation.

-

How does airSlate SignNow ensure the security of my chapter 13 orders?

Security is a top priority at airSlate SignNow. When you order chapter 13, your documents are protected with advanced encryption technologies and secure cloud storage. We ensure that your sensitive information remains confidential and is accessible only by authorized users.

-

Can I integrate airSlate SignNow with other applications when ordering chapter 13?

Yes, airSlate SignNow offers seamless integrations with various applications when you order chapter 13. From CRM systems to cloud storage services, our platform can connect with tools you already use. This integration enhances your workflow and document management capabilities.

-

What are the benefits of using airSlate SignNow for ordering chapter 13?

Using airSlate SignNow for ordering chapter 13 provides numerous benefits, including time efficiency, improved accuracy, and reduced paper usage. Our platform allows you to manage documents electronically, leading to quicker turnaround times and a more eco-friendly process. Experience the modern solution for your document needs.

-

How can I get support while ordering chapter 13 on airSlate SignNow?

If you need assistance while ordering chapter 13, airSlate SignNow offers comprehensive customer support. Our dedicated team is available via chat, email, or phone to help you with any inquiries. We are committed to making your experience smooth and satisfactory.

Get more for Chapter 13 Plan

- Form 2 instructions montana individual income tax form 2

- Printable 2020 montana form 2 worksheet v tax credits discontinued

- Understand the geothermal tax credit extension in pennsylvania form

- Printable 2020 oregon form 243 claim to refund due a deceased person

- I grant permission to the university of wisconsin extension to use my form

- Printable 2020 vermont form in 117 vt credit for income tax paid to other state or canadian province

- In 111 vermont income tax return vermont department of form

- Corporation schedule of federal line items virginia tax form

Find out other Chapter 13 Plan

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form