Il 941 Form

What is the IL 941

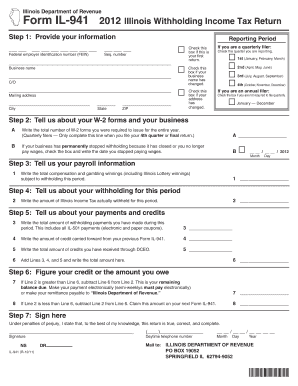

The IL 941 form is a crucial document used for reporting income tax withheld from employees in the state of Illinois. This form is primarily utilized by employers to report the amount of state income tax withheld from employees' wages throughout the quarter. It serves as an essential tool for ensuring compliance with state tax obligations and helps maintain accurate records of tax withholdings.

How to use the IL 941

Using the IL 941 form involves several key steps. Employers must first gather all necessary payroll information, including the total wages paid and the amount of state tax withheld for each employee during the reporting period. Once this information is compiled, employers can fill out the form, ensuring that all sections are completed accurately. After completing the form, it should be submitted to the Illinois Department of Revenue either electronically or via mail, depending on the employer's preference.

Steps to complete the IL 941

Completing the IL 941 form requires attention to detail. Here are the steps to follow:

- Gather payroll records for the quarter, including total wages and state tax withheld.

- Fill in the employer's information, including name, address, and account number.

- Report the total wages paid and the amount of state income tax withheld in the appropriate fields.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the Illinois Department of Revenue by the due date.

Legal use of the IL 941

The IL 941 form must be filled out and submitted in accordance with Illinois state law. Employers are legally required to report the amount of state income tax withheld from employees' wages. Failure to submit the form on time or inaccuracies in reporting can lead to penalties and interest charges. Thus, it is essential for employers to understand the legal implications of this form and ensure compliance with all relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IL 941 form are critical for employers to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For instance, the deadlines for submission are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Who Issues the Form

The IL 941 form is issued by the Illinois Department of Revenue. This agency is responsible for administering and enforcing tax laws in the state, including the collection of income taxes withheld from employees. Employers can obtain the form directly from the Illinois Department of Revenue's official website or through authorized tax preparation software.

Quick guide on how to complete il 941

Effortlessly Complete Il 941 on Any Device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Il 941 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign Il 941 Seamlessly

- Find Il 941 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or conceal sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Il 941 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 941

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 941 form, and why is it important?

The IL 941 form is a critical tax return that businesses in Illinois use to report their state withholding tax. It's essential for compliance with Illinois tax laws, as filing it accurately helps avoid penalties and ensures that your employees' withholdings are correctly reported to the state.

-

How can airSlate SignNow help me manage the IL 941 form?

airSlate SignNow provides an efficient way to electronically sign and send your IL 941 form. With an easy-to-use interface, you can prepare your documents quickly, ensuring that all necessary signatures are obtained for timely submission.

-

Is airSlate SignNow suitable for small businesses needing to file the IL 941?

Absolutely! airSlate SignNow is a cost-effective solution that caters to small businesses. Its features are designed to streamline document signing processes, making it easier for small companies to manage their IL 941 filings without the need for extensive administrative resources.

-

What features does airSlate SignNow offer to assist with IL 941 submissions?

airSlate SignNow offers several features that simplify the process of IL 941 submissions, including template management, electronic signatures, and document tracking. These tools help ensure that your forms are completed accurately and filed on time.

-

Are there any integrations available with airSlate SignNow to assist with IL 941 management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This means you can easily transfer data related to your IL 941 filings, improving accuracy and reducing the time spent on manual entries.

-

How does airSlate SignNow ensure the security of my IL 941 documents?

Security is a top priority for airSlate SignNow. The platform uses encryption and secure document storage to protect your IL 941 forms and any sensitive information, ensuring that your data remains confidential and secure.

-

What are the pricing options for using airSlate SignNow for IL 941 processing?

airSlate SignNow offers various pricing plans that cater to different business needs. Whether you are a small business or a larger organization, there is a plan available that includes features specifically designed to manage forms like the IL 941 efficiently.

Get more for Il 941

Find out other Il 941

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure