Comptroller Texas Govforms50 212Notice of Tax Rates Texas Comptroller of Public Accounts

Understanding the Texas Comptroller Form 50-212

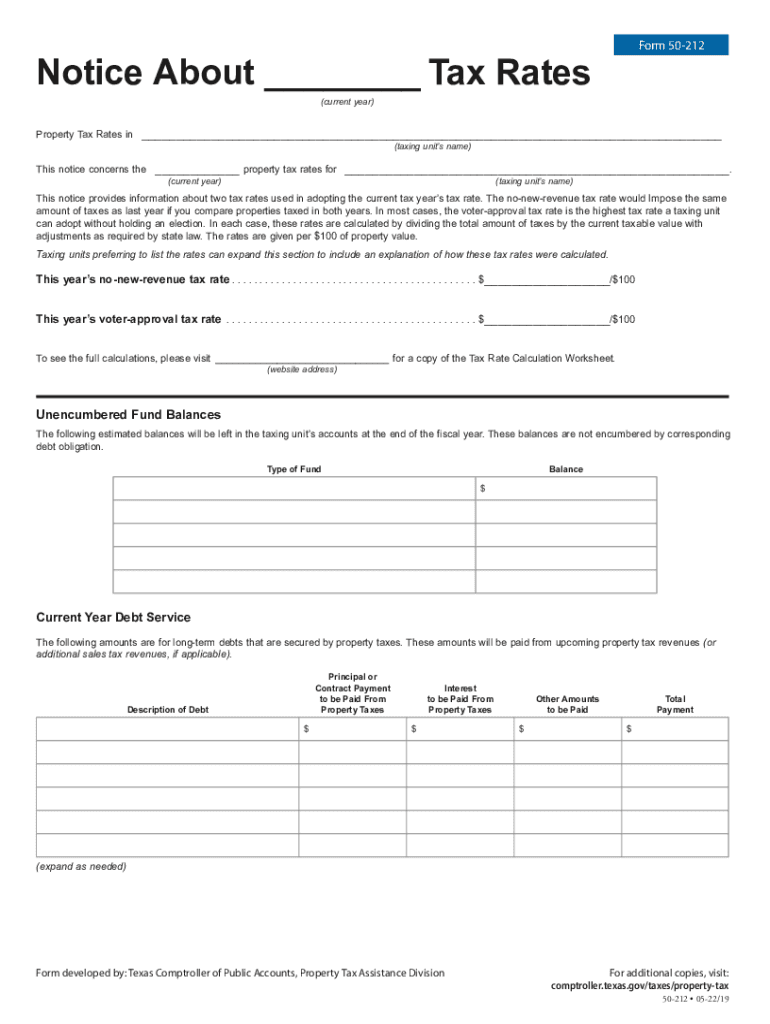

The Texas Comptroller Form 50-212, also known as the Notice of Tax Rates, is a crucial document for property tax purposes in Texas. This form is used by local taxing units to inform property owners about the proposed tax rates for the upcoming year. It is essential for ensuring transparency and compliance with state laws regarding property taxation.

The form outlines the proposed tax rates, the effective tax rate, and the rollback tax rate, which are vital for property owners to understand their tax liabilities. The information provided helps taxpayers make informed decisions regarding their property investments and financial planning.

Steps to Complete the Texas Comptroller Form 50-212

Filling out the Texas Comptroller Form 50-212 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including property details, current tax rates, and any changes in property value. Next, follow these steps:

- Access the form through the Texas Comptroller's website or a reliable source.

- Fill in the required fields, including the name of the taxing unit and the proposed tax rates.

- Provide details about the property, including its location and identification number.

- Double-check all information for accuracy before submission.

- Submit the completed form by the designated deadline, ensuring compliance with local regulations.

Legal Use of the Texas Comptroller Form 50-212

The legal use of the Texas Comptroller Form 50-212 is governed by state laws that require local taxing authorities to provide property owners with accurate tax rate information. This form must be completed and submitted in accordance with the Texas Property Tax Code to ensure that property owners are informed about their tax responsibilities.

Failure to comply with the legal requirements surrounding this form can lead to penalties for the taxing authority, including potential challenges to the validity of the tax rates proposed. Therefore, it is essential for local governments to handle this form with care and precision.

Key Elements of the Texas Comptroller Form 50-212

The Texas Comptroller Form 50-212 contains several key elements that are crucial for understanding property tax rates. These elements include:

- Proposed Tax Rate: The rate at which property taxes will be assessed for the upcoming year.

- Effective Tax Rate: The rate that would generate the same amount of revenue as the previous year, adjusted for changes in property values.

- Rollback Tax Rate: The maximum rate that can be imposed without triggering an election for a higher rate.

- Public Hearing Information: Details about any hearings where taxpayers can voice their opinions regarding the proposed rates.

Form Submission Methods for the Texas Comptroller Form 50-212

Submitting the Texas Comptroller Form 50-212 can be done through various methods, ensuring flexibility for local taxing units. The submission methods include:

- Online Submission: Many local governments allow for electronic submission through their official websites.

- Mail: The completed form can be printed and mailed to the appropriate office.

- In-Person Submission: Taxing units may accept forms delivered in person at their offices.

Each method has its own deadlines and requirements, so it is important to verify the preferred submission method with the local taxing authority.

Filing Deadlines for the Texas Comptroller Form 50-212

Filing deadlines for the Texas Comptroller Form 50-212 are critical for compliance. Typically, local taxing units must submit the form by a specific date, often aligned with the annual budget cycle. It is essential for property owners and taxing authorities to be aware of these deadlines to avoid penalties or delays in tax assessments.

In general, the deadlines may vary by jurisdiction, so checking with local tax offices for the exact dates is advisable. Timely submission ensures that property owners receive the necessary information regarding their tax rates and can plan accordingly.

Quick guide on how to complete comptroller texas govforms50 212notice of tax rates texas comptroller of public accounts

Effortlessly Prepare Comptroller texas govforms50 212Notice Of Tax Rates Texas Comptroller Of Public Accounts on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Comptroller texas govforms50 212Notice Of Tax Rates Texas Comptroller Of Public Accounts on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Comptroller texas govforms50 212Notice Of Tax Rates Texas Comptroller Of Public Accounts with ease

- Obtain Comptroller texas govforms50 212Notice Of Tax Rates Texas Comptroller Of Public Accounts and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to Save your updates.

- Choose how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Comptroller texas govforms50 212Notice Of Tax Rates Texas Comptroller Of Public Accounts and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the comptroller texas govforms50 212notice of tax rates texas comptroller of public accounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas Comptroller Form 50-212?

The Texas Comptroller Form 50-212 is a document used for property tax exemption applications in the state of Texas. This form aids organizations in applying for exemptions based on their nonprofit or religious status. Understanding how to correctly fill out the Texas Comptroller Form 50-212 can ensure your organization maximizes its tax benefits.

-

How can airSlate SignNow assist with the Texas Comptroller Form 50-212?

airSlate SignNow streamlines the process of electronically signing and sending the Texas Comptroller Form 50-212. Our user-friendly platform ensures that all necessary parties can easily eSign the document from any device. This efficiency not only speeds up the application process but also guarantees that all documents are managed securely.

-

What features are available for managing the Texas Comptroller Form 50-212 on airSlate SignNow?

When using airSlate SignNow for the Texas Comptroller Form 50-212, you have access to features like customizable templates, automated reminders, and tracking of document status. These features simplify the submission process and help keep everyone informed. This comprehensive functionality ensures that you never miss an important deadline.

-

Is airSlate SignNow cost-effective for handling multiple Texas Comptroller Form 50-212 submissions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses, especially those needing to submit multiple Texas Comptroller Form 50-212 forms. Our competitive pricing model allows organizations to manage documents efficiently without incurring heavy costs. Additionally, bulk pricing options are available for high-volume users.

-

Can I integrate airSlate SignNow with other software for Texas Comptroller Form 50-212 submissions?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, allowing for a more cohesive workflow when handling the Texas Comptroller Form 50-212. Whether you are using CRM systems or project management tools, our integrations enhance productivity and streamline document management.

-

What are the benefits of using airSlate SignNow for the Texas Comptroller Form 50-212?

Using airSlate SignNow for the Texas Comptroller Form 50-212 offers numerous benefits, including faster processing times and reduced paper waste. The platform also enhances collaboration among team members by providing real-time updates and notifications. Ultimately, this leads to a better-organized filing system for tax-exempt applications.

-

How secure is my data when using airSlate SignNow for the Texas Comptroller Form 50-212?

airSlate SignNow prioritizes the security of your data while you handle the Texas Comptroller Form 50-212. We employ advanced encryption protocols and adhere to strict compliance standards to protect sensitive information. You can trust that your documents are secure and accessible only to authorized users.

Get more for Comptroller texas govforms50 212Notice Of Tax Rates Texas Comptroller Of Public Accounts

- Proof of residency affidavit form

- Functional behavior assessment interview fbai form lausd

- Stroke clinical pathway checklist acute gbhnca form

- Birt ez form

- Ps form 3602 n

- Cbp form 7509 air cargo manifest

- Cic citizenship application guide pdf smc form

- Application for receipt of usda foods fd 15a part 2 form

Find out other Comptroller texas govforms50 212Notice Of Tax Rates Texas Comptroller Of Public Accounts

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself