Canada Direct Deposit Request 2018-2026

Understanding the rc366 tax form

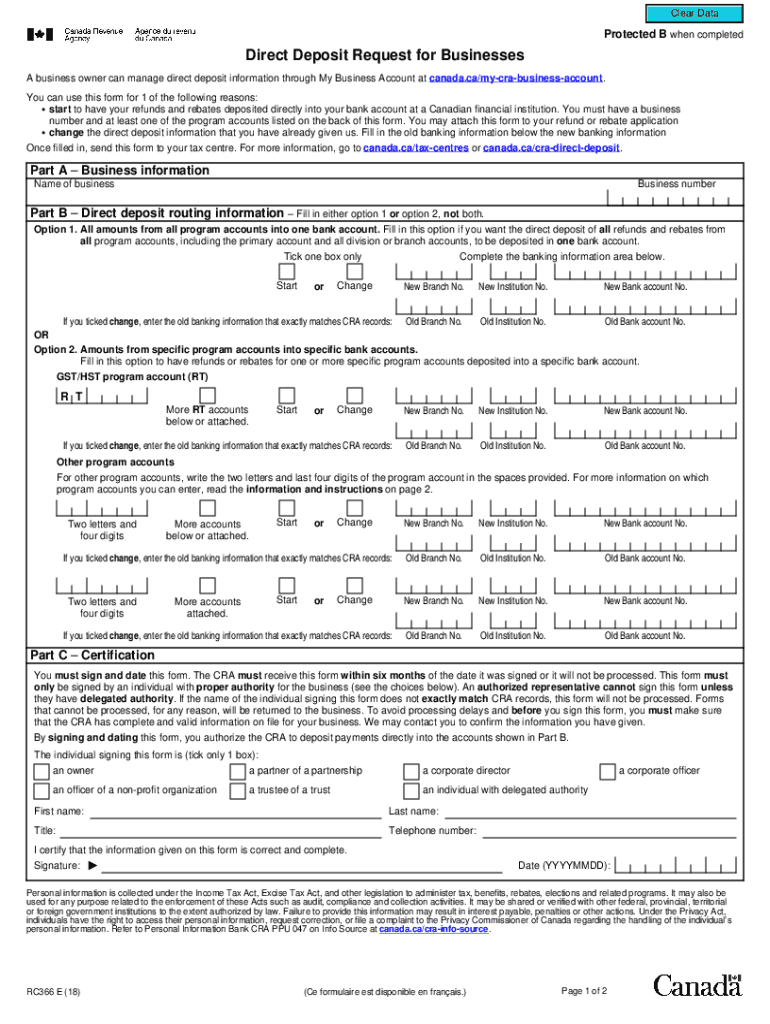

The rc366 tax form is a crucial document used in Canada for individuals to request direct deposit for their tax refunds. This form simplifies the process of receiving refunds, ensuring that funds are deposited directly into a bank account rather than being mailed as a check. Understanding the purpose and function of the rc366 tax form is essential for anyone looking to streamline their tax refund process.

Steps to complete the rc366 tax form

Completing the rc366 tax form involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your bank account details and personal identification. Next, fill out the form with your name, address, and Social Insurance Number (SIN). Be sure to double-check the bank account information to avoid delays. Finally, submit the completed form to the appropriate tax authority, either online or via mail.

Legal use of the rc366 tax form

The rc366 tax form is legally recognized as a valid request for direct deposit. To ensure its legal standing, it must be completed accurately and submitted through the appropriate channels. Compliance with tax regulations is paramount, as errors or omissions can lead to delays in processing your refund. Utilizing a reliable electronic signature solution can further enhance the legal validity of the submitted form.

Required documents for the rc366 tax form

When filling out the rc366 tax form, certain documents are necessary to support your request. These include your Social Insurance Number (SIN), bank account information, and any relevant tax documents that verify your identity and eligibility for a refund. Having these documents ready will facilitate a smoother completion process and help prevent any potential issues with your submission.

Form submission methods for the rc366 tax form

The rc366 tax form can be submitted through various methods, including online submission via the tax authority's website or by mailing a physical copy of the form. Online submission is typically faster and more efficient, allowing for quicker processing of your request. If you choose to mail the form, ensure it is sent to the correct address and consider using a trackable mailing option for added security.

Examples of using the rc366 tax form

There are several scenarios in which individuals may need to use the rc366 tax form. For instance, if you have recently changed your bank account and wish to ensure your tax refund is deposited into the new account, completing the rc366 tax form is essential. Additionally, if you are a first-time filer or have previously received paper checks, this form allows you to switch to direct deposit, enhancing the convenience of receiving your funds.

Quick guide on how to complete canada direct deposit request

Complete Canada Direct Deposit Request seamlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely keep it online. airSlate SignNow supplies you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Canada Direct Deposit Request on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign Canada Direct Deposit Request effortlessly

- Find Canada Direct Deposit Request and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns of lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Canada Direct Deposit Request and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct canada direct deposit request

Create this form in 5 minutes!

How to create an eSignature for the canada direct deposit request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rc366 tax pdf and how is it used?

The rc366 tax pdf is a crucial document for businesses that need to report their tax information accurately. It is used to file specific tax information with the government, ensuring compliance. AirSlate SignNow helps streamline the process of filling out and submitting the rc366 tax pdf with its intuitive eSigning features.

-

How can airSlate SignNow assist with rc366 tax pdf submissions?

AirSlate SignNow simplifies the process of completing and submitting the rc366 tax pdf. With its eSignature functionality, users can easily gather electronic signatures and securely submit the document. This not only saves time but also ensures that the rc366 tax pdf is submitted accurately and on time.

-

What are the pricing plans for using airSlate SignNow to manage rc366 tax pdf documents?

AirSlate SignNow offers various pricing plans suitable for different business needs, making it affordable to manage rc366 tax pdf documents. The plans vary based on features and the number of users, enabling businesses to choose what fits them best. This flexibility allows every organization to find a suitable solution for their eSigning needs.

-

What features does airSlate SignNow offer for working with rc366 tax pdf files?

With airSlate SignNow, users can easily upload, fill out, and eSign rc366 tax pdf documents efficiently. Key features include template creation, cloud storage, and integration with various applications to streamline document management. These features make handling tax documents smoother and more organized.

-

Can I integrate airSlate SignNow with other applications while managing rc366 tax pdf files?

Yes, airSlate SignNow offers seamless integration with a range of third-party applications for enhanced productivity when managing rc366 tax pdf files. This allows users to centralize their document workflow and improve efficiency. Popular integrations include CRM systems, cloud storage solutions, and more.

-

What are the benefits of using airSlate SignNow for rc366 tax pdf eSigning?

Using airSlate SignNow for rc366 tax pdf eSigning provides numerous benefits including improved turn-around times and increased productivity. The platform ensures that documents are securely signed and stored in compliance with legal standards. Additionally, users benefit from an intuitive interface and comprehensive support.

-

Is airSlate SignNow compliant with regulations for rc366 tax pdf submissions?

Yes, airSlate SignNow is compliant with regulatory standards for handling rc366 tax pdf submissions. The platform adheres to legal requirements to ensure that electronic signatures are valid and secure. This compliance helps businesses confidently manage their tax transactions.

Get more for Canada Direct Deposit Request

- Mdp membership form

- Credentialing application dental network of america form

- Form 58u

- Usps routing slip form

- All den cub scout requirement chart form

- Cci activity schedule form

- Dental practice chart audit analysis worksheet worksheet for auditing dental practice charts form

- Ruthclarkfuelgroup myfairpoint net form

Find out other Canada Direct Deposit Request

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter