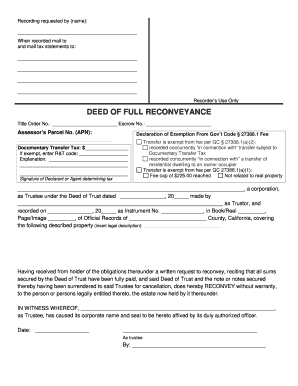

Escrow No Form

What is a reconveyance deed?

A reconveyance deed is a legal document that transfers the title of property back to the borrower once a mortgage or deed of trust has been paid off. This document serves as proof that the borrower has fulfilled their obligations under the loan agreement, effectively releasing them from any further claims by the lender. In the United States, this process is crucial for homeowners who want to clear their title and ensure that the property is free of any encumbrances related to the original loan.

Key elements of a reconveyance deed

Several important components must be included in a reconveyance deed to ensure its validity:

- Identification of the parties: The deed should clearly identify the borrower (grantor) and the lender (grantee).

- Property description: A precise description of the property being reconveyed must be included, often using the legal description found in the original mortgage documents.

- Statement of satisfaction: The deed should state that the loan has been paid in full, which releases the lender's interest in the property.

- Signatures: The document must be signed by the lender or their authorized representative to be legally binding.

- Notarization: Many states require that the reconveyance deed be notarized to confirm the authenticity of the signatures.

Steps to complete a reconveyance deed

Completing a reconveyance deed involves several steps to ensure that it is legally recognized:

- Gather necessary documents, including the original mortgage agreement and proof of payment.

- Draft the reconveyance deed, including all required elements as specified by state law.

- Have the lender sign the deed, ensuring that they are the authorized party to release the mortgage.

- Notarize the document to provide an additional layer of verification.

- Record the reconveyance deed with the appropriate county recorder's office to update public records.

Legal use of a reconveyance deed

The reconveyance deed is a vital legal instrument in real estate transactions. It is primarily used to confirm that a borrower has satisfied their mortgage obligations. By recording this deed, the borrower can ensure that their property title is clear of any claims from the lender. This process is essential for protecting property rights and is recognized across all states in the U.S.

State-specific rules for reconveyance deeds

While the basic principles of a reconveyance deed are consistent across the United States, specific requirements can vary by state. Some states may have particular forms that need to be used, or additional information that must be included. It is important for borrowers to check their state’s regulations to ensure compliance. Consulting with a local real estate attorney can provide clarity on any state-specific nuances.

Examples of using a reconveyance deed

Reconveyance deeds are commonly used in various scenarios, such as:

- When a homeowner pays off their mortgage and wants to confirm that the lender no longer has any interest in the property.

- In cases of refinancing, where the original mortgage is paid off and a new loan is established.

- When a property is sold, and the seller needs to provide proof that the property is free of liens from previous loans.

Quick guide on how to complete escrow no

Effortlessly Prepare Escrow No on Any Gadget

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and store it securely online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Handle Escrow No on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Escrow No with Ease

- Locate Escrow No and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate reprinting documents. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign Escrow No while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the escrow no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a reconveyance deed?

A reconveyance deed is a legal document that transfers the title of property from a lender back to the borrower once a loan is paid off. This document is crucial as it serves as proof that the debt has been satisfied, allowing the owner to clear any liens on the property.

-

How can airSlate SignNow help with reconveyance deeds?

airSlate SignNow offers a streamlined process for signing and managing reconveyance deeds. With its user-friendly platform, you can easily create, send, and eSign deeds quickly, ensuring that all parties can complete the transaction efficiently and securely.

-

What are the benefits of using airSlate SignNow for reconveyance deeds?

Using airSlate SignNow for reconveyance deeds simplifies the signing process and enhances document security. It provides a cost-effective solution that allows users to manage all their legal documents in one place, improving workflow and reducing the time spent on paperwork.

-

Is airSlate SignNow affordable for handling reconveyance deeds?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses looking to manage reconveyance deeds without breaking the bank. With various subscription options, you can choose a plan that best fits your needs and budget, all while benefiting from robust features.

-

What features does airSlate SignNow offer for reconveyance deed management?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for your reconveyance deeds. These features ensure that you can efficiently manage documents and maintain compliance throughout the signing process.

-

Can airSlate SignNow integrate with other software for reconveyance deeds?

Yes, airSlate SignNow offers integrations with various software tools, allowing you to streamline processes related to reconveyance deeds. These integrations can help enhance your overall workflow by connecting with CRM systems, document management solutions, and more.

-

How secure is airSlate SignNow for reconveyance deeds?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like reconveyance deeds. The platform employs advanced encryption and security measures to ensure that your information remains protected throughout the eSigning process.

Get more for Escrow No

- Home safety self assessment tool pdf form

- Finance form 10 wages sheet finance gov

- Potvrda o rezidentnosti bih form

- Ivco clearance form

- Experience verification form south carolina department of ed sc

- Little caesars pizza kit order form

- Biomedical waste 30 day log form

- Child care subsidy renewal application alberta form

Find out other Escrow No

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online