401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge 2014

What is the 401k participant deferral contribution change?

The 401k participant deferral contribution change refers to the process by which an employee modifies their contribution amount to a 401k retirement plan. This change can involve increasing or decreasing the percentage of salary that is deferred into the plan. It is essential for participants to understand the implications of these changes on their retirement savings and tax liabilities.

Typically, employees can make these changes during specific enrollment periods or at any time, depending on their employer's plan rules. Understanding the details of this form is crucial as it directly impacts long-term savings and financial planning.

Steps to complete the 401k participant deferral contribution change

Completing the 401k participant deferral contribution change form involves several key steps:

- Review your current contribution: Before making any changes, assess your current contribution levels and consider how they align with your retirement goals.

- Access the form: Obtain the 401k participant deferral contribution change form from your employer or plan administrator.

- Fill out the form: Provide the necessary information, including your personal details and the new contribution percentage you wish to set.

- Sign and date: Ensure you sign and date the form to validate your request.

- Submit the form: Return the completed form to your employer or plan administrator through the specified submission method.

Legal use of the 401k participant deferral contribution change

The legal use of the 401k participant deferral contribution change form is governed by federal regulations, including the Employee Retirement Income Security Act (ERISA). This act sets standards for retirement plans in private industry, ensuring that participants can make changes to their contributions in a compliant manner.

For the form to be legally binding, it must be completed accurately and submitted according to the plan's guidelines. Employers are required to maintain records of these changes for compliance and reporting purposes.

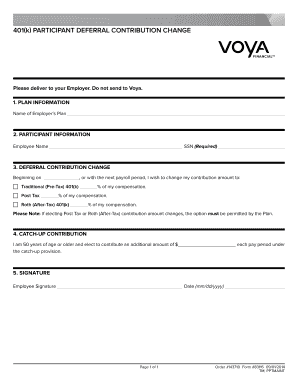

Key elements of the 401k participant deferral contribution change

Several key elements must be included in the 401k participant deferral contribution change form:

- Participant information: Full name, address, and employee identification number.

- Current contribution rate: The percentage of salary currently being deferred into the 401k plan.

- New contribution rate: The revised percentage you wish to contribute.

- Effective date: The date when the new contribution rate will take effect.

- Signature: A signature is required to validate the request.

Examples of using the 401k participant deferral contribution change

There are various scenarios in which an employee may need to utilize the 401k participant deferral contribution change form:

- Increase contributions: An employee may decide to increase their contributions after receiving a raise to maximize retirement savings.

- Decrease contributions: An employee facing financial difficulties may opt to reduce their contributions temporarily.

- Adjust for life changes: Major life events, such as marriage or having a child, may prompt a reassessment of retirement savings strategies.

Filing deadlines / Important dates

Filing deadlines for the 401k participant deferral contribution change form vary based on the employer's plan. Generally, it is advisable to submit the form well in advance of the effective date to ensure that the changes are processed in time. Key dates to consider include:

- The start of the new plan year.

- Open enrollment periods, if applicable.

- Any specific deadlines set by the employer for processing changes.

Quick guide on how to complete 401k participant deferral contribution change

Effortlessly Prepare 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for traditional printed and signed documentation, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly and without interruptions. Manage 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge with Ease

- Locate 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method of delivering your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 401k participant deferral contribution change

Create this form in 5 minutes!

How to create an eSignature for the 401k participant deferral contribution change

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge?

A 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge refers to modifications made by employees to their contribution amounts to a 401k retirement plan. This change can involve increasing or decreasing the percentage of salary deferrals. Understanding how to properly execute a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge is vital for effective retirement planning.

-

How can airSlate SignNow help with managing 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge?

airSlate SignNow streamlines the process of managing a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge by allowing businesses to send and sign necessary documents electronically. This means less paper and more efficient processing, ensuring that changes are recorded quickly and accurately. Our platform is designed to minimize errors and facilitate prompt updates.

-

Are there any fees associated with making a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge?

Typically, there are no direct fees for implementing a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge, as this is a standard feature of most retirement plans. However, it’s important to review your plan sponsor’s guidelines and possible administrative fees that might apply. Utilizing airSlate SignNow can help reduce administrative costs associated with processing these changes.

-

What features does airSlate SignNow offer to support 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge documentation?

airSlate SignNow offers advanced features such as customizable document templates, electronic signatures, and secure storage, all of which enhance the documentation process for a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge. These features ensure that the necessary forms are completed accurately and kept organized for future reference. Our platform also includes audit trails for compliance purposes.

-

How quickly can I implement a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge using airSlate SignNow?

Implementing a 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge with airSlate SignNow can be done quickly, often within a matter of hours. Our efficient document processing and eSigning capabilities allow for rapid turnaround times. This means you can adjust contributions as needed without long delays that often accompany traditional methods.

-

Can I integrate airSlate SignNow with my payroll system for 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge?

Yes, airSlate SignNow offers integrations with various payroll systems to ensure seamless processing of your 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge. These integrations help automate updates and ensure accurate payroll deductions based on the latest contribution changes. This not only saves time but also reduces the risk of errors in employee contributions.

-

What benefits does a smooth 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge process provide to employees?

A smooth 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge process ensures that employees can easily adjust their retirement savings according to their financial needs. This flexibility helps them optimize their retirement planning, ultimately leading to better financial security. Moreover, a quick and efficient process fosters employee satisfaction and trust in the employer's benefits management.

Get more for 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge

Find out other 401k PARTiciPAnT DefeRRAl ConTRibuTion ChAnge

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free