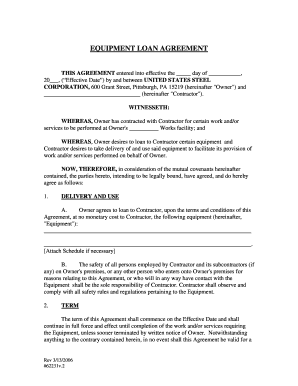

Equipment Loan Agreement Form

What is the Equipment Loan Agreement

The equipment loan agreement is a legal document that outlines the terms and conditions under which one party (the lender) allows another party (the borrower) to use specific equipment for a defined period. This agreement is essential for protecting the interests of both parties by clearly stating responsibilities, liabilities, and the expected return condition of the equipment. It typically includes details such as the description of the equipment, loan duration, payment terms, and any penalties for late return or damages.

Key Elements of the Equipment Loan Agreement

Several key elements are crucial in an equipment loan agreement to ensure clarity and legal enforceability. These elements include:

- Identification of Parties: Clearly state the names and contact information of both the lender and borrower.

- Description of Equipment: Provide a detailed description of the equipment being loaned, including serial numbers, model numbers, and any relevant specifications.

- Loan Duration: Specify the start and end dates of the loan period.

- Payment Terms: Outline any fees associated with the loan, including rental fees, late fees, and payment methods.

- Liability and Insurance: Define responsibilities for maintenance, damage, and insurance coverage during the loan period.

- Return Conditions: Detail the expected condition of the equipment upon return and any penalties for damage or late return.

Steps to Complete the Equipment Loan Agreement

Completing an equipment loan agreement involves several straightforward steps to ensure that all necessary information is accurately captured. Here are the steps to follow:

- Gather Information: Collect all relevant details about the equipment and the parties involved.

- Draft the Agreement: Use a template or create a document that includes all key elements of the agreement.

- Review the Terms: Ensure that both parties understand and agree to the terms outlined in the document.

- Sign the Agreement: Both parties should sign the document, preferably using a digital signature for convenience and security.

- Distribute Copies: Provide copies of the signed agreement to all parties for their records.

Legal Use of the Equipment Loan Agreement

The legal use of an equipment loan agreement is governed by various laws and regulations that ensure its enforceability. In the United States, it is essential to comply with federal and state laws regarding contracts. This includes ensuring that the agreement is written clearly, that both parties have the capacity to enter into the contract, and that the terms are not illegal or against public policy. Additionally, using a digital signature platform can enhance the legal standing of the agreement by providing a secure and verifiable method of signing.

How to Obtain the Equipment Loan Agreement

Obtaining an equipment loan agreement can be accomplished through several means. Many online resources offer templates that can be customized to fit specific needs. Additionally, legal professionals can provide tailored agreements that meet the unique requirements of the parties involved. When selecting a template or drafting an agreement, it is important to ensure that it includes all necessary elements and complies with relevant laws.

Examples of Using the Equipment Loan Agreement

Equipment loan agreements are commonly used in various scenarios, including:

- Business Equipment Loans: Companies may loan equipment such as computers, machinery, or tools to employees or other businesses.

- Event Rentals: Organizations often use loan agreements for renting equipment like audio-visual gear or staging for events.

- Educational Institutions: Schools may loan equipment such as laptops or scientific instruments to students for educational purposes.

Quick guide on how to complete equipment loan agreement

Complete Equipment Loan Agreement effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Equipment Loan Agreement on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Equipment Loan Agreement without hassle

- Obtain Equipment Loan Agreement and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow handles all your document management needs in just a few clicks from your chosen device. Modify and eSign Equipment Loan Agreement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the equipment loan agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an equipment loan agreement template?

An equipment loan agreement template is a pre-formatted document that outlines the terms and conditions for borrowing equipment. This template simplifies the process of lending and borrowing equipment, ensuring all legal requirements are met. By using an equipment loan agreement template, parties can clearly define their responsibilities and protect their interests.

-

How can I customize the equipment loan agreement template?

You can easily customize the equipment loan agreement template using airSlate SignNow's intuitive platform. Simply input specific details such as the names of the parties involved, the type of equipment, and the loan terms. This flexibility ensures the agreement fits your unique situation while maintaining all necessary legal aspects.

-

What are the benefits of using an equipment loan agreement template?

Using an equipment loan agreement template provides clarity and structure to the lending process, reducing the risk of disputes. It saves time by eliminating the need to create a document from scratch. Moreover, having a well-defined agreement can enhance trust between the borrower and lender, fostering better business relationships.

-

Is there a cost associated with the equipment loan agreement template?

airSlate SignNow offers a cost-effective solution for accessing the equipment loan agreement template. Pricing varies based on the chosen plan, but most options are designed to fit different budget needs. By investing in this template, you ensure that all your equipment loan transactions are handled professionally.

-

Can the equipment loan agreement template be used for various types of equipment?

Yes, the equipment loan agreement template is versatile and can be tailored for a variety of equipment types, from machinery to office devices. This adaptability allows businesses in different industries to utilize the same template. Customizing it for specific equipment ensures that all unique terms are accounted for.

-

Does the equipment loan agreement template comply with legal standards?

Absolutely, the equipment loan agreement template is designed to comply with legal standards, ensuring that all essential elements are covered. Using such a template minimizes the risk of legal issues down the line. However, it's always a good idea to consult a legal expert to confirm the template meets local laws.

-

What integrations does airSlate SignNow offer for the equipment loan agreement template?

airSlate SignNow provides various integrations with popular business applications to streamline your workflow. You can easily connect with tools like Google Drive, Dropbox, and CRM systems to manage your equipment loan agreement templates seamlessly. These integrations enhance efficiency by allowing you to access and send documents directly from your favorite platforms.

Get more for Equipment Loan Agreement

- Mvt 5 5 alabama form

- Rules for farm use tags in west virginia form

- Coughlin medical expense claim form

- Recommendation letter for conference travel grant form

- Aetna health assessment questionnaire form

- Application must be accompanied by transcript of school record form

- Sbd 6710 powts insp report r0313doc dsps wi form

- Parental visitation agreement template form

Find out other Equipment Loan Agreement

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy