Irs Cover Letter Example Form

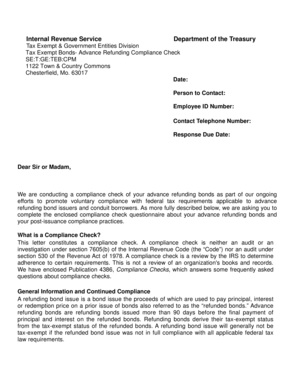

Understanding the IRS Cover Letter Example

An IRS cover letter serves as a formal introduction to your submitted documents, providing context and clarity to the information you are submitting. This letter is particularly useful when you are sending additional information to the IRS or responding to a notice. It should clearly state your purpose, include your contact information, and reference any relevant tax forms or notices. By using an IRS cover letter example, you can ensure that your letter meets the necessary requirements and effectively conveys your message.

Key Elements of the IRS Cover Letter Example

When drafting an IRS cover letter, certain key elements should be included to enhance clarity and professionalism:

- Your contact information: Include your full name, address, phone number, and email at the top of the letter.

- Date: Add the date you are sending the letter.

- IRS address: Clearly state the address of the IRS office you are sending the letter to.

- Subject line: A brief subject line that summarizes the purpose of your letter.

- Body of the letter: Clearly explain the purpose of your communication, referencing any relevant forms or notices.

- Closing: Use a professional closing statement, followed by your signature and printed name.

Steps to Complete the IRS Cover Letter Example

Completing an IRS cover letter involves several straightforward steps:

- Gather necessary information: Collect your personal information, IRS notice details, and any other relevant documents.

- Use a template: Consider starting with an IRS cover letter template to ensure you include all necessary elements.

- Draft your letter: Write the letter using clear and concise language, ensuring you address the IRS appropriately.

- Review for accuracy: Check for any spelling or grammatical errors, and ensure all information is correct.

- Sign and date: Sign the letter and include the date before sending it to the IRS.

How to Obtain the IRS Cover Letter Example

Obtaining an IRS cover letter example can be done through various means:

- IRS website: The IRS website often provides templates and examples for various forms of correspondence.

- Tax preparation software: Many tax software programs include templates for IRS cover letters.

- Professional tax advisors: Consulting with a tax professional can provide personalized guidance and examples tailored to your situation.

Filing Deadlines and Important Dates

When submitting an IRS cover letter, it is essential to be aware of relevant filing deadlines. Key dates may include:

- Tax return deadlines: Typically, individual tax returns are due on April 15 each year.

- Extensions: If you file for an extension, your return is due by October 15.

- Response deadlines: If responding to an IRS notice, ensure you adhere to the deadline specified in the notice to avoid penalties.

IRS Guidelines for Cover Letters

The IRS has specific guidelines regarding the submission of documents, including cover letters. These guidelines include:

- Clarity: Ensure your letter is clear and concise, making it easy for the IRS to understand your purpose.

- Documentation: Include any necessary supporting documents with your cover letter to substantiate your claims.

- Professional tone: Maintain a respectful and professional tone throughout your letter.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs cover letter example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS cover letter and why do I need one?

An IRS cover letter is a document that accompanies your tax submissions to the IRS, providing context and clarity. It is essential for ensuring that your documents are processed correctly and can help expedite any inquiries or issues. Using airSlate SignNow, you can easily create and send your IRS cover letter along with your tax forms.

-

How does airSlate SignNow help with creating an IRS cover letter?

airSlate SignNow offers customizable templates that simplify the process of drafting an IRS cover letter. You can easily fill in the necessary details and ensure that your letter meets IRS requirements. This feature saves time and reduces the risk of errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for IRS cover letters?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that streamline the creation and signing of documents, including IRS cover letters. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for my IRS cover letter needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your IRS cover letters alongside other business processes. This integration enhances efficiency and ensures that all your documents are in one place, making it easier to track submissions.

-

What are the benefits of using airSlate SignNow for IRS cover letters?

Using airSlate SignNow for your IRS cover letters provides numerous benefits, including ease of use, security, and compliance. The platform ensures that your documents are securely signed and stored, reducing the risk of loss or unauthorized access. Additionally, it helps you maintain compliance with IRS regulations.

-

How can I ensure my IRS cover letter is compliant with IRS standards?

airSlate SignNow provides templates that are designed to meet IRS standards, ensuring your IRS cover letter is compliant. You can also access resources and support to help you understand the requirements. This feature minimizes the chances of rejection or delays in processing your tax documents.

-

What types of documents can I send along with my IRS cover letter using airSlate SignNow?

With airSlate SignNow, you can send a variety of documents alongside your IRS cover letter, including tax returns, supporting documents, and additional forms. This capability allows you to submit a complete package to the IRS, ensuring that all necessary information is included for processing.

Get more for Irs Cover Letter Example

Find out other Irs Cover Letter Example

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast