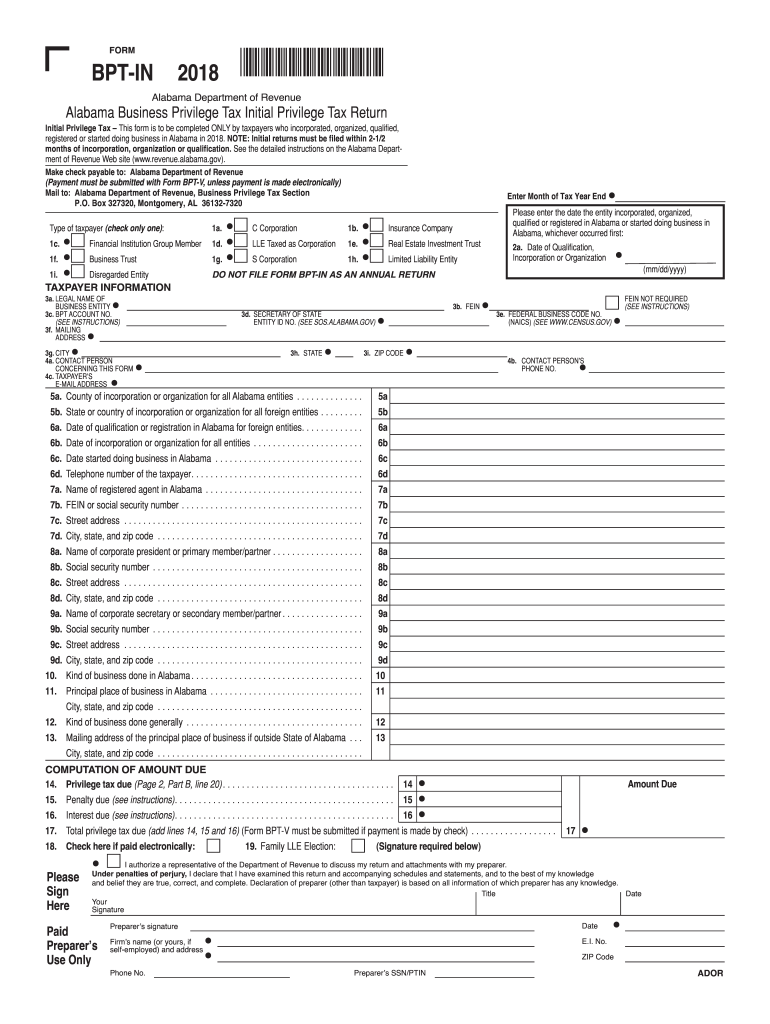

NOTE Initial Returns Must Be Filed within 2 12 2018

What is the NOTE Initial Returns Must Be Filed Within 2 12

The NOTE Initial Returns Must Be Filed Within 2 12 is a specific tax form required by the Internal Revenue Service (IRS) for certain taxpayers. This form is essential for reporting income and ensuring compliance with federal tax regulations. It is typically used by individuals and businesses to document their initial returns within the specified timeframe. Understanding this form is crucial for meeting tax obligations and avoiding penalties.

How to use the NOTE Initial Returns Must Be Filed Within 2 12

To effectively use the NOTE Initial Returns Must Be Filed Within 2 12 form, begin by gathering all necessary financial documentation, including income statements and deductions. Once you have the required information, access the form through the appropriate IRS channels or platforms that support electronic filing. Carefully fill out each section, ensuring accuracy to prevent delays or issues with your submission. After completing the form, review it for any errors before signing and submitting it electronically or via mail.

Filing Deadlines / Important Dates

Timely filing of the NOTE Initial Returns Must Be Filed Within 2 12 is critical to avoid penalties. The IRS typically sets specific deadlines for submission, which can vary based on the taxpayer's status and the type of income reported. Generally, individual taxpayers must file by April 15, while businesses may have different deadlines depending on their fiscal year. It is advisable to check the IRS website or consult a tax professional for the most current filing dates relevant to your situation.

Penalties for Non-Compliance

Failing to file the NOTE Initial Returns Must Be Filed Within 2 12 on time can result in significant penalties. The IRS imposes fines based on the amount of unpaid tax and the length of the delay. Additionally, interest accrues on any unpaid taxes from the due date until payment is made. Understanding these penalties emphasizes the importance of timely filing and compliance with tax regulations to avoid unnecessary financial burdens.

Required Documents

When preparing to complete the NOTE Initial Returns Must Be Filed Within 2 12, it is essential to gather all required documents. Key documents include W-2 forms for wage earners, 1099 forms for independent contractors, and any relevant receipts for deductions. Additionally, having your Social Security number and other identification details readily available will streamline the filing process. Ensuring you have all necessary documents will help in accurately reporting your income and minimizing errors.

Digital vs. Paper Version

Choosing between the digital and paper versions of the NOTE Initial Returns Must Be Filed Within 2 12 can impact your filing experience. The digital version offers benefits such as faster processing times, immediate confirmation of receipt, and reduced risk of lost documents. In contrast, the paper version may take longer to process and requires mailing, which can introduce delays. Utilizing an electronic filing method, especially through a secure platform, can enhance efficiency and compliance.

Quick guide on how to complete note initial returns must be filed within 2 12

Your assistance manual on how to prepare your NOTE Initial Returns Must Be Filed Within 2 12

If you’re curious about how to finalize and submit your NOTE Initial Returns Must Be Filed Within 2 12, here are a few straightforward instructions on how to simplify tax reporting.

To start, you simply need to create your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is an extremely intuitive and robust document solution that allows you to modify, generate, and complete your income tax documents effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to adjust details whenever necessary. Streamline your tax administration with advanced PDF editing, electronic signing, and easy sharing.

Follow the instructions below to finalize your NOTE Initial Returns Must Be Filed Within 2 12 in just a few minutes:

- Set up your account and start editing PDFs within moments.

- Utilize our directory to locate any IRS tax document; sift through versions and schedules.

- Click Get form to access your NOTE Initial Returns Must Be Filed Within 2 12 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding electronic signature (if applicable).

- Review your document and amend any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes digitally with airSlate SignNow. Keep in mind that paper submissions can lead to increased return errors and delayed reimbursements. It’s essential to verify the IRS website for reporting regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct note initial returns must be filed within 2 12

FAQs

-

Can a wide vocal range be expanded with training? I'm a male singer with 4 1/2 octaves and no formal training. I'd like to gain more usable notes but don't know how much further out I could push.

In many instances, I would say yes. However, a 4 octave + vocal range, as far as I’m aware, is above average, so I think you’re already ahead of the game in that sense. But if you really feel you need additional range, then I would recommend you consult with a vocal coach, who should be able to ascertain whether or not you’d be able to extend your already very decent range, either up or down, depending on which of the two you desire to expand. Speaking personally, you have a whole octave more than I do, and I can sing pretty much anything I want with three and a half octaves, so if I were you, I’d be feeling pretty darn happy about having your vocal prowess. Bravo!

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the note initial returns must be filed within 2 12

How to create an eSignature for the Note Initial Returns Must Be Filed Within 2 12 in the online mode

How to make an electronic signature for your Note Initial Returns Must Be Filed Within 2 12 in Chrome

How to create an electronic signature for signing the Note Initial Returns Must Be Filed Within 2 12 in Gmail

How to make an eSignature for the Note Initial Returns Must Be Filed Within 2 12 right from your smart phone

How to make an electronic signature for the Note Initial Returns Must Be Filed Within 2 12 on iOS devices

How to create an eSignature for the Note Initial Returns Must Be Filed Within 2 12 on Android devices

People also ask

-

What does 'NOTE Initial Returns Must Be Filed Within 2 12' mean?

'NOTE Initial Returns Must Be Filed Within 2 12' refers to an important deadline for businesses to submit their initial tax returns. Understanding this requirement ensures compliance and can help avoid penalties. It's crucial for businesses to maintain accurate records and timely submissions to streamline their operations.

-

How can airSlate SignNow help with filing 'NOTE Initial Returns Must Be Filed Within 2 12'?

airSlate SignNow offers an efficient platform for businesses to sign and send documents digitally, including tax return forms. With easy access to templates and eSignature features, businesses can ensure that 'NOTE Initial Returns Must Be Filed Within 2 12' are submitted accurately and swiftly, minimizing delay risks.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides flexible pricing plans tailored to various business needs. Each plan is designed to offer essential features that support document management and eSigning, making the submission of 'NOTE Initial Returns Must Be Filed Within 2 12' straightforward and cost-effective.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include customizable templates, bulk sending, real-time tracking, and secure cloud storage. These features make it particularly beneficial for businesses looking to streamline processes related to 'NOTE Initial Returns Must Be Filed Within 2 12' and enhance collaboration among team members.

-

Is it easy to integrate airSlate SignNow with other business tools?

Yes, airSlate SignNow seamlessly integrates with various business tools like CRM systems, productivity software, and accounting platforms. This allows users to manage documents related to 'NOTE Initial Returns Must Be Filed Within 2 12' alongside other essential processes, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents offers numerous benefits, including faster turnaround times, enhanced security, and reduced paper usage. For businesses needing to comply with 'NOTE Initial Returns Must Be Filed Within 2 12', these advantages streamline workflow and ensure timely submissions.

-

Can I use airSlate SignNow for international transactions?

Absolutely! airSlate SignNow supports international transactions and complies with global eSignature laws. This makes it a suitable choice for businesses managing documents related to 'NOTE Initial Returns Must Be Filed Within 2 12' across different countries, ensuring compliance and ease of use.

Get more for NOTE Initial Returns Must Be Filed Within 2 12

- How to make a cladogram worksheet answers form

- New product request form template

- How to get a wildlife hobby permit missouri form

- Beyelashb bextensionsb agreement amp consent bformb permanent

- Plea agreement template form

- Pledge of goods agreement template form

- Plumbing agreement template form

- Commercial real estate purchase contract template form

Find out other NOTE Initial Returns Must Be Filed Within 2 12

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word