Alabama DOR Reminds Minimum Business Privilege Tax 2024-2026

Understanding the Alabama DOR Minimum Business Privilege Tax

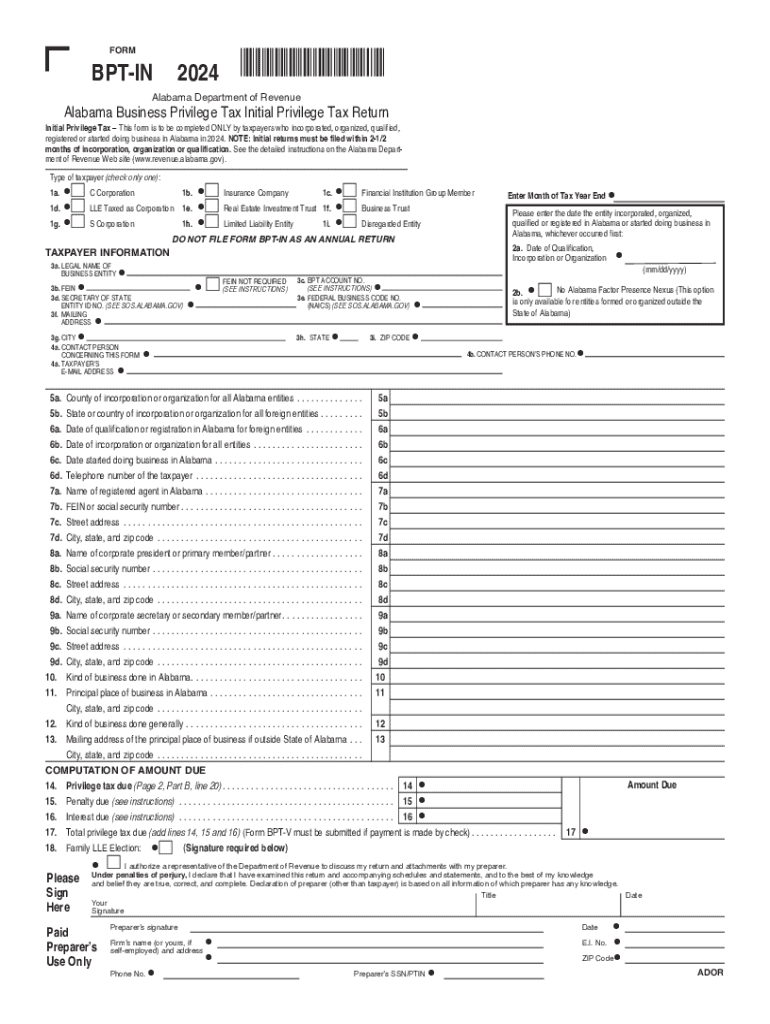

The Alabama Department of Revenue (DOR) administers the Minimum Business Privilege Tax, which is a tax imposed on businesses operating within the state. This tax applies to various business entities, including corporations and limited liability companies (LLCs). The tax is calculated based on the entity's net worth or capital, with a minimum amount due regardless of income. It is essential for businesses to understand their obligations under this tax to ensure compliance and avoid penalties.

Steps to Complete the Alabama DOR Minimum Business Privilege Tax

Completing the Alabama Minimum Business Privilege Tax involves several key steps:

- Determine the business entity type to identify the applicable tax rate and requirements.

- Gather necessary financial information, including total assets and liabilities, to calculate net worth.

- Complete the Alabama Form BPT, ensuring all sections are filled out accurately.

- Review the form for completeness and correctness before submission.

- Submit the form to the Alabama DOR by the designated deadline to avoid late fees.

Filing Deadlines and Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Alabama Minimum Business Privilege Tax. Typically, the tax return is due on the fifteenth day of the third month following the end of the tax year. For most businesses operating on a calendar year, this means the deadline is March 15. Late submissions may incur penalties, so timely filing is essential.

Required Documents for Filing

When filing the Alabama Minimum Business Privilege Tax, businesses must prepare specific documents:

- Completed Alabama Form BPT, which includes detailed financial information.

- Supporting documentation that verifies the financial data reported, such as balance sheets and income statements.

- Any additional forms required for specific business types or circumstances.

Penalties for Non-Compliance

Failure to comply with the Alabama Minimum Business Privilege Tax requirements can result in significant penalties. These may include:

- Late fees based on the amount of tax owed.

- Interest on unpaid taxes, which accrues over time.

- Potential legal action for continued non-compliance, which could lead to further financial consequences.

Eligibility Criteria for the Alabama DOR Minimum Business Privilege Tax

Eligibility for the Alabama Minimum Business Privilege Tax generally applies to all businesses operating within the state. This includes corporations, LLCs, and partnerships. However, certain exemptions may apply based on the nature of the business or specific activities conducted. It is advisable for businesses to review their eligibility with the Alabama DOR to ensure compliance.

Quick guide on how to complete alabama dor reminds minimum business privilege tax

Effortlessly Prepare Alabama DOR Reminds Minimum Business Privilege Tax on Any Device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and eSign your documents swiftly without delays. Manage Alabama DOR Reminds Minimum Business Privilege Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest method to modify and eSign Alabama DOR Reminds Minimum Business Privilege Tax with ease

- Find Alabama DOR Reminds Minimum Business Privilege Tax and then click Get Form to start.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Alabama DOR Reminds Minimum Business Privilege Tax and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama dor reminds minimum business privilege tax

Create this form in 5 minutes!

How to create an eSignature for the alabama dor reminds minimum business privilege tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama Form BPT in 2021?

The Alabama Form BPT in 2021 is a business privilege tax return that businesses operating in Alabama must file. This form is essential for compliance with state tax regulations and ensures that your business meets its tax obligations. Understanding how to complete this form accurately can save you time and potential penalties.

-

How can airSlate SignNow help with the Alabama Form BPT in 2021?

airSlate SignNow provides an efficient platform for electronically signing and sending the Alabama Form BPT in 2021. With its user-friendly interface, you can easily manage your documents and ensure they are signed and submitted on time. This streamlines the process, making tax compliance simpler for your business.

-

What are the pricing options for using airSlate SignNow for the Alabama Form BPT in 2021?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it cost-effective for handling the Alabama Form BPT in 2021. You can choose from monthly or annual subscriptions, with features that scale according to your requirements. This flexibility allows businesses of all sizes to benefit from our services.

-

What features does airSlate SignNow offer for managing the Alabama Form BPT in 2021?

airSlate SignNow includes features such as document templates, automated workflows, and secure eSigning, all of which are beneficial for managing the Alabama Form BPT in 2021. These tools help you streamline the document preparation and signing process, ensuring that everything is completed efficiently and securely.

-

Are there any integrations available with airSlate SignNow for the Alabama Form BPT in 2021?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the Alabama Form BPT in 2021. Whether you use CRM systems, cloud storage, or accounting software, our integrations help you maintain a smooth workflow and keep all your documents organized.

-

What are the benefits of using airSlate SignNow for the Alabama Form BPT in 2021?

Using airSlate SignNow for the Alabama Form BPT in 2021 offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are signed quickly and stored securely, reducing the risk of errors and compliance issues. This allows you to focus more on your business rather than paperwork.

-

Is airSlate SignNow user-friendly for filing the Alabama Form BPT in 2021?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to file the Alabama Form BPT in 2021. The intuitive interface guides you through the process, ensuring that even those with minimal technical skills can navigate and complete their documents without hassle.

Get more for Alabama DOR Reminds Minimum Business Privilege Tax

- Receipt goods purchase form

- Guide for identity theft victims who know their imposter form

- Licensor form

- Sample character reference letter form

- Proposed settlement form

- Resolution for for a church member family member form

- Letter from identity theft victim to credit issuer regarding known imposter identity theft form

- Not bid form

Find out other Alabama DOR Reminds Minimum Business Privilege Tax

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding