Bpt in Form Alabama 2019

What is the BPT In Form Alabama

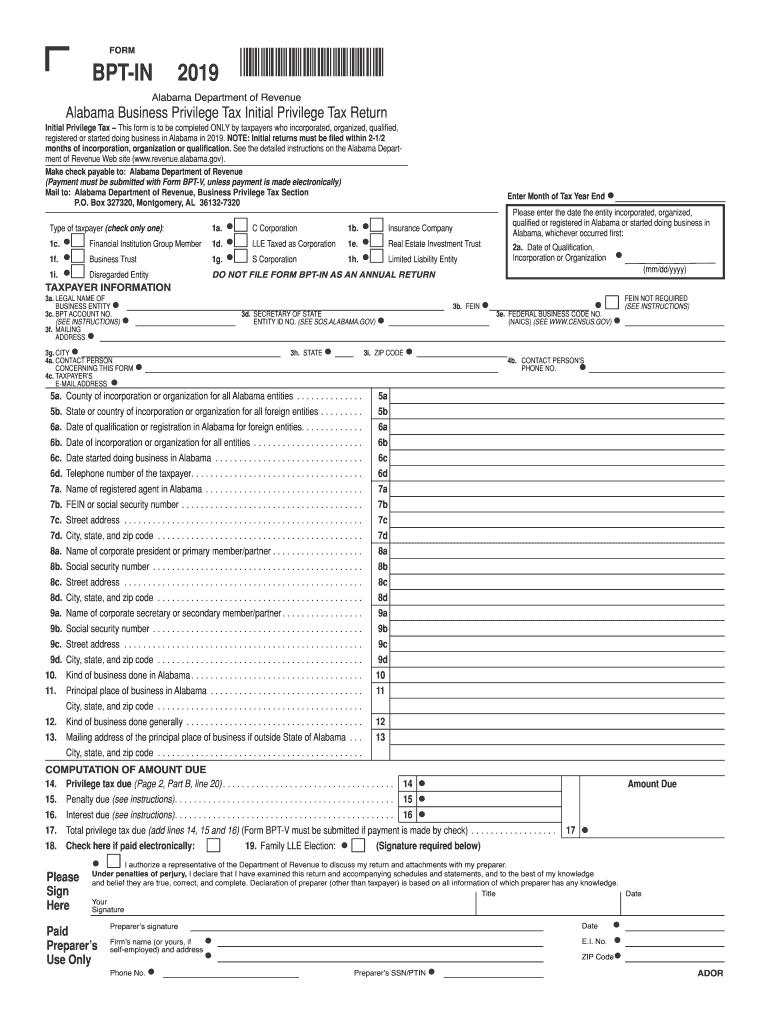

The BPT In Form Alabama, also known as the Business Privilege Tax (BPT) form, is a tax document that businesses in Alabama are required to file annually. This form is used to report the business privilege tax owed by corporations, limited liability companies (LLCs), and other business entities operating within the state. The form captures essential information about the business's financial performance, including revenue and other relevant financial data. Understanding the purpose and requirements of this form is crucial for compliance with Alabama tax laws.

Steps to complete the BPT In Form Alabama

Completing the BPT In Form Alabama involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather Necessary Information: Collect all financial records, including revenue statements and previous tax filings.

- Access the Form: Obtain the latest version of the BPT In Form Alabama from the official state website or authorized platforms.

- Fill Out the Form: Accurately input your business information, including name, address, and financial details as required.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid penalties.

- Sign and Date: Ensure the form is signed by an authorized representative of the business.

- Submit the Form: File the completed form by the designated deadline, either online or via mail.

Legal use of the BPT In Form Alabama

The BPT In Form Alabama is legally mandated under Alabama state law for businesses operating within the state. Filing this form accurately and on time is essential for compliance with state tax regulations. Failure to file or inaccuracies in reporting can lead to penalties, interest on unpaid taxes, and potential legal action. It is important for businesses to understand their obligations regarding this form to maintain good standing with the state.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the BPT In Form Alabama is crucial for businesses to avoid penalties. The form is typically due on the fifteenth day of the third month following the end of the business's fiscal year. For most businesses operating on a calendar year, this means the form is due by March 15. It is advisable for businesses to mark this date on their calendars and prepare their filings in advance to ensure timely submission.

Form Submission Methods

Businesses can submit the BPT In Form Alabama through various methods to accommodate different preferences. The primary submission methods include:

- Online Submission: Many businesses opt to file electronically through the Alabama Department of Revenue's online portal, which offers a streamlined process.

- Mail Submission: Businesses may also choose to print the completed form and mail it to the appropriate state office.

- In-Person Submission: Some may prefer to deliver the form in person at designated state offices for immediate confirmation of receipt.

Key elements of the BPT In Form Alabama

The BPT In Form Alabama includes several key elements that businesses must accurately complete. These elements typically consist of:

- Business Information: Name, address, and contact details of the business.

- Financial Data: Total revenue, deductions, and the calculation of the business privilege tax owed.

- Signature Section: A section for the authorized representative to sign and date the form.

- Payment Information: Details on how to remit payment for any taxes owed.

Quick guide on how to complete form bpt in alabama business privilege tax initial privilege tax

Your assistance manual on how to prepare your Bpt In Form Alabama

If you’re wondering how to complete and submit your Bpt In Form Alabama, here are some straightforward guidelines on how to streamline tax processing.

To start, simply register your airSlate SignNow account to revolutionize how you manage paperwork online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to amend details as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Bpt In Form Alabama in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our catalog to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Bpt In Form Alabama in our editor.

- Populate the required fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save updates, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper can increase return errors and prolong reimbursements. Before e-filing your taxes, make sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form bpt in alabama business privilege tax initial privilege tax

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Why does my boss want me to fill out the tax identification number (on the w-4 form) when it isn't my business?

As an employee, your tax ID is your social security number. An employer would submit an EIN or employer identification number. Now if she's asking you to submit as 'your own employer' she's shady boots!I would check with her to clarify because you both can be in deep trouble 'fudging' tax documents, it's serious business. If you're not the employer, you don't submit as the employer, who cares what she says? Boss or not anyone caught defrauding uncle Sam will usually end up in jail! You will be in jail because you filled out the form, and unless you did so at gun point, you will be there alone! She'll swear she knew nothing of it. Never allow anyone to make you break the law or do jail-time for their dishonesty!

Create this form in 5 minutes!

How to create an eSignature for the form bpt in alabama business privilege tax initial privilege tax

How to make an eSignature for the Form Bpt In Alabama Business Privilege Tax Initial Privilege Tax online

How to create an eSignature for your Form Bpt In Alabama Business Privilege Tax Initial Privilege Tax in Google Chrome

How to make an eSignature for putting it on the Form Bpt In Alabama Business Privilege Tax Initial Privilege Tax in Gmail

How to generate an electronic signature for the Form Bpt In Alabama Business Privilege Tax Initial Privilege Tax from your mobile device

How to generate an eSignature for the Form Bpt In Alabama Business Privilege Tax Initial Privilege Tax on iOS devices

How to make an electronic signature for the Form Bpt In Alabama Business Privilege Tax Initial Privilege Tax on Android devices

People also ask

-

What is the alabama form bpt 2019 and why is it important?

The Alabama Form BPT 2019 is a crucial business privilege tax return required for businesses operating in Alabama. It helps ensure compliance with state tax regulations. Filling out this form accurately is vital to avoid penalties and maintain good standing with the state.

-

How can airSlate SignNow assist with submitting the alabama form bpt 2019?

AirSlate SignNow simplifies the process of filling and submitting the Alabama Form BPT 2019 electronically. With its easy-to-use interface, you can quickly complete the necessary fields and ensure that your document is securely eSigned. This helps streamline your tax submission process.

-

Is there a cost involved with using airSlate SignNow for the alabama form bpt 2019?

Yes, while airSlate SignNow offers various subscription plans, its pricing is competitive and designed to suit different business needs. The cost can vary based on features and usage, but it remains a cost-effective solution for managing documents, including the Alabama Form BPT 2019.

-

What features does airSlate SignNow provide for the alabama form bpt 2019?

AirSlate SignNow provides features such as customizable templates, drag-and-drop tools, and real-time collaboration for the Alabama Form BPT 2019. Users can track document status, set reminders, and receive notifications to ensure timely submissions. These features enhance efficiency and accuracy.

-

Can I integrate airSlate SignNow with other software to manage the alabama form bpt 2019?

Yes, airSlate SignNow offers integrations with popular accounting and business management software that can help you manage the Alabama Form BPT 2019 alongside your other financial documents. This allows for seamless data transfer and enhanced workflow, reducing potential errors.

-

Are there any benefits of using airSlate SignNow for the alabama form bpt 2019?

Using airSlate SignNow for the Alabama Form BPT 2019 provides signNow benefits such as improved efficiency, reduced paper waste, and enhanced tracking capabilities. You can also enjoy secure storage of your documents and easy access anytime, which is great for audits or future reference.

-

How does airSlate SignNow ensure the security of the alabama form bpt 2019?

AirSlate SignNow employs advanced encryption and security protocols to safeguard your documents, including the Alabama Form BPT 2019. This ensures that sensitive data remains protected both during transmission and while stored in the cloud.

Get more for Bpt In Form Alabama

Find out other Bpt In Form Alabama

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer