the FSA Trade off Flexible Spending Accounts Can Save Money Now 2018

What is the FSA Trade Off Flexible Spending Accounts Can Save Money Now

The FSA Trade Off Flexible Spending Accounts Can Save Money Now is a financial tool designed to help individuals manage their healthcare expenses more effectively. It allows employees to set aside pre-tax dollars to pay for eligible medical expenses, thereby reducing their taxable income. This program is particularly beneficial for those who anticipate significant healthcare costs, as it enables them to save money while receiving necessary medical care.

By participating in an FSA, employees can allocate funds for various healthcare expenses, including copayments, deductibles, and certain over-the-counter medications. The trade-off aspect refers to the decision-making process involved in balancing the amount contributed to the FSA against potential savings on taxes and out-of-pocket costs.

How to Use the FSA Trade Off Flexible Spending Accounts Can Save Money Now

Using the FSA Trade Off Flexible Spending Accounts Can Save Money Now involves several straightforward steps. First, employees should determine their expected healthcare expenses for the year. This estimation helps in deciding how much to contribute to the FSA.

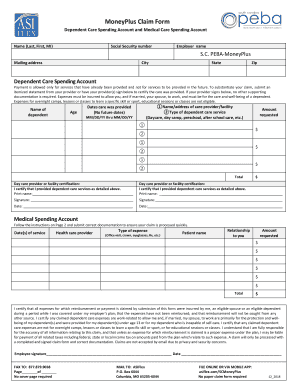

Next, employees can enroll in the FSA during their employer's open enrollment period. Once enrolled, they can begin contributing funds through payroll deductions. As expenses are incurred, employees can use their FSA debit card or submit claims for reimbursement. It's essential to keep receipts and documentation for all eligible expenses to ensure compliance and facilitate reimbursements.

Steps to Complete the FSA Trade Off Flexible Spending Accounts Can Save Money Now

Completing the FSA Trade Off Flexible Spending Accounts Can Save Money Now requires careful attention to detail. Here are the steps involved:

- Estimate your annual healthcare expenses to determine the appropriate contribution amount.

- Enroll in the FSA during your employer's open enrollment period.

- Contribute funds through payroll deductions throughout the year.

- Use your FSA debit card or submit claims for eligible expenses as they arise.

- Retain all receipts and documentation for your records and for potential audits.

Legal Use of the FSA Trade Off Flexible Spending Accounts Can Save Money Now

The FSA Trade Off Flexible Spending Accounts Can Save Money Now is governed by specific legal guidelines that ensure its proper use. To be compliant, the funds must be used exclusively for qualified medical expenses as defined by the Internal Revenue Service (IRS). This includes expenses such as doctor visits, prescription medications, and certain medical supplies.

Employers must also adhere to regulations regarding the establishment and maintenance of FSAs, including providing clear communication to employees about their rights and responsibilities. Understanding these legal requirements is crucial for both employees and employers to avoid potential penalties or disqualification from the program.

Eligibility Criteria for the FSA Trade Off Flexible Spending Accounts Can Save Money Now

Eligibility for the FSA Trade Off Flexible Spending Accounts Can Save Money Now typically requires employees to be enrolled in a qualifying employer-sponsored health plan. Most employers offer FSAs as part of their benefits package, but participation may vary based on employment status, such as full-time or part-time work.

Additionally, employees should be aware of contribution limits set by the IRS, which can change annually. Meeting these criteria ensures that individuals can take full advantage of the tax benefits associated with FSAs.

IRS Guidelines for the FSA Trade Off Flexible Spending Accounts Can Save Money Now

The IRS provides guidelines that govern the operation of the FSA Trade Off Flexible Spending Accounts Can Save Money Now. These guidelines outline what constitutes eligible medical expenses, contribution limits, and the tax implications of using an FSA. For the current tax year, the maximum contribution limit is set by the IRS and may be adjusted annually for inflation.

Employees should familiarize themselves with these guidelines to maximize their benefits and ensure compliance. Understanding the rules can help prevent costly mistakes, such as using funds for ineligible expenses, which could lead to tax penalties.

Quick guide on how to complete the fsa trade off flexible spending accounts can save money now

Complete The FSA Trade off Flexible Spending Accounts Can Save Money Now effortlessly on any device

Web-based document administration has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage The FSA Trade off Flexible Spending Accounts Can Save Money Now on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to modify and eSign The FSA Trade off Flexible Spending Accounts Can Save Money Now with ease

- Obtain The FSA Trade off Flexible Spending Accounts Can Save Money Now and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign The FSA Trade off Flexible Spending Accounts Can Save Money Now and ensure effective communication throughout the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the fsa trade off flexible spending accounts can save money now

Create this form in 5 minutes!

How to create an eSignature for the the fsa trade off flexible spending accounts can save money now

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are flexible spending accounts (FSAs) and how do they work?

Flexible Spending Accounts (FSAs) allow employees to set aside pre-tax dollars for qualified healthcare expenses. The FSA Trade off Flexible Spending Accounts Can Save Money Now by reducing taxable income, making it easier to manage medical costs effectively. Employees can access their funds as needed, ensuring they use their resources wisely.

-

How can The FSA Trade off Flexible Spending Accounts Can Save Money Now benefit my employees?

Offering FSAs can positively impact employee satisfaction by providing them with a way to save on out-of-pocket healthcare expenses. The FSA Trade off Flexible Spending Accounts Can Save Money Now enables employees to utilize pre-tax dollars for essential services, decreasing their overall healthcare costs. This benefit can enhance your company's recruitment and retention efforts.

-

What types of expenses can be covered by flexible spending accounts?

FSAs can cover a variety of healthcare-related expenses, including co-payments, prescriptions, and medical supplies. Understanding how The FSA Trade off Flexible Spending Accounts Can Save Money Now can help employees maximize their savings and utilize their accounts efficiently. It’s essential for participants to familiarize themselves with eligible expenses to take full advantage.

-

Are there any limitations on the amount I can contribute to an FSA?

Yes, there are contribution limits set by the IRS for FSAs each year. The FSA Trade off Flexible Spending Accounts Can Save Money Now offers an opportunity for employees to save more with pre-tax contributions while ensuring compliance with these regulations. Always check the latest limits to effectively plan your annual contributions.

-

Can flexible spending accounts be used in conjunction with other health benefit plans?

Yes, FSAs can be used alongside other health benefit plans, such as HSAs or traditional health insurance. Understanding how The FSA Trade off Flexible Spending Accounts Can Save Money Now interacts with existing coverage is key to maximizing benefits. This integration allows employees to optimize their healthcare spending across multiple channels.

-

What are the administrative costs associated with implementing FSAs for my business?

Administrative costs can vary based on the provider and the complexity of your FSA plan. However, the potential savings realized from The FSA Trade off Flexible Spending Accounts Can Save Money Now often outweigh these expenses. It’s important for businesses to evaluate the ROI when considering the setup of an FSA program.

-

Is it easy to manage flexible spending accounts through airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly platform to manage FSAs efficiently. The FSA Trade off Flexible Spending Accounts Can Save Money Now simplifies document handling and e-signatures, allowing administrators and employees to manage their accounts seamlessly and effortlessly.

Get more for The FSA Trade off Flexible Spending Accounts Can Save Money Now

- Form m4 statement of arrangements for children in the county courtsni gov

- Fire drill record doc form

- Atm placement agreement template form

- Gse algebra 1 answer key form

- This form will be used for new vendors amp updateschanges for any vendor information

- Vendor selection form iit

- St vincent de paul st joseph catholic church form

- Voluntary separation agreement template form

Find out other The FSA Trade off Flexible Spending Accounts Can Save Money Now

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later