California Estate 2017-2026

What is the California Estate

The California estate refers to the totality of a person's assets and liabilities at the time of their passing. This includes real estate, personal property, financial accounts, and any other belongings owned by the individual. Understanding the components of a California estate is crucial for heirs and beneficiaries, as it determines how assets will be distributed according to state laws and the deceased's wishes, typically outlined in a will or trust.

Steps to Complete the California Estate

Completing the California estate process involves several key steps:

- Gather Documentation: Collect all relevant documents, including the will, trust agreements, and financial statements.

- File Necessary Forms: Submit required forms to the probate court if the estate goes through probate. This includes the Petition for Probate and the Notice of Hearing.

- Inventory Assets: Create a detailed inventory of all assets and liabilities to determine the estate's total value.

- Notify Heirs and Creditors: Inform all potential heirs and creditors about the estate proceedings to ensure transparency.

- Distribute Assets: Once debts and taxes are settled, distribute the remaining assets according to the will or state law.

Legal Use of the California Estate

The legal use of a California estate involves adhering to state laws governing estate management and distribution. Executors or administrators must act in the best interest of the estate and its beneficiaries, following the legal framework established by California probate law. This includes filing necessary documents, maintaining accurate records, and ensuring that all debts and taxes are settled before distributing assets.

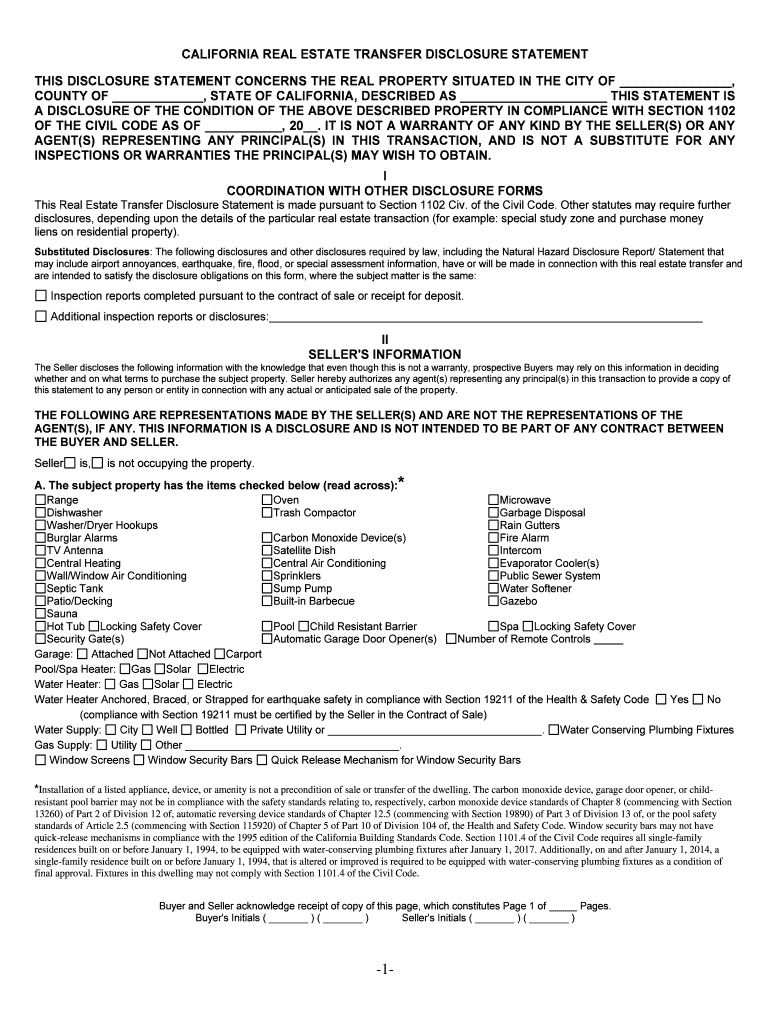

Disclosure Requirements

California law mandates specific disclosure requirements for real estate transactions. Sellers must provide a California real estate disclosure form, which outlines any known issues with the property, such as structural problems, pest infestations, or environmental hazards. This disclosure aims to protect buyers by ensuring they are fully informed about the property’s condition before completing the transaction.

Required Documents

To navigate the California estate process smoothly, several documents are essential:

- Death Certificate: Official proof of the individual's passing.

- Will: A legally binding document outlining the deceased's wishes regarding asset distribution.

- Trust Documents: If applicable, any trust agreements must be included.

- Financial Statements: Bank statements, investment accounts, and any other financial records relevant to the estate.

- Real Estate Deeds: Documentation of property ownership and any liens or mortgages.

State-Specific Rules for the California Estate

California has unique rules governing estate management and distribution. These include the requirement for a formal probate process for estates exceeding a certain value, which is adjusted periodically. Additionally, California recognizes community property laws, meaning that assets acquired during marriage are typically considered jointly owned. Understanding these state-specific rules is vital for effective estate planning and execution.

Quick guide on how to complete california estate 495562657

Complete California Estate effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage California Estate on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign California Estate without any hassle

- Locate California Estate and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere moments and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and eSign California Estate and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california estate 495562657

Create this form in 5 minutes!

How to create an eSignature for the california estate 495562657

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA real estate disclosure form?

The CA real estate disclosure form is a legally required document that sellers must provide to buyers. It outlines any known issues with the property, ensuring transparency in real estate transactions. Complying with this form protects both parties by clarifying the condition of the property.

-

How can airSlate SignNow help with the CA real estate disclosure form?

airSlate SignNow simplifies the process of sending and signing the CA real estate disclosure form, making it efficient and hassle-free. With our platform, you can easily generate, eSign, and store the form securely, ensuring compliance with California real estate laws. This streamlines your transaction and keeps everything organized in one place.

-

Is there a cost associated with using airSlate SignNow for the CA real estate disclosure form?

Yes, airSlate SignNow offers several pricing plans to suit different needs, including options for managing the CA real estate disclosure form. Our plans are designed to be cost-effective, ensuring you get excellent value for your document management solutions. You can choose a plan that best fits your real estate business requirements.

-

What features does airSlate SignNow offer for managing the CA real estate disclosure form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows for the CA real estate disclosure form. These features allow you to easily create and manage documents, ensuring a smooth transaction process. Our user-friendly interface makes it easy for anyone to navigate and utilize these tools.

-

Can I integrate airSlate SignNow with other tools for handling the CA real estate disclosure form?

Yes, airSlate SignNow can be integrated with various CRM systems and other applications that you may already use in your real estate business. This allows for seamless data transfer and enhanced productivity when working with the CA real estate disclosure form. Integrations help streamline your workflows and save you time.

-

What are the benefits of using airSlate SignNow for the CA real estate disclosure form?

Using airSlate SignNow for the CA real estate disclosure form provides numerous benefits, including time savings, reduced paperwork, and enhanced compliance. The platform ensures secure storage and easy access to your documents while providing a straightforward eSigning experience for all parties. This lets you focus more on closing deals than on managing paperwork.

-

How secure is airSlate SignNow when handling the CA real estate disclosure form?

airSlate SignNow is committed to providing a secure environment for handling the CA real estate disclosure form. We utilize industry-standard encryption and compliance with regulations to protect your documents. Rest assured, your sensitive information is safe while you manage real estate transactions through our platform.

Get more for California Estate

Find out other California Estate

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later