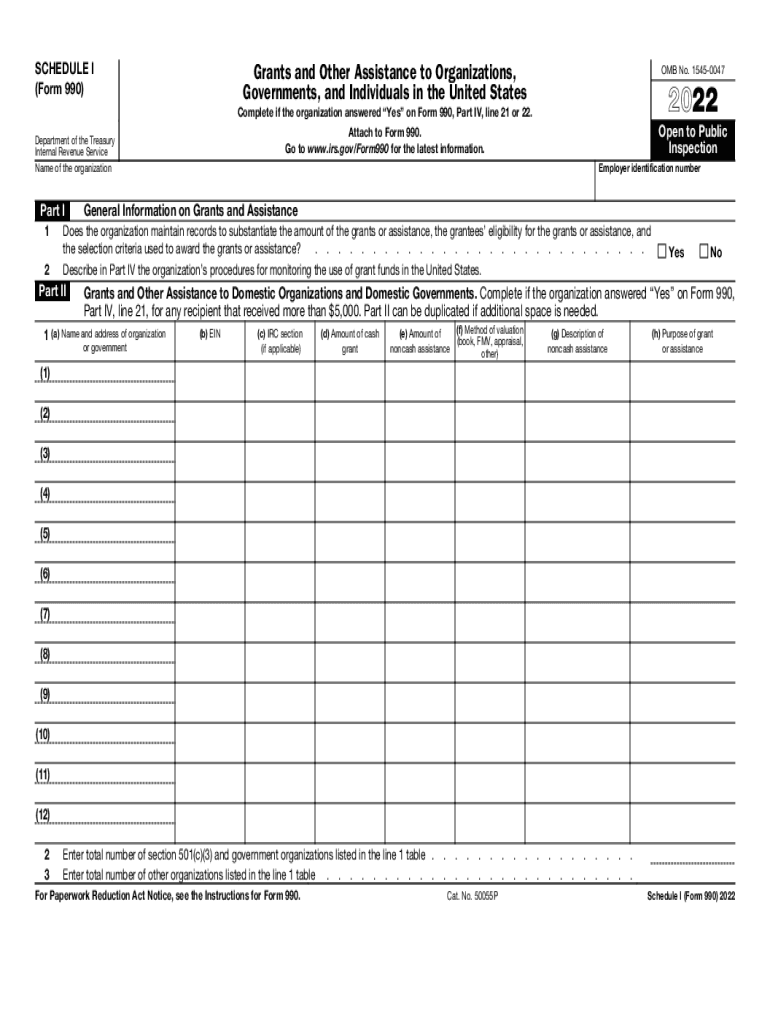

Schedule I Form 990 Grants and Other Assistance to Organizations, Governments, and Individuals in the United States 2022

What is the Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States

The Schedule I Form 990 is a critical document used by tax-exempt organizations in the United States to report grants and other forms of assistance provided to various entities, including organizations, governments, and individuals. This form is part of the IRS Form 990 series, which nonprofit organizations must file annually to maintain their tax-exempt status. It provides transparency regarding how funds are allocated and ensures compliance with federal regulations.

Specifically, the Schedule I form captures detailed information about the types of assistance given, the recipients, and the amounts disbursed. This information is essential for the IRS to assess the organization's adherence to its charitable mission and for the public to understand how nonprofit resources are utilized.

Steps to complete the Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States

Completing the Schedule I Form 990 involves several key steps to ensure accuracy and compliance with IRS requirements. Here are the steps to follow:

- Gather necessary information: Collect data regarding all grants and assistance provided during the tax year. This includes details about recipients, amounts, and the purpose of the assistance.

- Fill out the form: Enter the required information into the Schedule I form. This includes identifying the type of assistance, the recipient's name, and the total amount given.

- Review for accuracy: Double-check all entries for completeness and correctness. Ensure that all figures match your financial records.

- Attach to Form 990: Once completed, attach the Schedule I to your main Form 990 before submission. It is essential that all forms are submitted together to avoid processing delays.

Legal use of the Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States

The legal use of the Schedule I Form 990 is governed by IRS regulations, which require tax-exempt organizations to disclose their financial activities transparently. This form must be completed accurately to reflect the organization's grant-making activities. Misrepresentation or failure to file can lead to penalties, including loss of tax-exempt status.

Organizations must ensure that the information provided on the Schedule I is consistent with their mission and complies with applicable laws. This includes adhering to federal, state, and local regulations regarding charitable contributions and reporting requirements.

IRS Guidelines

The IRS has established specific guidelines for completing the Schedule I Form 990. These guidelines provide detailed instructions on the information required, the format for reporting, and the deadlines for submission. Organizations must familiarize themselves with these guidelines to ensure compliance and avoid potential penalties.

Key aspects of the IRS guidelines include:

- Clear definitions of what constitutes a grant or assistance.

- Requirements for documenting the purpose of each grant.

- Instructions for reporting amounts and recipient details accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule I Form 990 align with the overall deadlines for Form 990 submissions. Generally, tax-exempt organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. Organizations can apply for an extension if needed, but they must still comply with the extended deadlines.

It is crucial for organizations to mark these important dates on their calendars to ensure timely submission and avoid late fees or penalties.

Required Documents

To complete the Schedule I Form 990, organizations must have several documents ready. These include:

- Financial statements that detail the organization’s income and expenses.

- Records of all grants and assistance provided during the fiscal year.

- Documentation supporting the purpose and use of the funds granted.

Having these documents organized and accessible will streamline the completion of the Schedule I and help ensure compliance with IRS regulations.

Quick guide on how to complete 2022 schedule i form 990 grants and other assistance to organizations governments and individuals in the united states

Complete Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States on any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to edit and electronically sign Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States with ease

- Obtain Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device. Edit and electronically sign Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule i form 990 grants and other assistance to organizations governments and individuals in the united states

Create this form in 5 minutes!

People also ask

-

What is the 2017 Schedule I form used for?

The 2017 Schedule I form is used to report certain types of income that are exempt from self-employment tax. This can include income from rental properties, partnerships, and other similar income sources. Understanding the specifics of the 2017 Schedule I form can help businesses ensure accurate reporting and compliance.

-

How do I fill out the 2017 Schedule I form using airSlate SignNow?

With airSlate SignNow, filling out the 2017 Schedule I form is made simple and efficient. Our platform allows you to easily upload your documents, fill in the required fields, and eSign your schedule securely. This streamlines your tax reporting process and keeps your records organized.

-

What features does airSlate SignNow offer for managing the 2017 Schedule I form?

airSlate SignNow provides a user-friendly interface designed for managing the 2017 Schedule I form and other documents. Key features include document templates, collaborative editing, and advanced eSigning options. These tools ensure that businesses can manage their tax documentation efficiently and effectively.

-

Is there a free trial available for the airSlate SignNow service?

Yes, airSlate SignNow offers a free trial for new users to explore our services before committing. This allows you to familiarize yourself with how to complete and manage the 2017 Schedule I form, as well as utilize our eSigning capabilities without any upfront costs.

-

How can airSlate SignNow help in reducing errors on the 2017 Schedule I form?

Using airSlate SignNow signNowly reduces the chances of errors on your 2017 Schedule I form because of its automated fields and validation checks. Our system prompts you to complete necessary sections and ensures all information is accurately captured before submission. This way, you’re less likely to face audits or penalties due to inaccuracies.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to the needs of various businesses. Whether you're a freelancer or a large enterprise, you can choose from monthly or annual subscriptions based on your specific requirements for managing documents like the 2017 Schedule I form. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for easier management of the 2017 Schedule I form?

Absolutely! airSlate SignNow can integrate seamlessly with various software applications including CRM systems, accounting tools, and cloud storage solutions. This connectivity allows for easier management of your 2017 Schedule I form and enhances overall efficiency in your business operations.

Get more for Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States

Find out other Schedule I Form 990 Grants And Other Assistance To Organizations, Governments, And Individuals In The United States

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy