What is Form 8867Earned Income Tax Credit IRS Tax Forms 2022

What is Form 8867?

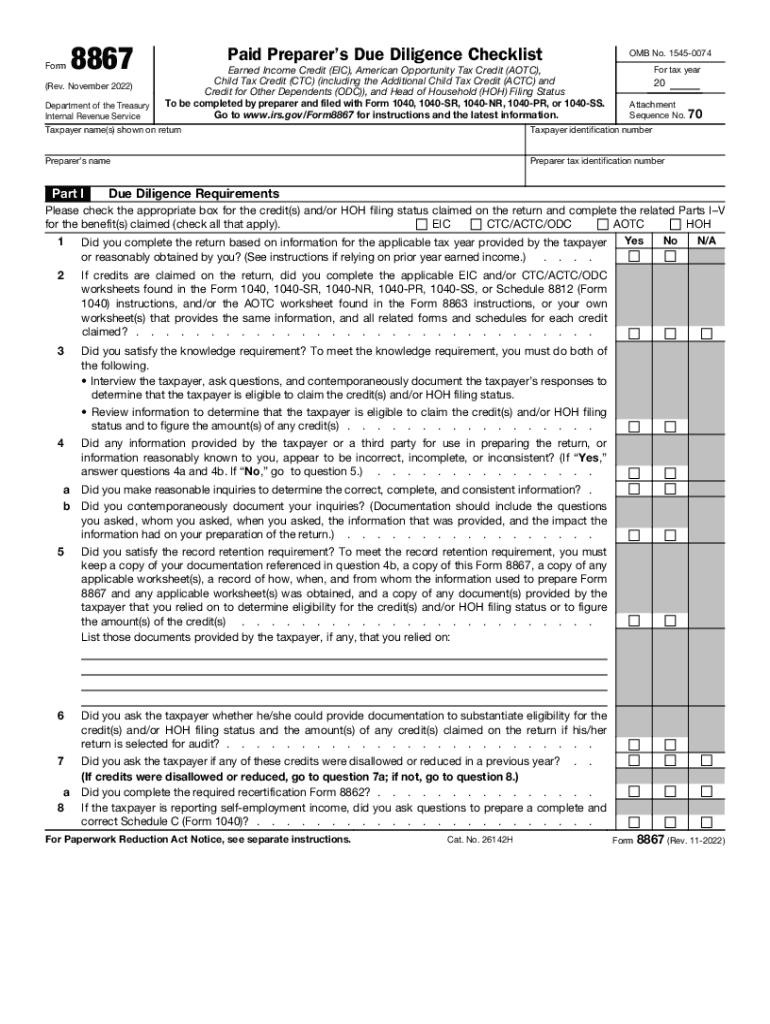

Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a crucial document for tax professionals who assist clients in claiming the Earned Income Tax Credit (EITC). This form ensures that preparers follow the necessary guidelines set by the IRS to verify a taxpayer's eligibility for the EITC. The form requires preparers to confirm that they have reviewed specific information and documentation related to the taxpayer's income, filing status, and qualifying children. Failure to complete Form 8867 accurately can lead to penalties for both the preparer and the taxpayer.

Steps to Complete Form 8867

Completing Form 8867 involves several important steps to ensure compliance with IRS requirements. The following outlines the process:

- Gather necessary documents: Collect all relevant information, including income statements, tax returns, and documentation for qualifying children.

- Review eligibility criteria: Ensure the taxpayer meets all requirements for the Earned Income Tax Credit, including income limits and filing status.

- Complete the form: Fill out each section of Form 8867, providing accurate information based on the gathered documents.

- Sign and date: The tax preparer must sign and date the form, affirming that due diligence has been exercised.

Following these steps helps ensure that the form is completed correctly and that the taxpayer's claim for the EITC is valid.

Legal Use of Form 8867

Form 8867 serves a legal purpose in the tax preparation process by ensuring that tax preparers adhere to IRS regulations regarding the Earned Income Tax Credit. This form is legally binding and must be submitted with the taxpayer's return when claiming the EITC. The IRS mandates that preparers maintain a copy of Form 8867 for their records. This documentation can be critical in the event of an audit or inquiry regarding the taxpayer's eligibility for the credit.

Eligibility Criteria for the Earned Income Tax Credit

To qualify for the Earned Income Tax Credit, taxpayers must meet specific eligibility criteria, which include:

- Having earned income from employment or self-employment.

- Meeting income limits that vary based on filing status and number of qualifying children.

- Filing a federal tax return, even if no tax is owed.

- Having a valid Social Security number for the taxpayer and any qualifying children.

Understanding these criteria is essential for both taxpayers and preparers to ensure that claims for the EITC are valid and compliant with IRS regulations.

Required Documents for Form 8867

When completing Form 8867, several documents are required to substantiate the claims made on the form. These documents include:

- W-2 forms or 1099 forms showing earned income.

- Proof of residency for qualifying children, such as school records or medical documents.

- Tax returns from previous years, if applicable.

- Any additional documentation that supports the taxpayer's eligibility for the EITC.

Having these documents on hand ensures a smoother filing process and helps avoid potential issues with the IRS.

Filing Deadlines for Form 8867

Form 8867 must be filed along with the taxpayer's tax return by the standard filing deadline, which is typically April 15 of each year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers who file for an extension must still submit Form 8867 by the original deadline to ensure compliance. Missing the deadline can result in penalties and delays in processing the tax return.

Quick guide on how to complete what is form 8867earned income tax credit irs tax forms

Complete What Is Form 8867Earned Income Tax Credit IRS Tax Forms seamlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can locate the suitable form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage What Is Form 8867Earned Income Tax Credit IRS Tax Forms on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign What Is Form 8867Earned Income Tax Credit IRS Tax Forms easily

- Locate What Is Form 8867Earned Income Tax Credit IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign What Is Form 8867Earned Income Tax Credit IRS Tax Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is form 8867earned income tax credit irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the form 8867 and why is it important?

The form 8867 is the IRS document used by tax preparers to verify a client's eligibility for certain tax credits. It is crucial because completing this form accurately helps prevent penalties for erroneous claims and ensures clients receive the correct credits. Using airSlate SignNow can streamline the signing process for the form 8867, making compliance easier.

-

How can airSlate SignNow help with form 8867 submissions?

airSlate SignNow provides a simple and efficient platform for preparing and signing the form 8867 electronically. With its intuitive interface, tax preparers can easily send the form for eSignature, reducing the time spent on paperwork. This leads to faster submissions and a more organized documentation process.

-

Is there a cost associated with using airSlate SignNow for form 8867?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features specifically for managing documents like form 8867. These plans are designed to be cost-effective, ensuring that even small firms can benefit from using our platform. You can explore our pricing options on the website for more details.

-

What features does airSlate SignNow include for handling form 8867?

airSlate SignNow includes features like template creation, bulk sending, and advanced tracking for documents, making it easier to manage the form 8867. The platform also allows users to customize workflows and integrates with other tax preparation software, ensuring a seamless experience. This enhances productivity and reduces the potential for errors.

-

Can I integrate airSlate SignNow with other tools I use for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation tools and customer relationship management software. This means you can easily incorporate the form 8867 into your existing workflows without interruptions. Integration helps streamline your processes and keep all your documents in one accessible place.

-

What are the benefits of using airSlate SignNow for form 8867?

Using airSlate SignNow for your form 8867 submissions provides numerous benefits, including reduced processing time, enhanced compliance, and the ability to access documents anytime, anywhere. The electronic signature capability ensures that your forms are legally binding and secure. These advantages contribute to a more efficient workflow and improved client satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents like form 8867?

Yes, airSlate SignNow prioritizes security and compliance, implementing robust measures to protect sensitive documents such as form 8867. Our platform employs encryption and secure data storage to ensure your information is safe from unauthorized access. You can trust that your clients' data is handled with the utmost care.

Get more for What Is Form 8867Earned Income Tax Credit IRS Tax Forms

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497320830 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497320831 form

- Marital agreement have form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497320833 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497320834 form

- Nevada dissolution package to dissolve corporation nevada form

- Nevada dissolution package to dissolve limited liability company llc nevada form

- Living trust for husband and wife with no children nevada form

Find out other What Is Form 8867Earned Income Tax Credit IRS Tax Forms

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later