Schedule D Form 990 Supplemental Financial Statements 2022

What is the Schedule D Form 990 Supplemental Financial Statements

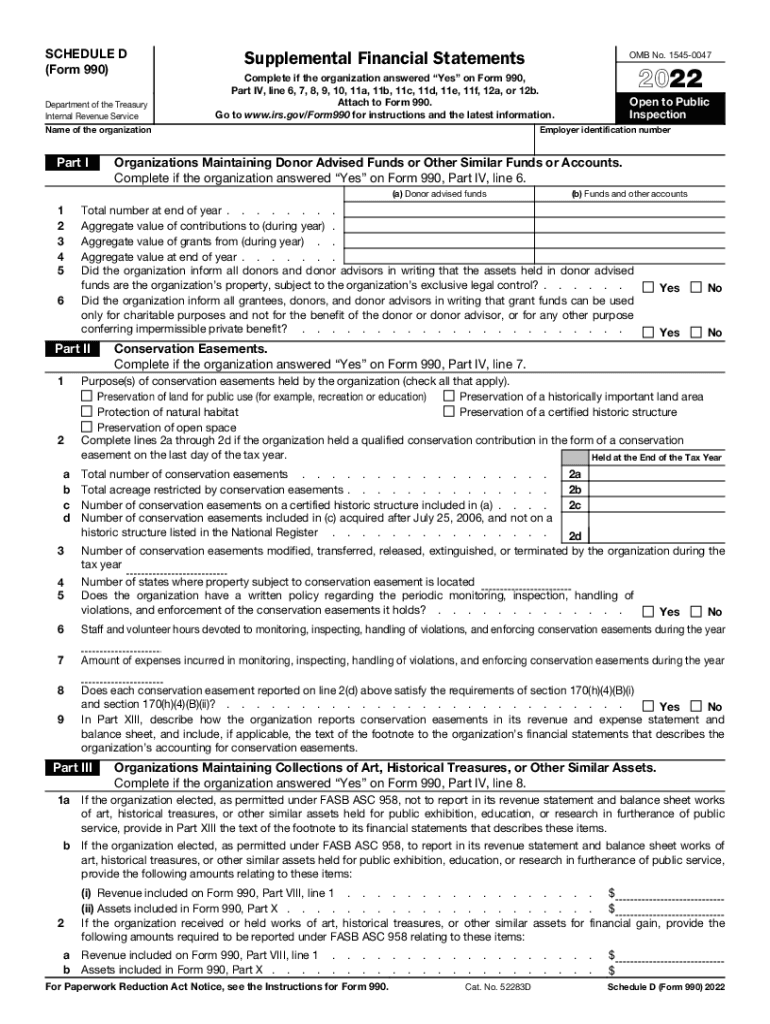

The Schedule D Form 990 Supplemental Financial Statements is a crucial document for tax-exempt organizations in the United States. This form provides detailed information about the organization's financial activities, including its investments, endowments, and other assets. It is designed to enhance transparency and accountability, allowing stakeholders to assess the financial health and operational integrity of the organization. The Schedule D is part of the IRS Form 990, which non-profit organizations must file annually to report their financial status and activities.

How to use the Schedule D Form 990 Supplemental Financial Statements

Using the Schedule D Form 990 involves several steps to ensure accurate reporting. Organizations must first gather all relevant financial data, including investment holdings and asset valuations. Next, they should complete the form by providing detailed descriptions of each asset, including its fair market value and any related liabilities. It is important to adhere to IRS guidelines to ensure compliance and avoid penalties. Once completed, the Schedule D should be submitted along with the main Form 990 during the organization's tax filing process.

Steps to complete the Schedule D Form 990 Supplemental Financial Statements

Completing the Schedule D Form 990 requires a systematic approach:

- Gather financial records, including investment statements and asset valuations.

- Identify all assets that need to be reported, such as stocks, bonds, and real estate.

- Fill out the form, providing necessary details for each asset, including descriptions and values.

- Review the completed form for accuracy and completeness.

- Submit the Schedule D along with the Form 990 by the filing deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 990. Organizations must ensure that all reported values reflect the fair market value as of the reporting date. Additionally, the IRS requires that organizations disclose any related party transactions and provide explanations for significant fluctuations in asset values. Adhering to these guidelines helps maintain compliance and fosters trust among stakeholders.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Schedule D Form 990. Typically, the deadline for filing Form 990 is the 15th day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Organizations can apply for a six-month extension, but they must file the extension request before the original deadline.

Required Documents

To complete the Schedule D Form 990, organizations need to gather several key documents:

- Financial statements, including balance sheets and income statements.

- Investment statements detailing holdings and valuations.

- Documentation of any related party transactions.

- Prior year tax returns for reference.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Schedule D Form 990 can result in significant penalties. The IRS may impose fines for late filings, inaccuracies, or failure to disclose required information. Organizations may also risk losing their tax-exempt status if they consistently fail to meet reporting obligations. It is essential for organizations to understand these risks and prioritize timely and accurate reporting.

Quick guide on how to complete 2022 schedule d form 990 supplemental financial statements

Complete Schedule D Form 990 Supplemental Financial Statements effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule D Form 990 Supplemental Financial Statements on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign Schedule D Form 990 Supplemental Financial Statements with ease

- Obtain Schedule D Form 990 Supplemental Financial Statements and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new paper copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Schedule D Form 990 Supplemental Financial Statements to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule d form 990 supplemental financial statements

Create this form in 5 minutes!

People also ask

-

What is the guidestar login process for airSlate SignNow?

The guidestar login process for airSlate SignNow is straightforward. Simply visit the SignNow website and click on the 'Login' button at the top right corner. Enter your credentials associated with your Guidestar account, and you'll be able to access all your documents and eSign features seamlessly.

-

Is there a cost associated with using guidestar login on airSlate SignNow?

Accessing airSlate SignNow with a guidestar login is completely free for basic features. However, for advanced functionalities and additional storage, you may consider our subscription plans. These plans are cost-effective and cater to various business needs, ensuring you get the best value for your investment.

-

What features are available through the guidestar login on airSlate SignNow?

With your guidestar login, you gain access to a variety of features on airSlate SignNow, including electronic signatures, document templates, and collaborative workflows. These features enhance your document management process, making it easier to send, sign, and manage important documents efficiently.

-

How can I benefit from using the guidestar login with airSlate SignNow?

Using your guidestar login with airSlate SignNow allows you to streamline your document signing process. The platform offers an intuitive interface, robust security measures, and time-saving automation that can signNowly enhance your productivity. Enjoy the flexibility of signing documents anytime, anywhere!

-

Does airSlate SignNow integrate with other apps when using the guidestar login?

Yes, airSlate SignNow supports integrations with numerous applications when you log in using your guidestar account. Popular integrations include CRM systems, cloud storage services, and productivity tools, enabling you to synchronize workflows and improve efficiency. These integrations ensure a cohesive work environment.

-

What if I forget my password for the guidestar login?

If you forget your password for the guidestar login, you can easily reset it. Just click on the 'Forgot Password?' link on the login page, enter your registered email address, and follow the prompts to create a new password. This process ensures you regain access quickly and securely.

-

Can I use airSlate SignNow for document management with my guidestar login?

Absolutely! Your guidestar login on airSlate SignNow provides comprehensive document management capabilities. You can organize, track, and store documents securely, making it an ideal solution for businesses that require efficient document oversight and management control.

Get more for Schedule D Form 990 Supplemental Financial Statements

- Nevada guardian form

- Affidavit name change form

- Nv name change form

- Applications for appointment as guardian family name change nevada form

- Nevada consent form

- Nevada change name form

- Applications for appointment as guardian family name change with second child nevada form

- Family name change 497320888 form

Find out other Schedule D Form 990 Supplemental Financial Statements

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple