Commercial Mortgage Application Commercial1 Form

Understanding the Commercial Mortgage Application Commercial1

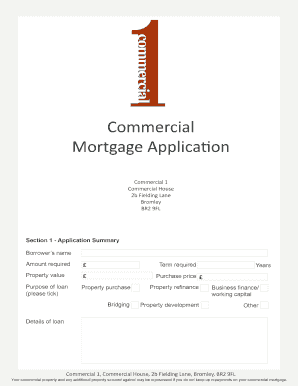

The Commercial Mortgage Application Commercial1 is a vital document used by businesses seeking financing for commercial real estate purchases or refinancing existing loans. This application collects essential information about the borrower, the property, and the financial details necessary for lenders to evaluate the loan request. Understanding its components and purpose is crucial for a successful application process.

Essential Components of the Commercial Mortgage Application Commercial1

This application typically includes several key elements:

- Borrower Information: Details about the business entity, including its legal structure, ownership, and contact information.

- Property Details: Information regarding the commercial property, such as its address, type, and current market value.

- Financial Statements: Recent financial documents that provide insight into the business's financial health, including balance sheets and income statements.

- Loan Amount Requested: The specific amount of financing being sought and its intended use.

- Repayment Terms: Proposed terms for loan repayment, including duration and interest rates.

Steps to Complete the Commercial Mortgage Application Commercial1

Filling out the Commercial Mortgage Application Commercial1 involves several important steps:

- Gather Required Documents: Collect all necessary financial documents and information about the business and property.

- Fill Out the Application: Carefully complete each section of the application, ensuring accuracy and clarity.

- Review for Completeness: Double-check the application for any missing information or errors before submission.

- Submit the Application: Send the completed application along with required documents to the lender through the preferred submission method.

Legal Considerations for the Commercial Mortgage Application Commercial1

When completing the Commercial Mortgage Application Commercial1, it is important to be aware of legal considerations that may affect the application process:

- Disclosure Requirements: Applicants must provide accurate and complete information to avoid potential legal issues.

- State-Specific Regulations: Different states may have unique laws governing commercial loans, which can impact the application process.

- Compliance with Lending Laws: Ensure that the application adheres to federal and state lending regulations to avoid penalties.

Required Documents for the Commercial Mortgage Application Commercial1

Applicants need to prepare several key documents to support their Commercial Mortgage Application Commercial1:

- Business financial statements for the past two to three years.

- Tax returns for the business and any owners for the previous two years.

- Current lease agreements if the property is leased.

- Details of any existing loans or liens on the property.

- Personal financial statements of the business owners, if applicable.

Application Process and Approval Time for the Commercial Mortgage Application Commercial1

The application process for the Commercial Mortgage Application Commercial1 typically involves several stages:

- Submission: Once the application and documents are submitted, the lender will acknowledge receipt.

- Review: The lender will review the application, assessing the financial stability of the business and the value of the property.

- Approval or Denial: The lender will notify the applicant of the decision, which may take anywhere from a few days to several weeks, depending on the lender's processes.

Quick guide on how to complete commercial mortgage application commercial1

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, a process that takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure effective communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Commercial Mortgage Application Commercial1

Create this form in 5 minutes!

How to create an eSignature for the commercial mortgage application commercial1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Commercial Mortgage Application Commercial1?

A Commercial Mortgage Application Commercial1 is a document used by businesses seeking financing for commercial real estate. This application collects essential information about the property, the borrower, and financial details. With airSlate SignNow, completing and eSigning this application has never been easier.

-

How can airSlate SignNow help with the Commercial Mortgage Application Commercial1 process?

airSlate SignNow streamlines the Commercial Mortgage Application Commercial1 process by providing an intuitive platform for creating, sending, and eSigning documents. This eliminates the need for paper-based processes and minimizes delays in approval times. Our solution is designed to empower businesses, making it simple to manage applications efficiently.

-

What are the pricing options for airSlate SignNow for Commercial Mortgage Application Commercial1?

airSlate SignNow offers flexible pricing plans to cater to different business needs involved in handling the Commercial Mortgage Application Commercial1. Our competitive pricing ensures businesses have access to cost-effective solutions without sacrificing features or quality. Visit our website for detailed information on pricing and features.

-

What features are included in the airSlate SignNow platform for handling Commercial Mortgage Application Commercial1?

The airSlate SignNow platform includes features such as templates for the Commercial Mortgage Application Commercial1, customizable workflows, and secure eSigning capabilities. Additionally, our platform provides tracking options for document status and reminders for recipients. These features ensure a smooth and organized process for all users.

-

Is airSlate SignNow compliant with regulations when handling Commercial Mortgage Application Commercial1?

Yes, airSlate SignNow is fully compliant with industry regulations, ensuring secure handling of your Commercial Mortgage Application Commercial1. We prioritize data privacy and security, employing encryption and secure storage measures. Clients can confidently manage their applications while adhering to legal standards.

-

Can I integrate airSlate SignNow with other software for my Commercial Mortgage Application Commercial1?

Absolutely! airSlate SignNow offers integrations with popular software solutions to enhance your workflow for the Commercial Mortgage Application Commercial1. By connecting with CRM systems, accounting software, and other business tools, you can streamline processes and improve efficiency in document management.

-

What are the benefits of using airSlate SignNow for my Commercial Mortgage Application Commercial1?

Using airSlate SignNow for your Commercial Mortgage Application Commercial1 provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform simplifies the entire application process, allowing for quick adjustments and faster approvals. Businesses can focus on growth while we handle the documentation.

Get more for Commercial Mortgage Application Commercial1

Find out other Commercial Mortgage Application Commercial1

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free