it 2105 2021

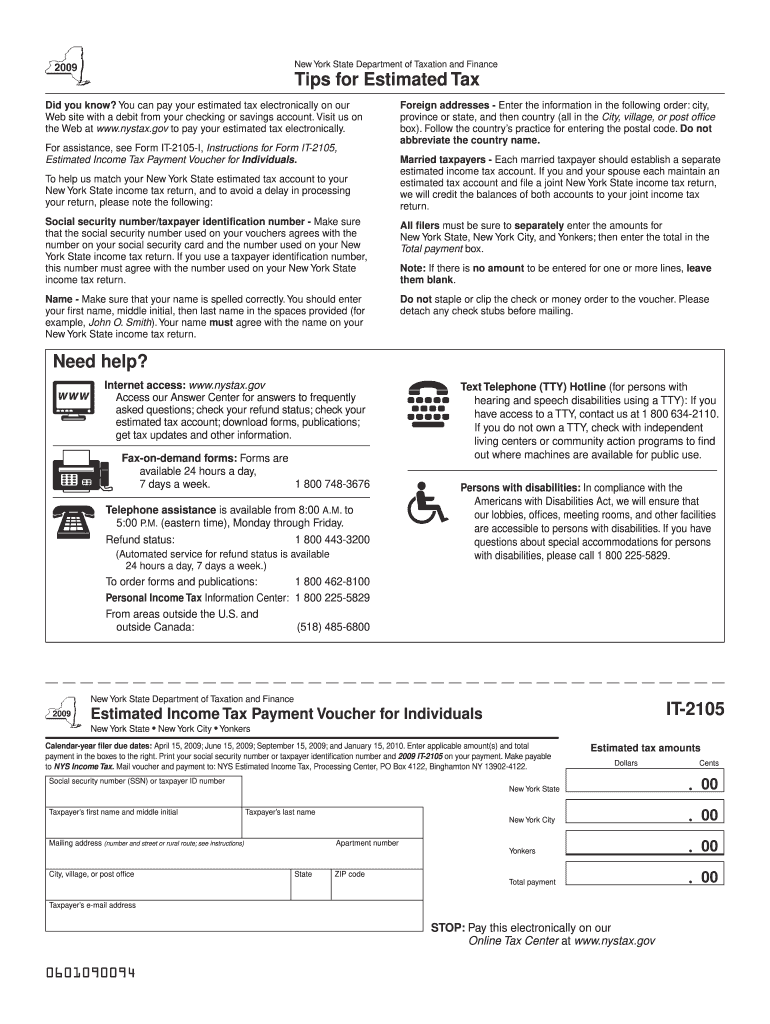

What is the IT-2105?

The IT-2105 is a New York State tax form used by individuals to request a withholding exemption from their New York State income tax. This form is particularly relevant for those who expect to owe less than a certain amount in taxes for the current tax year and wish to avoid having taxes withheld from their income. The IT-2105 helps taxpayers manage their cash flow by allowing them to keep more of their earnings throughout the year.

How to Use the IT-2105

To use the IT-2105, taxpayers must complete the form accurately, providing necessary personal information, including their name, address, and Social Security number. The form requires individuals to indicate their expected tax liability for the year and provide justification for the exemption request. Once completed, the IT-2105 should be submitted to the employer or withholding agent to ensure that no state income tax is withheld from their paychecks.

Steps to Complete the IT-2105

Completing the IT-2105 involves several key steps:

- Gather personal information, including your Social Security number and address.

- Determine your expected income and tax liability for the year.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the form to certify the information provided.

- Submit the form to your employer or withholding agent.

Legal Use of the IT-2105

The IT-2105 is legally recognized by the New York State Department of Taxation and Finance. It is essential for individuals to ensure that they meet the eligibility criteria for claiming a withholding exemption. Misuse of the form or providing false information can result in penalties, including fines or back taxes owed.

Filing Deadlines / Important Dates

Taxpayers should be aware of specific deadlines related to the IT-2105. Typically, the form should be submitted before the start of the tax year or when beginning new employment. It is also important to monitor any updates from the New York State Department of Taxation and Finance regarding changes to deadlines or filing requirements.

Required Documents

When completing the IT-2105, individuals may need to provide supporting documentation to justify their exemption request. This may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of any deductions or credits that may affect tax liability.

- Any other relevant financial information that supports the exemption claim.

Quick guide on how to complete it 2105

Complete It 2105 seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage It 2105 on any gadget with airSlate SignNow’s applications for Android or iOS and simplify any document-related process today.

How to adjust and eSign It 2105 with ease

- Obtain It 2105 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to missing or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and eSign It 2105 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 2105

Create this form in 5 minutes!

How to create an eSignature for the it 2105

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 2105 and how does it relate to airSlate SignNow?

The term 'it 2105' refers to the latest updates and features of airSlate SignNow. This innovative platform offers enhanced document signing capabilities and integrates seamlessly with existing business processes, making it an essential tool for any organization.

-

Are there pricing plans available for airSlate SignNow related to it 2105?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including those interested in the it 2105 features. These plans provide flexibility and scalability, ensuring you can choose an option that aligns with your budget and business requirements.

-

What unique features are included in the it 2105 update?

The it 2105 update includes several new features such as enhanced mobile signing, advanced templates, and automated workflows. These improvements streamline the document signing process and increase overall efficiency for users of airSlate SignNow.

-

How can businesses benefit from using airSlate SignNow as part of it 2105?

By utilizing airSlate SignNow with the it 2105 features, businesses can improve their document management processes, reduce turnaround times, and enhance collaboration. These benefits not only save time but also lower operational costs, contributing to a more efficient workflow.

-

Is airSlate SignNow compatible with third-party applications as part of the it 2105 features?

Absolutely! airSlate SignNow supports numerous integrations with popular third-party applications in the it 2105 update. This compatibility allows businesses to streamline their workflows by connecting their existing tools, such as CRMs and project management software.

-

What are the security measures in place for documents signed through it 2105 on airSlate SignNow?

Security is a top priority for airSlate SignNow. With the it 2105 update, robust measures such as encryption, two-factor authentication, and compliance with industry standards ensure that your documents are safely signed and stored.

-

Can I customize my document templates with it 2105 on airSlate SignNow?

Yes, users can easily customize document templates using airSlate SignNow's features included in the it 2105 update. This flexibility allows for a tailored approach to document management, making your workflows more personalized and efficient.

Get more for It 2105

- Eclb 7 department of business and professional regulation form

- Declaration concerning the language of study outside canada form

- Otc form 998 oklahoma tax commission state of oklahoma

- United healthcare employee enrollment form

- A 250 flutningstilkynning innanlands j skr slands skra form

- Rebate 437232631 form

- Authorization for use and disclosure of individual information msc 2099

- City of johannesburg environmental health business licensing restaurant org form

Find out other It 2105

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy