Form it 2105 Estimated Income Tax Payment Voucher Tax Year 2021

What is the Form IT-2105 Estimated Income Tax Payment Voucher?

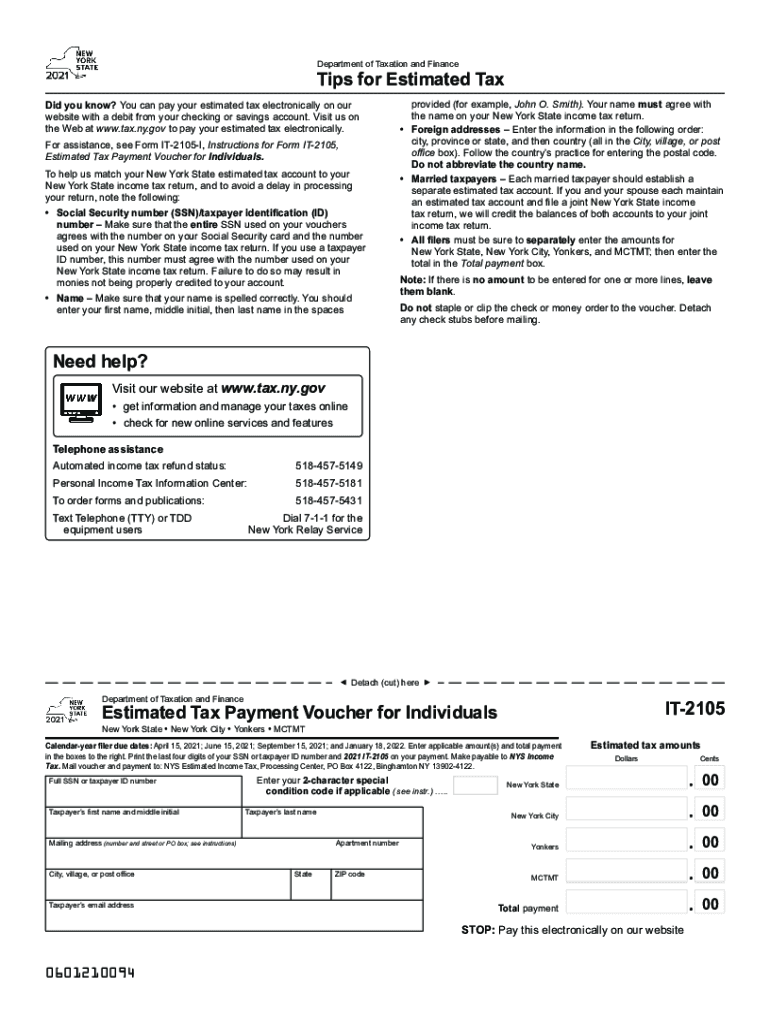

The Form IT-2105 is a document used by individuals in New York to report and pay their estimated income tax. This form is essential for taxpayers who expect to owe tax of $300 or more when they file their annual tax return. The IT-2105 allows taxpayers to make quarterly payments towards their estimated tax liabilities, ensuring they remain compliant with state tax regulations. This form is specifically designed for the tax year and must be submitted according to the schedule set forth by the New York State Department of Taxation and Finance.

Steps to Complete the Form IT-2105

Completing the Form IT-2105 involves several key steps:

- Gather Necessary Information: Collect your income details, deductions, and any credits you expect to claim.

- Calculate Your Estimated Tax: Use your projected income to determine the estimated tax you will owe for the year.

- Fill Out the Form: Enter your personal information, including your name, address, and Social Security number, along with the calculated estimated tax amount.

- Determine Payment Amount: Based on your calculations, decide how much you will pay for each quarter.

- Sign and Date the Form: Ensure you sign and date the form to validate it.

- Submit the Form: Choose your submission method—online, by mail, or in person—and send the form to the appropriate tax authority.

Legal Use of the Form IT-2105

The Form IT-2105 is legally binding when completed accurately and submitted according to New York State tax laws. It is crucial to ensure that all information provided is correct and that the form is submitted by the deadlines set by the state. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. The form must also be filed in accordance with the guidelines established by the New York State Department of Taxation and Finance to ensure its validity.

Filing Deadlines for the Form IT-2105

Filing deadlines for the Form IT-2105 are critical for compliance. Taxpayers must submit their estimated tax payments quarterly. The typical deadlines are:

- First Quarter: April 15

- Second Quarter: June 15

- Third Quarter: September 15

- Fourth Quarter: January 15 of the following year

It is essential to adhere to these deadlines to avoid penalties for late payments.

Key Elements of the Form IT-2105

The Form IT-2105 includes several important elements that taxpayers must understand:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Estimated Tax Calculation: The estimated tax amount owed based on projected income.

- Payment Schedule: Information on how much to pay each quarter.

- Signature: A signature is required to validate the form.

Understanding these elements ensures that the form is completed accurately and submitted correctly.

Obtaining the Form IT-2105

The Form IT-2105 can be obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill it out at their convenience. Additionally, physical copies may be available at local tax offices or through tax professionals. Ensuring you have the most current version of the form is essential for compliance.

Quick guide on how to complete form it 2105 estimated income tax payment voucher tax year 2021

Complete Form IT 2105 Estimated Income Tax Payment Voucher Tax Year effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form IT 2105 Estimated Income Tax Payment Voucher Tax Year on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax Year seamlessly

- Locate Form IT 2105 Estimated Income Tax Payment Voucher Tax Year and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax Year and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2105 estimated income tax payment voucher tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 estimated income tax payment voucher tax year 2021

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is estimated income tax?

Estimated income tax refers to the tax you expect to owe for the year, which is typically paid in quarterly installments. It's crucial for self-employed individuals and businesses to calculate their estimated income tax accurately to avoid penalties. Understanding your estimated income tax can help streamline your financial planning.

-

How can airSlate SignNow help with my estimated income tax documents?

airSlate SignNow provides an efficient platform to send and eSign documents related to your estimated income tax filings. With our solution, you can easily manage, track, and sign tax-related forms electronically, simplifying your tax process. This ease of use can signNowly reduce the stress associated with managing your estimated income tax.

-

What features does airSlate SignNow offer for managing estimated income tax forms?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage for your estimated income tax forms. These features enhance collaboration and ensure all necessary documents are signed on time. The platform's intuitive interface makes it easy to navigate and manage your tax-related paperwork efficiently.

-

How much does airSlate SignNow cost for handling estimated income tax documents?

The pricing for airSlate SignNow is competitive, and it varies based on the plan you choose. Each plan provides access to features that can streamline your estimated income tax document processes. Considering the efficiency and time savings, many users find airSlate SignNow a cost-effective solution for their estimated income tax management.

-

Can I integrate airSlate SignNow with other accounting software for my estimated income tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software and tools to help manage your estimated income tax. This integration allows for smoother workflows and better data management, making tax preparation simpler. By connecting airSlate SignNow with your existing systems, you can streamline your estimated income tax processes.

-

Is airSlate SignNow secure for sensitive estimated income tax documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including those related to your estimated income tax. The platform uses advanced encryption protocols to protect your data during transmission and storage. Ensuring the security of sensitive information like estimated income tax documents is a top consideration for us.

-

What are the benefits of using airSlate SignNow for estimated income tax management?

Using airSlate SignNow for your estimated income tax management offers numerous benefits, including enhanced efficiency, reduced paperwork, and increased accuracy. Our platform simplifies the process of sending and signing tax documents, allowing you to focus on your core business activities. Additionally, the digital nature of this solution can save time and resources overall.

Get more for Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

Find out other Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free