Form it 2105 Estimated Income Tax Payment Voucher Tax Year 2025-2026

What is the Form IT 2105 Estimated Income Tax Payment Voucher?

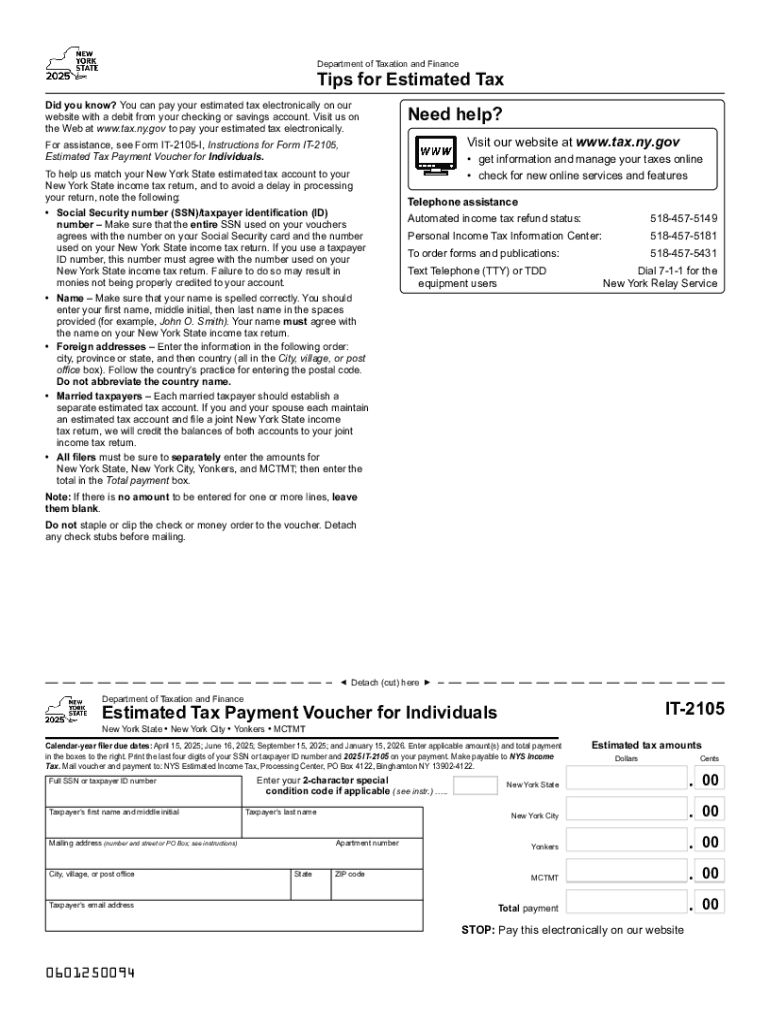

The Form IT 2105 is an essential document used by New York State taxpayers to make estimated income tax payments. It is specifically designed for individuals who expect to owe tax of $300 or more when they file their state tax returns. This form allows taxpayers to pay their estimated tax liability in four installments throughout the year, ensuring compliance with state tax regulations. The form is applicable for various tax years, including the upcoming 2025 tax year.

How to Use the Form IT 2105 Estimated Income Tax Payment Voucher

To effectively use the Form IT 2105, taxpayers should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated amount is established, taxpayers can fill out the form with their personal information, including name, address, and Social Security number. Each voucher corresponds to a specific payment due date, so it is important to submit the correct voucher for each installment. Payments can be made via check or electronically, depending on the taxpayer's preference.

Steps to Complete the Form IT 2105 Estimated Income Tax Payment Voucher

Completing the Form IT 2105 involves several key steps:

- Gather your financial information, including income, deductions, and credits.

- Calculate your estimated tax liability for the year.

- Fill in your personal details on the form, including your name, address, and Social Security number.

- Indicate the amount of estimated tax you are paying with this voucher.

- Sign and date the form to validate your payment.

- Submit the completed voucher by the due date, either by mail or electronically.

Filing Deadlines / Important Dates for the Form IT 2105

Taxpayers should be aware of the important deadlines associated with the Form IT 2105. Payments are typically due in four installments throughout the year: April 15, June 15, September 15, and January 15 of the following year. It is crucial to submit each payment on time to avoid penalties and interest charges. Keeping track of these dates will help ensure compliance with New York State tax regulations.

Legal Use of the Form IT 2105 Estimated Income Tax Payment Voucher

The Form IT 2105 serves a legal purpose by allowing taxpayers to fulfill their estimated tax obligations under New York State law. Proper use of the form ensures that individuals meet their tax responsibilities and avoid potential penalties for underpayment. It is important to use the most current version of the form and adhere to state guidelines to ensure legality and accuracy in tax reporting.

Key Elements of the Form IT 2105 Estimated Income Tax Payment Voucher

Key elements of the Form IT 2105 include:

- Taxpayer identification information, such as name and Social Security number.

- Estimated tax payment amount for the current tax year.

- Payment due date associated with each voucher.

- Instructions for submission, including acceptable payment methods.

Handy tips for filling out Form IT 2105 Estimated Income Tax Payment Voucher Tax Year online

Quick steps to complete and e-sign Form IT 2105 Estimated Income Tax Payment Voucher Tax Year online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a HIPAA and GDPR compliant service for maximum simpleness. Use signNow to electronically sign and send out Form IT 2105 Estimated Income Tax Payment Voucher Tax Year for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form it 2105 estimated income tax payment voucher tax year 772030048

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 estimated income tax payment voucher tax year 772030048

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 2105 and how does it relate to airSlate SignNow?

It 2105 refers to the latest version of our document signing solution, airSlate SignNow. This version enhances user experience with improved features and integrations, making it easier for businesses to manage their eSigning needs efficiently.

-

What are the key features of it 2105?

The key features of it 2105 include advanced document editing, customizable templates, and real-time tracking of document status. These features streamline the signing process, ensuring that users can send and receive signed documents quickly and securely.

-

How does it 2105 improve document security?

It 2105 enhances document security through advanced encryption and authentication measures. Users can trust that their sensitive information is protected, as airSlate SignNow complies with industry standards for data security and privacy.

-

What pricing options are available for it 2105?

airSlate SignNow offers flexible pricing plans for it 2105, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that provide access to all features at competitive rates.

-

Can it 2105 integrate with other software?

Yes, it 2105 seamlessly integrates with various software applications, including CRM systems and cloud storage services. This integration capability allows businesses to streamline their workflows and enhance productivity.

-

What benefits does it 2105 offer for businesses?

It 2105 provides numerous benefits for businesses, including increased efficiency, reduced turnaround times for document signing, and improved customer satisfaction. By simplifying the eSigning process, businesses can focus more on their core operations.

-

Is it 2105 suitable for small businesses?

Absolutely! It 2105 is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses. With its scalable features, small businesses can easily manage their document signing needs without breaking the bank.

Get more for Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- Curious about careers firefighters form

- Pa homeschool affidavit printable form

- Ttb gov forms

- 00 74 0070nsbw form

- Printable application for the university of houston form

- Pit rc form

- All dogs must be licensed in the state of connecticut when they are 6 months old and then southington form

- Vendor permit shelton police department form

Find out other Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors