Form it 2105 Estimated Income Tax Payment Voucher Tax Year 2024

What is the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

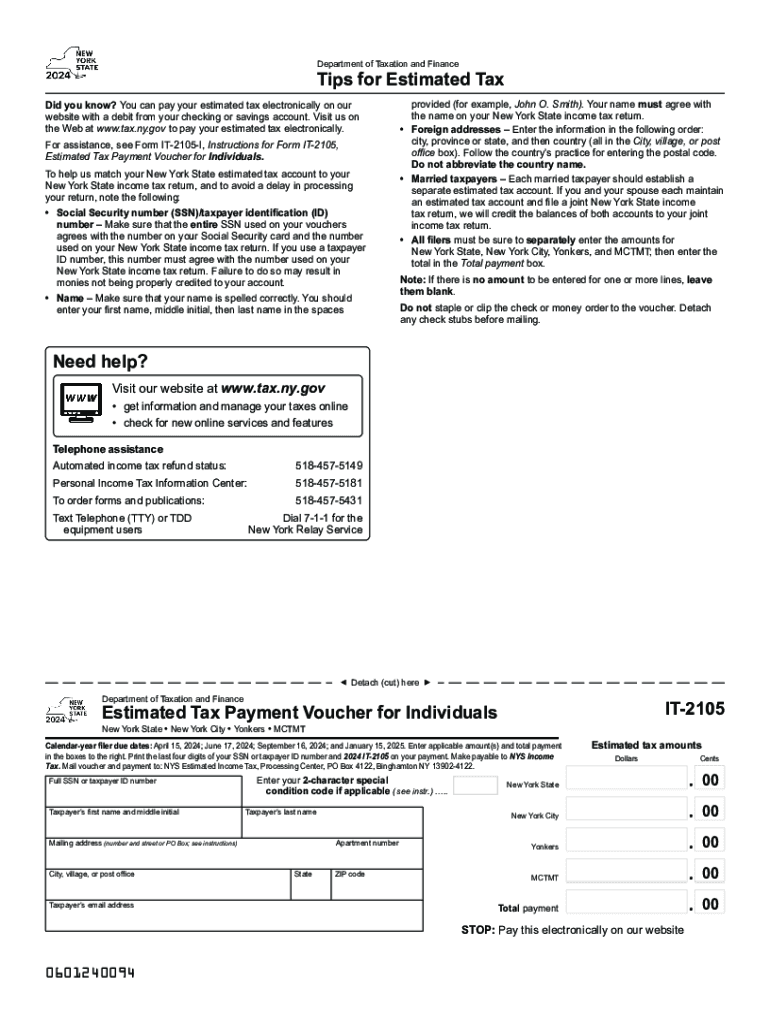

The Form IT 2105 is an essential document used by New York taxpayers to report and make estimated income tax payments. This form is specifically designed for individuals who expect to owe tax of $300 or more when they file their New York State income tax return. The IT 2105 serves as a payment voucher that helps taxpayers fulfill their estimated tax obligations throughout the year, ensuring compliance with state tax laws.

How to use the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

To effectively use the Form IT 2105, taxpayers must first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax amount is established, the taxpayer can fill out the IT 2105 form, indicating the payment amount and the tax year. The completed form should then be submitted along with the payment, either by mail or electronically, depending on the chosen submission method.

Steps to complete the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

Completing the Form IT 2105 involves several straightforward steps:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Calculate your estimated tax payment based on your expected income and deductions for the year.

- Indicate the payment amount in the designated field.

- Specify the tax year for which the payment is being made.

- Sign and date the form to validate your submission.

Filing Deadlines / Important Dates

Timely filing of the Form IT 2105 is crucial to avoid penalties. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. For the 2024 tax year, the specific due dates for estimated payments are April 15, June 17, September 16, and January 15, 2025. Taxpayers should mark these dates on their calendars to ensure compliance.

Required Documents

When preparing to complete the Form IT 2105, taxpayers should gather relevant documents that support their income and deduction estimates. This may include:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Documentation for any deductions or credits expected to claim.

Penalties for Non-Compliance

Failure to file the Form IT 2105 or make the required estimated tax payments can result in significant penalties. New York State imposes interest on unpaid taxes, and taxpayers may face additional penalties for underpayment. It is essential to adhere to the filing requirements to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct form it 2105 estimated income tax payment voucher tax year 708427419

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 estimated income tax payment voucher tax year 708427419

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new york estimated tax and how does it work?

The New York estimated tax is a method for taxpayers to pay their expected tax liability throughout the year, rather than waiting until the tax return is filed. This is particularly important for self-employed individuals and those with signNow income not subject to withholding. By making estimated tax payments, you can avoid penalties and interest on underpayment.

-

How can airSlate SignNow help with managing new york estimated tax documents?

airSlate SignNow simplifies the process of managing documents related to your New York estimated tax. With our eSigning capabilities, you can easily send, sign, and store tax-related documents securely. This ensures that you have all necessary paperwork organized and accessible when it’s time to file your taxes.

-

What features does airSlate SignNow offer for tax professionals dealing with new york estimated tax?

For tax professionals, airSlate SignNow offers features like customizable templates, bulk sending, and real-time tracking of document status. These tools streamline the process of collecting signatures and managing client documents related to New York estimated tax. This efficiency can save time and enhance client satisfaction.

-

Is airSlate SignNow cost-effective for small businesses handling new york estimated tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing New York estimated tax. Our pricing plans are designed to fit various budgets, allowing businesses to access essential eSigning features without breaking the bank. This affordability makes it easier for small businesses to stay compliant with tax obligations.

-

Can I integrate airSlate SignNow with other accounting software for new york estimated tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your New York estimated tax documents. This integration allows for a smooth workflow, ensuring that all your financial data is synchronized and accessible in one place, enhancing productivity.

-

What are the benefits of using airSlate SignNow for new york estimated tax filings?

Using airSlate SignNow for New York estimated tax filings offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or fraud. Additionally, the ease of use allows you to focus more on your business rather than administrative tasks.

-

How does airSlate SignNow ensure the security of my new york estimated tax documents?

airSlate SignNow prioritizes the security of your New York estimated tax documents with advanced encryption and secure cloud storage. We comply with industry standards to protect sensitive information, ensuring that your documents are safe from unauthorized access. This commitment to security gives you peace of mind when handling important tax documents.

Get more for Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles wisconsin form

- Letter from tenant to landlord about landlords failure to make repairs wisconsin form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497430591 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession wisconsin form

- Letter from tenant to landlord about illegal entry by landlord wisconsin form

- Letter from landlord to tenant about time of intent to enter premises wisconsin form

- Wisconsin landlord form

- Letter from tenant to landlord about sexual harassment wisconsin form

Find out other Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later