to Help Us Match Your NewYork State Estimated Tax Account to Your 2018

What is the To Help Us Match Your NewYork State Estimated Tax Account To Your

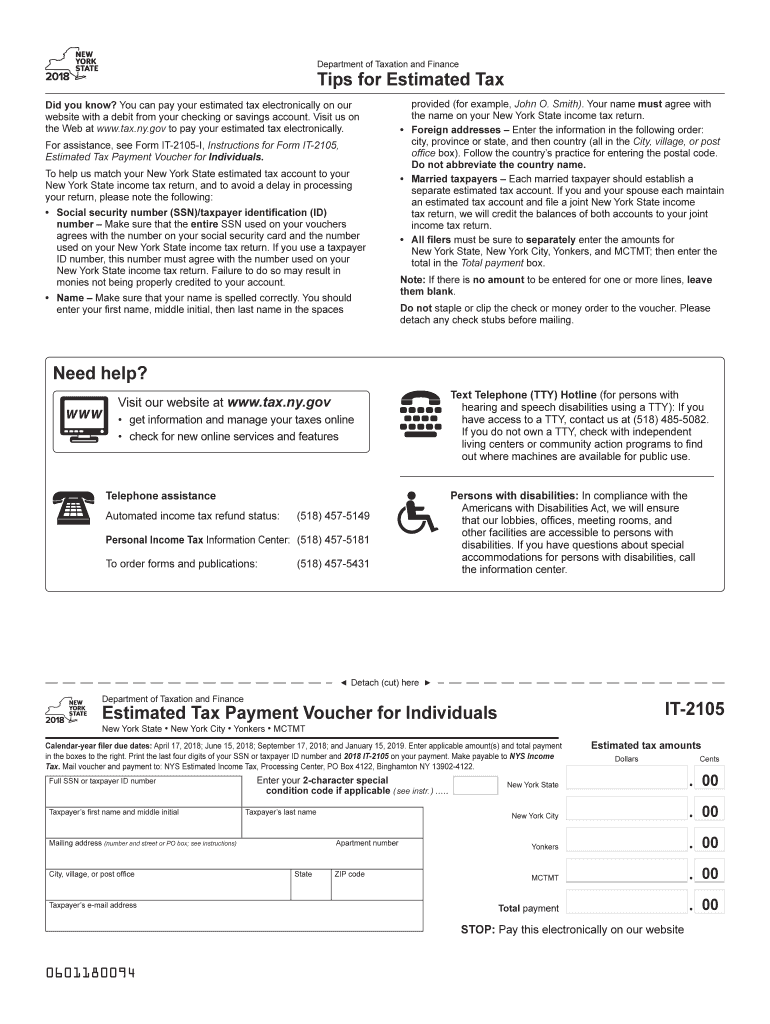

The form "To Help Us Match Your NewYork State Estimated Tax Account To Your" is essential for ensuring that your estimated tax payments are accurately credited to your tax account. This form is particularly relevant for individuals and businesses in New York State who are required to make estimated tax payments throughout the year. It serves as a bridge between your payment and your official tax records, helping to prevent any discrepancies that could arise during tax filing.

How to use the To Help Us Match Your NewYork State Estimated Tax Account To Your

Using the form involves a straightforward process. First, gather all necessary information, including your personal identification details and tax account number. Next, fill out the form accurately, ensuring that all information matches your official tax records. Once completed, submit the form according to the specified guidelines, which may include online submission or mailing it to the appropriate tax authority. This ensures that your estimated payments are properly recorded and credited.

Steps to complete the To Help Us Match Your NewYork State Estimated Tax Account To Your

Completing this form requires careful attention to detail. Follow these steps:

- Gather your tax identification information.

- Access the form through the official New York State tax website or your tax preparation software.

- Fill out the form, ensuring all details are accurate and complete.

- Review the form for any errors or omissions.

- Submit the form as instructed, ensuring you keep a copy for your records.

Legal use of the To Help Us Match Your NewYork State Estimated Tax Account To Your

This form is legally binding when completed and submitted correctly. It adheres to the regulations set forth by the New York State Department of Taxation and Finance. To ensure its legal standing, it is crucial to provide accurate information and submit the form within the designated timeframes. Failure to do so may result in penalties or misallocation of your estimated tax payments.

Required Documents

To complete the form, you will need several documents:

- Your Social Security Number or Employer Identification Number.

- Previous year’s tax return for reference.

- Records of any previous estimated tax payments made.

- Any correspondence from the New York State tax authority related to your account.

Filing Deadlines / Important Dates

Timely submission of the form is critical. The deadlines for estimated tax payments in New York typically align with quarterly payment schedules. It is essential to be aware of these dates to avoid penalties:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Quick guide on how to complete to help us match your newyork state estimated tax account to your

Complete To Help Us Match Your NewYork State Estimated Tax Account To Your effortlessly on any device

Internet-based document management has become widely embraced by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage To Help Us Match Your NewYork State Estimated Tax Account To Your on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign To Help Us Match Your NewYork State Estimated Tax Account To Your with ease

- Find To Help Us Match Your NewYork State Estimated Tax Account To Your and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign To Help Us Match Your NewYork State Estimated Tax Account To Your and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct to help us match your newyork state estimated tax account to your

Create this form in 5 minutes!

How to create an eSignature for the to help us match your newyork state estimated tax account to your

How to create an electronic signature for the To Help Us Match Your Newyork State Estimated Tax Account To Your in the online mode

How to make an eSignature for your To Help Us Match Your Newyork State Estimated Tax Account To Your in Google Chrome

How to generate an electronic signature for signing the To Help Us Match Your Newyork State Estimated Tax Account To Your in Gmail

How to make an electronic signature for the To Help Us Match Your Newyork State Estimated Tax Account To Your from your smart phone

How to create an eSignature for the To Help Us Match Your Newyork State Estimated Tax Account To Your on iOS devices

How to make an eSignature for the To Help Us Match Your Newyork State Estimated Tax Account To Your on Android devices

People also ask

-

What is airSlate SignNow and how can it help me with my New York State estimated tax account?

airSlate SignNow is an eSignature solution that simplifies the signing and sending of documents. To help us match your New York State estimated tax account to your business needs, our platform provides a user-friendly interface that ensures compliance and streamlines the tax filing process.

-

How does airSlate SignNow ensure the security of my documents?

We prioritize document security with advanced encryption and authentication measures. To help us match your New York State estimated tax account to your requirements, we ensure that all documents are transmitted securely, giving you peace of mind when handling sensitive financial information.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a wide range of features including eSignatures, document templates, and customizable workflows. To help us match your New York State estimated tax account to your unique situation, our platform enables you to manage tax documents efficiently and effectively.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRMs. To help us match your New York State estimated tax account to your existing tools, our integration options enhance your workflow and streamline your document management processes.

-

What pricing plans does airSlate SignNow offer?

Our pricing plans are designed to be cost-effective and cater to businesses of all sizes. To help us match your New York State estimated tax account to your budget, we offer various plans with different features, ensuring you find the right fit for your organization.

-

Can airSlate SignNow assist with multiple users in my organization?

Absolutely! airSlate SignNow allows multiple users to collaborate on documents in real-time. To help us match your New York State estimated tax account to your team’s needs, our collaborative features facilitate seamless communication and document management among team members.

-

Is training available to help users get started with airSlate SignNow?

Yes, we provide comprehensive training resources to help users maximize the benefits of airSlate SignNow. To help us match your New York State estimated tax account to your workflow, our training materials include tutorials, webinars, and customer support to ensure a smooth onboarding experience.

Get more for To Help Us Match Your NewYork State Estimated Tax Account To Your

Find out other To Help Us Match Your NewYork State Estimated Tax Account To Your

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word