Form REW 1 1040 Maine Gov 2022

What is the Form REW 1 1040 Maine gov

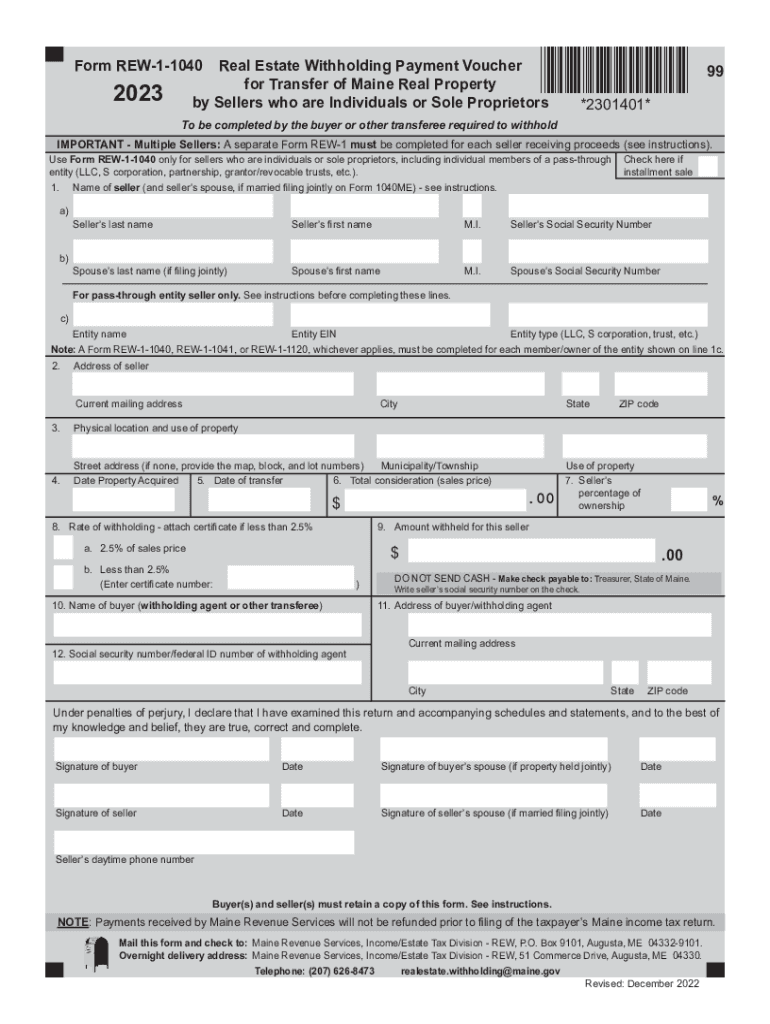

The Form REW 1 1040 is a state-specific tax form used in Maine for reporting income and calculating state income tax obligations. It is designed for individual taxpayers and is part of the Maine Revenue Services' requirements for filing state taxes. This form collects essential information about the taxpayer's income, deductions, and credits, enabling the state to assess the correct amount of tax owed. Understanding this form is crucial for compliance with Maine tax laws.

How to use the Form REW 1 1040 Maine gov

Using the Form REW 1 1040 involves several steps to ensure accurate completion. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. After collecting these documents, individuals can fill out the form by entering their personal information, income details, and applicable deductions. It is important to review the completed form for accuracy before submission, as errors can lead to delays or penalties.

Steps to complete the Form REW 1 1040 Maine gov

Completing the Form REW 1 1040 involves a systematic approach:

- Gather all relevant financial documents, such as income statements and receipts for deductions.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include wages, dividends, and any other earnings.

- Apply any eligible deductions and credits according to Maine tax guidelines.

- Calculate the total tax owed or refund due based on the provided information.

- Review the form for completeness and accuracy before submission.

Legal use of the Form REW 1 1040 Maine gov

The Form REW 1 1040 must be used in accordance with Maine's tax laws and regulations. It serves as a legal document that taxpayers submit to report their income and calculate their tax liabilities. Filing this form accurately is essential to avoid legal repercussions, such as fines or audits. Taxpayers should ensure they understand the legal requirements associated with the form, including deadlines and documentation needed for compliance.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form REW 1 1040 is crucial for taxpayers in Maine. Typically, the deadline for filing state income tax returns is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines for estimated tax payments and extensions, ensuring they meet all requirements to avoid penalties.

Required Documents

To complete the Form REW 1 1040, taxpayers need to gather several key documents:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any freelance or contract work.

- Documentation for deductible expenses, such as medical bills and charitable contributions.

- Any other relevant financial statements that support income or deductions claimed on the form.

Quick guide on how to complete form rew 1 1040 maine gov

Effortlessly Prepare Form REW 1 1040 Maine gov on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Handle Form REW 1 1040 Maine gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The Easiest Way to Edit and Electronically Sign Form REW 1 1040 Maine gov

- Locate Form REW 1 1040 Maine gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any preferred device. Edit and electronically sign Form REW 1 1040 Maine gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rew 1 1040 maine gov

Create this form in 5 minutes!

How to create an eSignature for the form rew 1 1040 maine gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form REW 1 1040 Maine gov and who needs it?

Form REW 1 1040 Maine gov is a tax form required by residents of Maine to report their income for state tax purposes. It's essential for individuals who are filing their annual state tax returns. Understanding this form is crucial for accurate tax reporting.

-

How can airSlate SignNow assist me with Form REW 1 1040 Maine gov?

airSlate SignNow offers a user-friendly platform to easily fill out and eSign Form REW 1 1040 Maine gov. Our solution simplifies the process, making it quick and secure for individuals and businesses to manage essential tax documents.

-

Is there a cost associated with using airSlate SignNow for Form REW 1 1040 Maine gov?

Yes, airSlate SignNow offers a variety of pricing plans based on your needs, including options for single users or larger teams. We believe our competitive pricing makes it an affordable solution for efficiently handling Form REW 1 1040 Maine gov.

-

What features does airSlate SignNow provide for Form REW 1 1040 Maine gov?

With airSlate SignNow, you get features like customizable templates, secure eSigning, and real-time document tracking specifically for Form REW 1 1040 Maine gov. This helps streamline the entire process and enhances document management and compliance.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software. This makes it easy to incorporate Form REW 1 1040 Maine gov into your current workflow without a hitch.

-

How secure is my information when using airSlate SignNow for Form REW 1 1040 Maine gov?

Security is a top priority at airSlate SignNow. We use advanced encryption and comply with industry standards to ensure that all data related to Form REW 1 1040 Maine gov is kept private and secure.

-

Are there any templates available for Form REW 1 1040 Maine gov on airSlate SignNow?

Yes, airSlate SignNow provides templates for Form REW 1 1040 Maine gov, which can be easily customized to suit your needs. Leveraging templates helps facilitate a smoother experience when preparing your tax documents.

Get more for Form REW 1 1040 Maine gov

- I registration training current reg training procedures ppsb nccrimecontrol form

- Pie order form template

- Nationwide retirement solutions forms

- Return on investment roieconomic investment ei form phqix

- Cat adoption application template 40979059 form

- Application for process and affidavit of indigency form

- Fsc form pdf

- General release and settlement agreement template form

Find out other Form REW 1 1040 Maine gov

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document